Hi everyone,

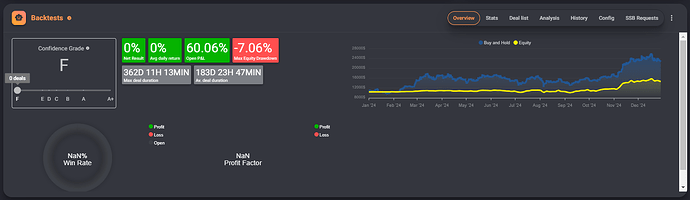

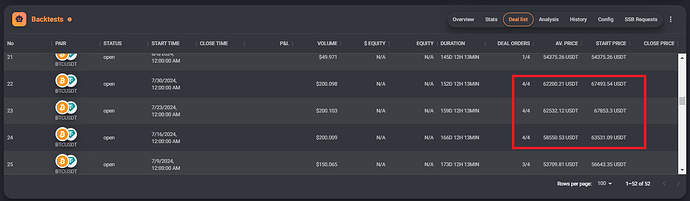

I’m happy to contribute to this community. The first topic I’d like to share is my approach to accumulating Bitcoin over time. This strategy is the result of a lot of thought and experimentation. In this post, I’ll share the main concepts, and later, I’ll explain how to implement some of these ideas using Gainium.

When it comes to accumulating BTC, here are the approaches I focus on:

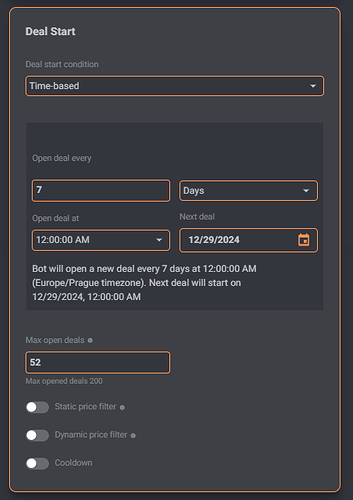

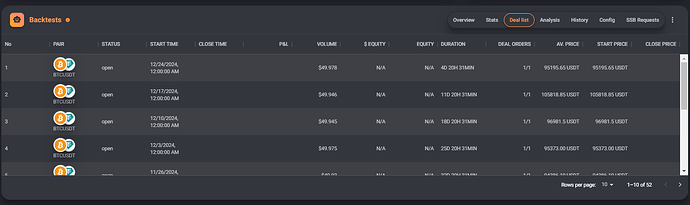

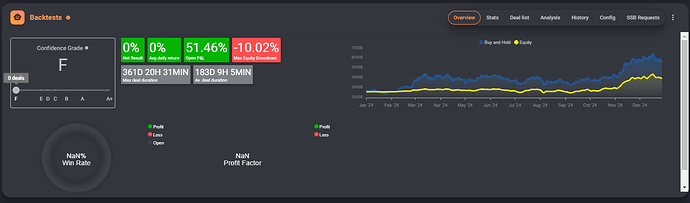

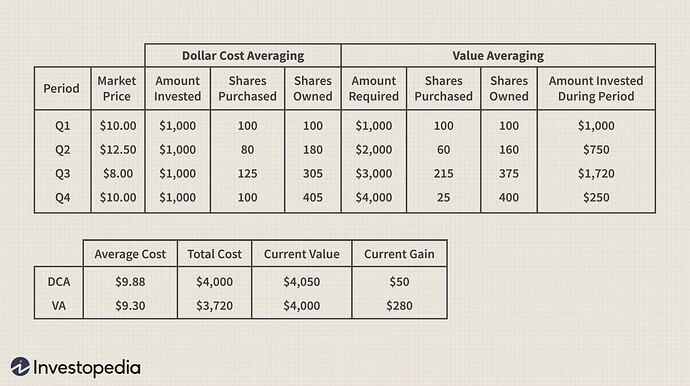

1. Scheduled Regular Purchases

A straightforward method—buy BTC at regular intervals (daily, weekly, monthly) for a fixed amount, like 50 USDT.

