Only the short

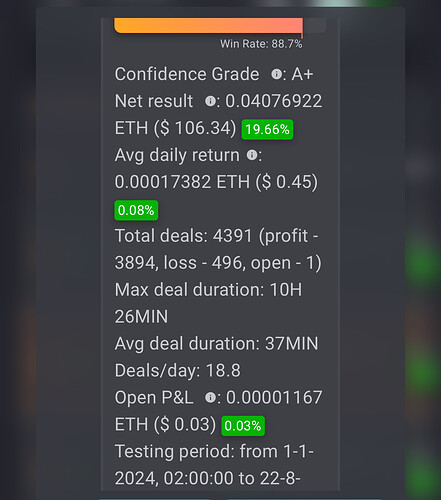

Trying to create a short version for ETH (or other alts) as well, also for accumulating:

Changed the DCA deviation, Volume Scale and SL for a little more volatility. Backtesting seems fine, curious if someone has suggestions for futher optimizations. Just started this one Live.

Next is creating one for DOT / ADA / XRP with adapted parameters.

Deleted… Nevermind…

Is it possible that your backtest used 0.1% Fee instead of 0% on Bybit?

My backtest for 2024 shows in profit:

I’m on mobile now but I’ll try your suggestions, thanks for the input! Was only using reinvest profit because I couldn’t get close to 100% of total amount using a Volume scale of 0.85

Ooops… Sorry, you are correct! These are the new results:

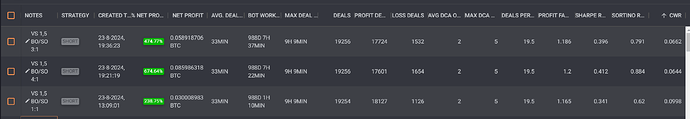

Your settings, with 100% reinvest

BO/SO 7% ETH Total %

BO/SO 7% ETH Total % VS 1,5%

Hmm weird, if I set the VS at 0.85 I can’t get it to 100% with ETH Total % either.

But why would you want the VS lower than 1%? Then the deposit of each SO after the first one gets lower and lower, and thus the chance of closing with a profit also gets lower.

Now I understand, that the backtests show different results, but I would not choose it.

True, the deposits get lower and lower with 0.85.

The way I see it: With normal DCA with a set TP %, it would take longer to close the deal. But because the TP condition is crossing down support, it’s kind of a static TP condition.

Or does the support line move due to DCA orders?

As most orders close with less than 5 DCA deals, it’s more profitable to have larger volume at the first DCA orders.

Correct me if i’m wrong, it could well be that my thinking about this is wrong ![]()

I think your idea is correct, but I think it is more practical to set your Base Order higher than your DCA, I am testing that now.

Hi @Remy! Can you share the long version again when you will have a moment, it is not available, what you can do in order to make a long lasting version is to run it on paper and not make modifications on it, I hope that your real strategy is running well!

I’m on vacation at the moment, so I am a bit limited with testing etc. I’ll try to recreate the long version sometime this week.

Don’t hurry, enjoy your hollidays ![]()

Remy? Please have you got the long version and did you change some settings yet in this strategie. The short had some stop losses the past day.

Anyone running this bot real time?

Yes, i‘m in it since two weeks. Looks good so far. Played with some settings and shorter time for the supp/res but they didn’t worked well on paper.

So, Good Job ![]() @remy1111 !!! how is it going on your site?

@remy1111 !!! how is it going on your site?

Which of above configurations du you use now?

The link is not working for me, maybe the share option is disabled within the bot?

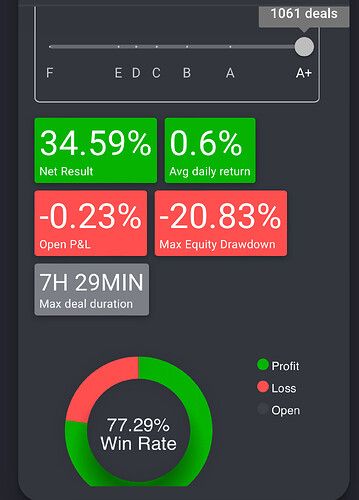

I’m still running the short version live, 5% in 41 days. Strange that I ‘only’ have 796 deals in this period while you are over 1000 deals in 2 weeks? Maybe other exhange than Bybit or different settings?

Hi Aaron,

Okay, sorry for my false information… time goes by really fast and the bot is running since 57 days. so almost two weeks and some days on top. ![]()

Before i shared the link on mobile, maybe this was the problem. Try it again, share is enabled on bot settings.

Apparently I missed some posts and neglected to respond to some questions, I apologize for that.

@Reemster , I tried to make a profitable Long variant of the bot, but I did not find a good combination of settings for this.

