and it’s a powerful way to lock in profits without risking the gains you’ve already secured. Here’s how this feature would work and why it’s beneficial:

How This Feature Works:

-

Initial Take Profit (TP) Setup:

- You set a fixed Take Profit at 1%. This is the level at which you want to secure your initial profit.

- The Trailing Take Profit (TTP) is configured to start only after the price reaches this 1% TP.

-

Activation of Trailing Take Profit:

- When the price hits the 1% TP, the TTP activates. At this point, your trade is in profit, and you want to maximize that profit as the price continues to move in your favor.

- The TTP will begin trailing at a set percentage, which in your example is 1%.

-

Price Movement After TP is Hit:

- Scenario 1:

- If the price rises another 1% (total 2% up from the entry), the TTP will move up to 1.5% from the entry point. If the price reverses and drops to this 1.5% level, the trade will close, securing a 1.5% profit.

- If the price rises only another 0.5% (total 1.5% up from the entry) and then reverses back to the 1% level, the TTP ensures that your trade will close at the original 1% TP level. You’ve already secured that 1% profit, so even if the price reverses, you’re still in profit.

- Scenario 2:

- If the price continues to rise another 1% (total 3% up from the entry), the TTP will move up to 2% from the entry point. Now, if the price reverses, the trade will close at this 2% level, securing a 2% profit.

- Scenario 1:

-

Continued Price Increase:

- As the price continues to rise in 1% increments, the TTP follows, always trailing by 1% from the highest point reached after the initial TP was hit.

- This means that for every 1% rise in the price, the TTP moves up by 0.5% from the last locked-in profit level.

Example Summary:

- Initial TP: 1%

- TTP Activation: Begins only after the price hits the 1% TP.

- TTP Trailing Distance: 1% behind the highest price after TP is hit.

- Price at 2% Profit: TTP is at 1.5% profit.

- Price at 3% Profit: TTP is at 2% profit.

Why This is a Great Feature:

-

Locks in Gains: The TTP only starts once you’ve secured your initial TP, meaning you’re already in profit. If the price reverses immediately after hitting the TP or after rising another 0.5% and then reversing back to 1%, you still exit with your planned 1% profit.

-

Maximizes Potential Profit: If the price continues to rise after hitting the initial TP, the TTP locks in additional profits without the risk of giving up the gains you’ve already secured.

-

Reduces Risk: Since the TTP only activates after the initial TP is reached, it doesn’t interfere with your trade’s original risk management strategy. Your stop loss remains in place until the initial TP is hit, so you’re not adding any additional risk by using TTP.

-

Adds Extra Profit: The TTP feature ensures that you don’t just settle for the fixed TP but can capture more profit if the market continues to move in your favor. Every additional rise in price locks in a higher profit margin.

-

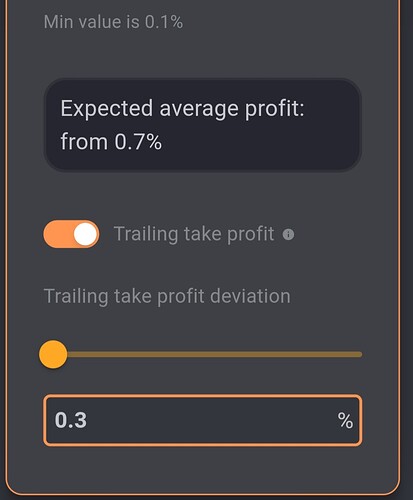

Flexibility of Settings: The numbers used in this example—such as the 1% TP, the 1% trailing distance, and the 0.5% adjustment—are just examples. You can adjust these values according to your trading strategy and risk tolerance. For instance, you might choose a smaller or larger initial TP, or a different trailing distance, to better align with your market expectations.

In-Depth Description:

Imagine you’re in a trade, and you’ve set your TP at 1%. As the price moves up and finally hits that 1% gain, your trade is now in profit, and you’re ready to secure those gains. But instead of closing the trade right there, you activate a TTP that trails the price as it potentially continues to rise.

This TTP is set to follow the price at a 1% distance, meaning that it locks in profits 1% below the highest point the price reaches after your initial TP is hit. So, if the price goes up to a 2% gain, your TTP will be at 1.5% profit. If it goes up to 3%, your TTP will move up to secure a 2% profit.

If at any point the price reverses, the trade will close at the TTP level, ensuring you walk away with a secured profit that’s higher than your original TP. Even if the price only rises another 0.5% after hitting the initial TP and then reverses, your trade will still close at the original TP level, ensuring a 1% profit. This method not only protects your profits but also gives you the opportunity to capture more gains if the market continues to move in your favor.

This feature is particularly powerful because it allows you to ride the momentum of a profitable trade without exposing yourself to the risk of a full reversal back to your original entry point. It’s a way to let your winners run while minimizing the risk of losing the gains you’ve already made. Plus, the flexibility in setting these parameters allows you to tailor the strategy to your specific needs, making it a versatile tool in any trading setup.