| Feature | Details |

|---|---|

| Feature Suggestion | AUTO-Merge deals (trading bot) |

| Purpose | To work in tandem with the current dynamic price filter and manage floating deals automatically or manually. |

| Logic | When selecting simultaneous deals via dynamic price, specify the number of deals and dynamic price filter deviation %. |

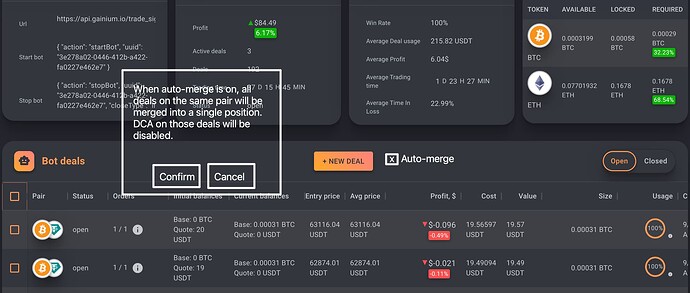

| Auto-Merge Activation | Toggle the auto-merge deals feature. The bot merges deals that deviate too far from the current price into the second to last deal to average the price. |

| Case Scenario | Set a strategy to cover x% deviation before starting a new deal. If the price moves opposite to the set direction and all simultaneous deals are opened, the bot merges the last deal with the second to last. |

| Extra Option | Merge consecutive deals up to a set number of deals, merging more than one deal at once. |

| Benefits | - Rescue red bags (deals that went too far in the opposite direction) - DCA: Average the price using the auto-merge feature - Free up order slots to open new deals - Improve speed and efficiency by managing risk and funds through merging smaller deals that went too far in the opposite direction without waiting for price recovery. |

That’s exactly what I asked for another bot provider quite a while ago.

Idea: We have to Trading Bot deals for the same pair and on the same exchange. We define one deal as the safety order source, the other deal as the target deal. We are getting a dialogue that previews us the result of the merge.

If we decided to merge the deals, the source deal is cancelled, i.e. it is left open at the exchange. At Gainium we do a virtual safety order on the target deal, with the volume and average price of the cancelled source deal. The volume and average price of the target deal gets updated. Now both deals are merged.

Probably we have to take care of the stats now, because the same volume now appears at cancelled deal and virtual safety order.

Yep I thought sometime a lot easier to implement and for the traders to use - I will update the post today if I have a moment

Maybe it’s best to either completely remove the previous deal from the list. Or maybe better we move its history to the target deal. That way we keep a detailed history of all orders. And who knows maybe can use those for our tax reports or even create thos from that.

Bear in mind that this option already exists - the suggestion is about automating this process so we can include it when building our strategies

I’m really looking forward to this. I hope its already considered by @aressanch.

This is could be a good feature to keep our bot going once the max number of simultaneous deals is reached:

How would it work?

When settings the number of max deals we could select the number of deal we would like to merge once the bot has reached the number max of deal - for example if we set 30 max deals and the bot reaches 30 deals we can set the bot to merge the last 10 deals - it will be useful also if the new deals can have the option to copy the current bot settings so once auto-merged the deals are automatically set to carry on as normal.

The question is, why are there many deals for the same pair of the same bot. Either they didn’t take profit before adding another deal. Or they were opened as independent deals on an opposite trend. What could be the idea of that? That could be to build a grid of separate (DCA) deals that could get closed on a possible reversal. If the opposite trend is to strong, then many deals are likely to stay active.

The auto-merge could combine some of those working like a single DCA step combining several deals and there safety orders. The auto-merge could take a bunch of deals and merge the funds of the older deals one by one as if they were manual safety orders with the volume and average price of the merged deals even.The merged deals would be cancelled. And of course, the manual safety orders would only happen virtually on Gainium’s servers.

@EdleArth if you like this feature suggestion make sure you vote using the orange button on the top left

Sorry, 1st time !

Next ask your whole family and neighbours to subscribe and to vote ![]()

This is a good suggestion although when merging we are already averaging the price and the volume - so in essence it’s like if we are making a DCA with SOs - the volume will be equal the sums of the merged deals and the avg price is equal the breakeven.

Visually we will have a new fresh deal with only one entry point and no DCA - a suggestion could be to have those merged deals, now DCA, as yellow marks so we have an history of the past deals and a reference for the new added DCA (if any)

This is confusing, why not auto merge all deals? Dynamic price filter is not the only use case for this, also for periodic or any time the bot has more than one deal on the same pair.

The way I envision it, the bot will always have just one position per pair. All orders opened will be added to it.

Ignore my initial statement it was confusing I agree - also as you said we can have simultaneous deals even not using dynamic price filter.

I don’t think forcing to merge ALL deals into one will be a good idea only because it reduces flexibility - say for example I have 5 deals and I want to merge only those 2 which are in red - merging all deals isn’t always a good option.

I would prefer the option to enter how many deals we want to merge ONLY when the max number of deals is reached this way I can say of my 10 deals I only want to merge the last 5 so I can free 4 slots for new deals and also avg the price.

@MarkusP if you think it will come useful make sure you VOTE above

I think that auto-merge should only merge (the oldest) deals once the Max open deals per pair is reached into the next oldest deal to free the configured amount of spaces for further deals as I described it above. The merged deals get cancelled, there funds are virtually added according to the deals’ average price virtually. Only whether the settings of the target deal would be an important point to consider. Because it should be mentioned, that the price of the target deal won’t move closer to the current price but away from it, similarly to what would happen for DCA steps on the winning side of a deal where the take profit price is moving away from the current price.

Of course, we could overcome this possibly counter intuitive price movement of the target deal if we change the target. If the oldest deal becomes the target and the newer deals get merged into it, the target deal’s average price will move into the direction of the current price and lower the required change to take profit.

And another restriction might be if the deals that are meant to be merged still have open DCA steps. What shall happen then?

I will solve automatically by itself if you merge the latest deals.

This is a good point actually - once we merge the deals the system should add them to a deal - here makes more sense what @aressanch suggested

@aressanch what do you think about using the ‘oldest/youngest opened deal’ (based on the bot direction LONG/SHORT) and merge the rest of the deals as DCAs?

Will look into it

Appreciate