I’m working on a strategy which I think will be the first strategy made by the community where the down trend is fully covered by not more than 2/3 DCA and the up trend is covered by the same bot via dynamic price

The winrate is less good but it’s preferable to add a SL as on market crashes you could have very important drawdowns that are difficult to detect woth backtest even on the 1min. That’s a nice addition, thanks for sharing ![]()

That sounds good, I’m looking forward to it!

True, but we’ll take that for granted when we’re sure we’re not taking huge losses ![]()

You’re welcome!

Yes, this strategy won’t work with fees because most of the wins are very small 0.05-0.2%. The exchange fee would have made all those unprofitable.

In my experience, strategies with a high volume of deals of small profit % never perform well in live. You can run it in a small budget and see, I am curious to see the results after a month.

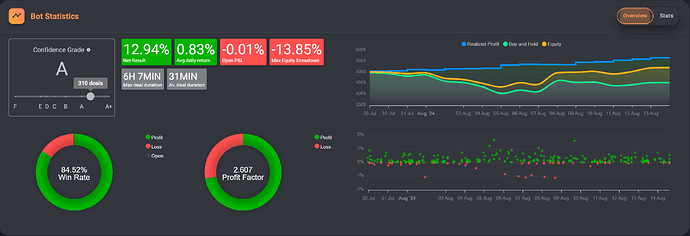

Quick update:

I’ve stopped the long version, and a week ago I backtested/created a short version because I want to gather more BTC. And the short version is going quite well!

Interesting strategy - do you think it will be good only during sideways? never thought about having very tiny close DCA then SL at -1.1%

It’s a good time for shorts indeed

I don’t really know actually.

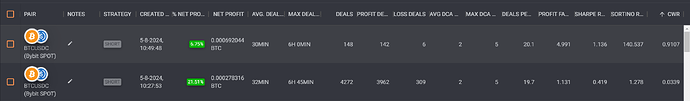

Below is a picture of 2 backtests, the top one is from the past 7 days, and the bottom one is from this year. And I don’t really know what to think of those results regarding sideways/up/down etc.

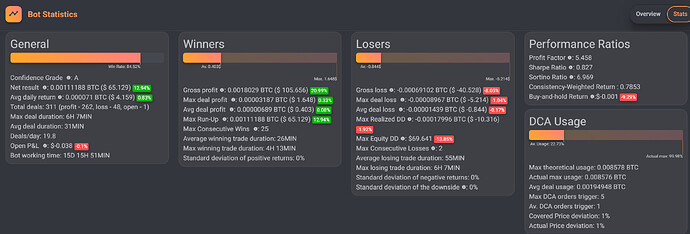

I only added the DCA and SL later, I initially had it active without DCA and that went reasonably well, but too often gave losing deals. So then I started backtesting DCA, and this combination gave quite nice results.

interesting how even on longer backtest you max deal duration is 6H even if you are not using any timeout

So you operate on a small deviation. Either the safety orders help to cope with the small drawdown after the deal was started or you close it by SL. But apparently most of the time you are currently lucky to take profit instead.

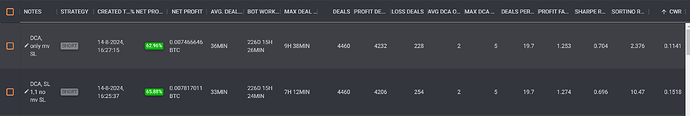

Here are some backtests of 2024, here you can see that DCA is the salvation of the bot, because as a result there are a lot fewer loss-making deals.

What I ended up looking for in terms of backtests is as few losing deals as possible, but still a ‘reasonably’ high % net profit, and a low deal duration as possible.

And no idea if it’s luck, the next few months will have to prove that, but for now it’s a nice little bot that gathers some BTC every day.

Yes indeed ![]()

What did you change in between?

Nothing, which I had linked, I have on real active.

This afternoon’s images/tests are backtested based on my real variant.

Impressive ![]() I really want to have a look on this, thanks for sharing!

I really want to have a look on this, thanks for sharing!

I made this one after one week testing active. Thx for sharing.

Have you run the long and short bot at the same times? Or just using the short bot at the moment?