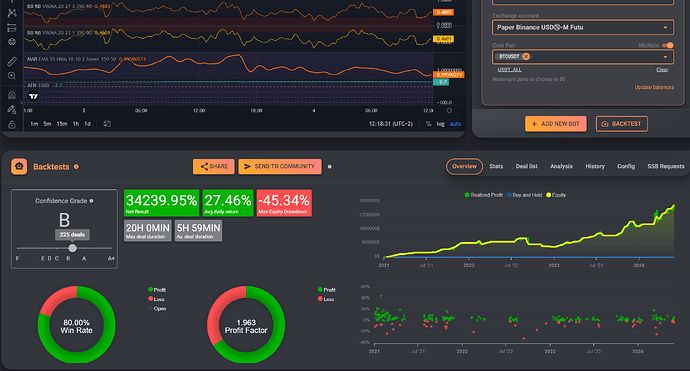

I continued testing, and adding the ATH drawdown gives interesting results.

Interesting indeed. I doubt it would be that good in real trading, but worth doing a trial run with a smaller budget.

I also assume it’s too good to be true, but I put a small bot with real money on it to see how it goes.

@remy1111 would you mind sharing the settings for the live account? I‘d like to run a test with a small amount as well. Thanks

Those are the same as the backtest, and the exchange is kucoin.

Hi Perez and others, thank you for sharing your results. Did any of you here find other tokens that performed well with this strategy? I am struggling to find any. I am wondering if there was a bit of overfitting. Thanks.

No not really, for this bot I only focussed on BTC.

Hi Roni, I only was opning trades on BTC, ETH and BNB but you should compare the behaviour with other coins with some backtesting. But these are the coins that I prefer to trade.

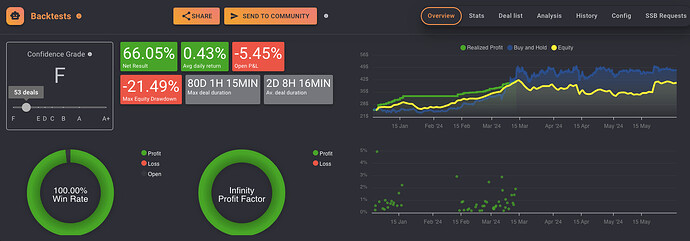

Yes it’s working well for BTC, ETH, and BNB, even in spot. Since I am accumulating those coins, I added the minimum take profit option. Profiting in base. Here are the last 6 months results (spot):

-

Gainium app → 1 deal at the time. Higher daily ROI, but deals stuck for a long while

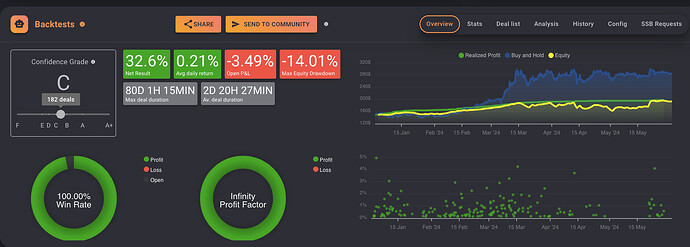

-

Gainium app → 2 Max deals per pair, 6 total, smoother equity curve.

I am going to start running number 2 now. Named “BB%B Scalping Accumulator Blue Chips”.

Buy and Hold outperforms Equity - again. Is there any strategy that is really better than Buy and Hold?

I always find Buy and Hold a tricky one, with bots/trade you secure your profits, with Buy and Hold you are never sure in advance.

In hindsight Buy and Hold can be better, but you don’t always know that in advance.

With BTC that will certainly be the case, but if you had started Buy and Hold at the ATH of 2021, it took a long time before you had more ‘profit’ with that.

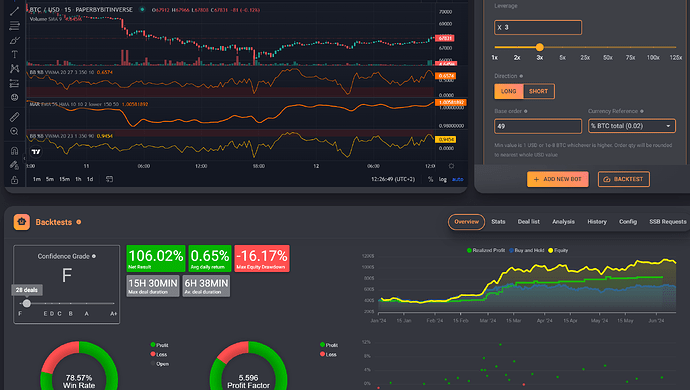

And in my opinion, it is quite easy to create a strategy that is better than Buy and Hold, and that is through Inverse/Coin-M like options, then you use BTC to trade.

See this example, via leverage it is of course more dangerous/more risky, but with lev x3 it is still reasonably safe to use.

I’ve said it many times before. The purpose of a strategy is not to have more return than buy and hold. Buy and hold is just a benchmark, you don’t even have a return, it’s all unrealized. And knowing when the buy and when to sell is better delegated to a strategy. In this particular example since it’s mostly bull market buy and hold unrealized at the end of the period does better, but plenty of other examples where buy and hold is the worst strategy, try any period in 2022.

Thanks. I have but all don’t work with existing settings (losses). I think the overall strategy is good, so I will try with different settings now.

Thank you for the caution. I was told my a developer of another dca and grid bot that isolated margin applies to the token, irrespective to the number of deals you have open for that token. So all the dca and grid openings for one token is considered collectively for “isolated margin”. Can anybody confirm or dispel this please? Thanks.

Correct, isolated margin is per position. All bots opened on the same position share the same margin. If one gets liquidated, all of them will register the liquidation event.

What do you mean by position? Is that the same coin-leverage?

Can anyone recommend a good SL Risk indicator that would shut down the bot on a downtrend? In this downtrend my bots and this one has shut down already but if anyone knows of better indicators I would love to hv something even safer. Cheers.

If you are looking for a SL for this strategy, I don’t recommend using one as you will have better probabilities to close the trade on a 90-95% percentile up even if it’s under the opening price. But I understand that it can be annoying to see such red positions sometimes…

If you are looking for general SL strategy I like to use Support/Resistance or Lower lows/Pivot Lows as they are super simple but effective, you can find the last ones on the Market Structure indicator and price based division. But bear in mind that in general, these kind of SL that are super evident can be used as liquidity for the big hands, so they will try to manipulate the price to go where there are most of the SL to then go in the opposite direction. Not easy to find something useful in all market conditions…

Correct

My two favs are supertrend and market structure (market structure can also detect bearish and bullish structure).