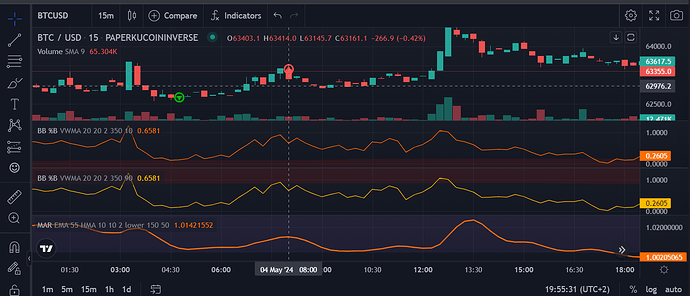

Hello everyone, I’ve been trying to do some tests on the BB%B strategy that I wanted to share with you.

1. Context:

For this tests I used the High Sortino Rate strategy from Ares (YouTube) with BTC, ETH and BNB against USDT on Paper Bybit SPOT & Future (Linear) and backtested from 1/2/2023, 12:00:00 AM to 3/25/2024, 12:00:00 AM (448 days)

2. Replacing MAR indicator by Supertrend on Deal Start conditions:

The idea came from Ares last video, he was speaking about Supertrend as a nice trend indicator, so I tried to test it. With the already available parameters for Supertrend, the strategy get a little bit worse than BB%B High Sortino:

-

BB%B High sortino: Net result = 95% / Drawdown = -18.8% / Winrate = 66.2% / Profit factor = 1.546 / Sortino Ratio = 1.052

-

BB%B Supertrend (Not optimized): Net result = 76% / Drawdown = -43.2% / Winrate = 62.7% / Profit factor = 1.225 / Sortino Ratio = 0.523

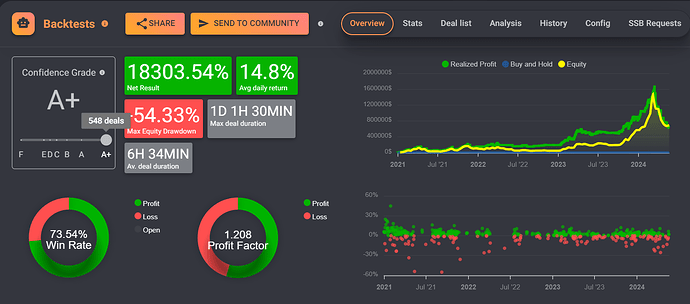

After optimization of some Supertrend parameters I got this:

- BB%B Supertrend (Optimized): Net result = 161% / Drawdown = -14.7% / Winrate = 68% / Profit factor = 1.396 / Sortino Ratio = 1.815

You can find this at the following link (Super trend x BB%B (no DCA)). The results seem to have improved comparing to what is obtained with the original strategy both in terms of Net result and drawdown.

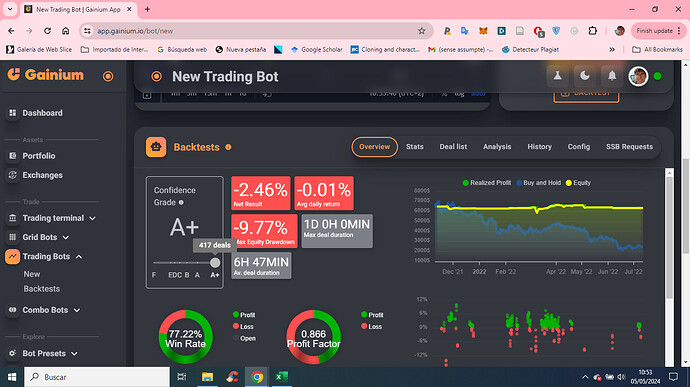

3. Adding DCA orders to the strategy:

This time I tried the function DCA on the optimized BB%B Supertrend and the results after some changes on the parameters where surprising:

- BB%B Supertrend + DCA (Optimized): Net result = 179.25% / Drawdown = -7.44% / Winrate = 74.52% / Profit factor = 2.013 / Sortino Ratio = 5.179

You can find this at the following link: Super trend x BB%B (DCA). What is interesting about the DCA option here, is that not only it improves the net result but also the drawdown and the winrate. What the DCA option allows here is to improve the entry price by buying at several points.

WARNING (updated): after talking with some users (@remy1111 and @salmanhamza) using DCA with an isolated strategy might by risky and the strategy might not work as backtested or in paper. In the next days I will try to create a new strategy that could work in SPOT with DCA but without using leverage.

4. Final thoughts:

I tested this strategy with this same parameters on other coins, exchanges and conditions and sometimes it helps on the overall but it also happens that the results get worse. I probably over-optimized this strategy and it fits too good to one specific situation but the results were interesting so I thought that this could be interesting also for you. I also want to share all the optimizations that I’ve been trying and the results of the backtests, as this takes a lot of time, it can be nice if it can help others to not test what has already been tested ![]() (Gainium test.xlsx - Google Таблици)

(Gainium test.xlsx - Google Таблици)

Comments on everything are welcomed!