Therefore, I have been working on fine tuning the short bot for the past few weeks.

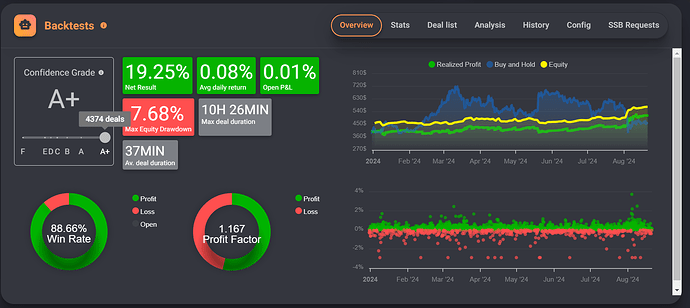

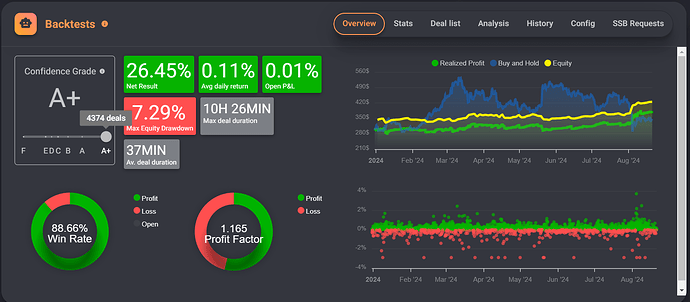

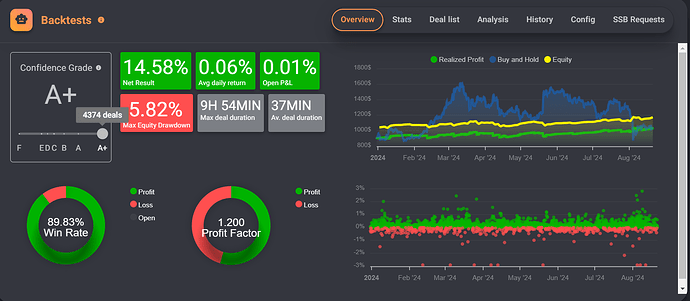

This is the current bot: Gainium app

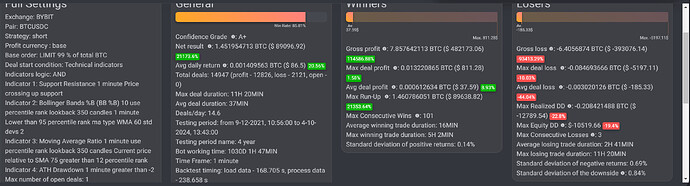

With the following modifications compared to the previous version:

- No more DCA, if a deal closes in the minus with all the DCA slots filled, that gives comparatively quite a loss, and it then requires many deals to make up for it. Without DCA, you suffer a lot less from that.

- No more fixed stoploss, I now only use the Stoploss with webhook option so I can use the move stoploss. The webhook is not active, this is purely there to make sure I don’t have to set a fixed SL.

- New indicators!

Compared to the previous version, I have added 2 (I think?) new indicators. The ‘Moving Average Ratio’ (MAR), this is to make sure it doesn’t start deals when BTC is already low, because the chance of it going up then is pretty high. And the ATH Drawdown, which like the MAR ensures that it does not start deals if BTC has just dropped too much.

Compared to the previous version, I have added 2 (I think?) new indicators. The ‘Moving Average Ratio’ (MAR), this is to make sure it doesn’t start deals when BTC is already low, because the chance of it going up then is pretty high. And the ATH Drawdown, which like the MAR ensures that it does not start deals if BTC has just dropped too much.

Through these adjustments I have mainly focused on getting the profit factor as high as possible, without lowering the net % too far.

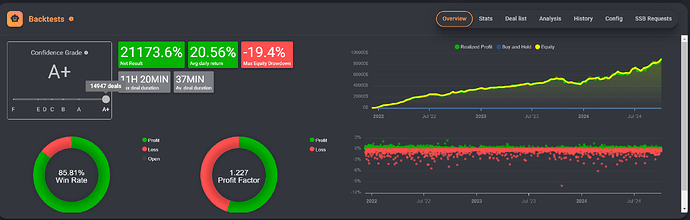

In the backtest it does very well (the real version does even slightly better), and there hasn’t been a year that it has made a loss, although it does have lesser/better years.

As you can see on the backtest chart, it has been performing very well since 2022!

If you guys have any questions/comments/improvements, let me know ![]()

Backtest info:

https://app.gainium.io/bot/backtests?a=140&aid=share-backtest&backtestShare=3d30018e-8624-4295-8c37-57f4900a6566

Genius as always , where you have been? Didn’t see you much here