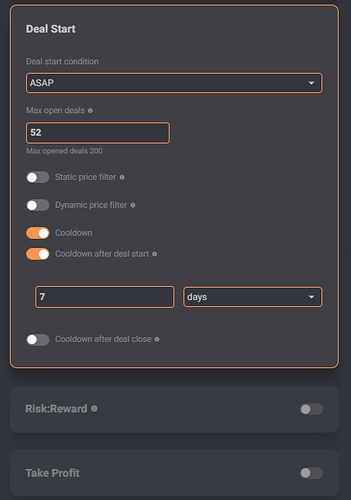

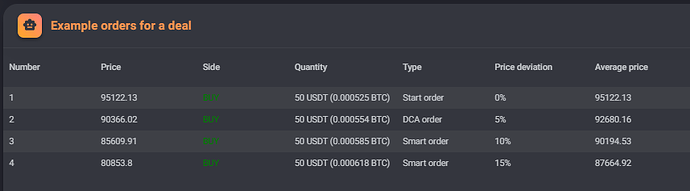

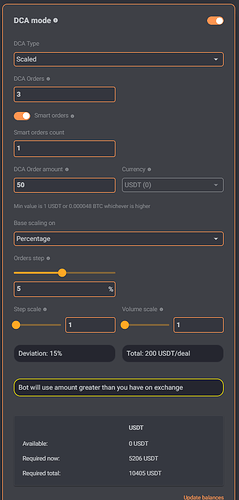

2. Regular Purchases with a DCA Grid

Build on the above by adding a DCA “grid” below your base order. This approach automatically adds to your position during price dips, lowering your average cost.

Note that in both of these approaches, 1 and 2, we buy but do not sell. Our goal is to buy and hold here.

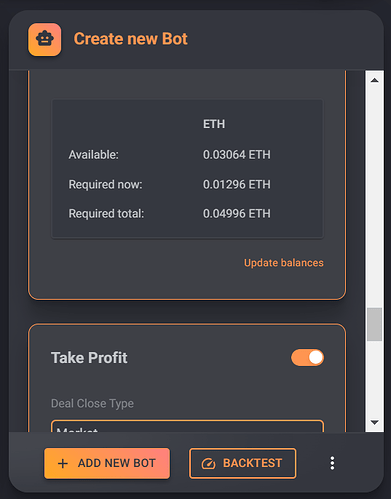

3. Trading BTC Pairs

Trade pairs like ETH/BTC or SOL/BTC. Instead of taking profits in USDT, profits are credited in BTC, directly increasing your holdings over time.

4. Using BTC Collateral on Inverse Futures

Hold BTC as collateral while trading on inverse perpetual contracts. This way, profits remain in BTC, and you grow your stack.

5. BTC Collateral with Leveraged Multi-Asset Accounts

On exchanges with Universal or Multi-Asset accounts (e.g. Bybit, Binance, OKX), you can use BTC as collateral for leveraged trading on other pairs. The profits (earned in USDT or other tokens) can be regularly converted back into BTC to accumulate further.

These 5 approaches form a solid and well-rounded starting point for accumulating Bitcoin.

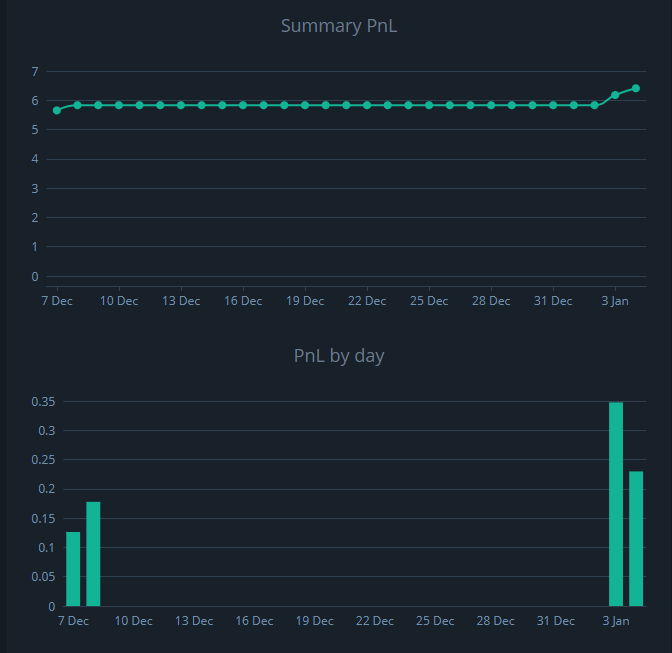

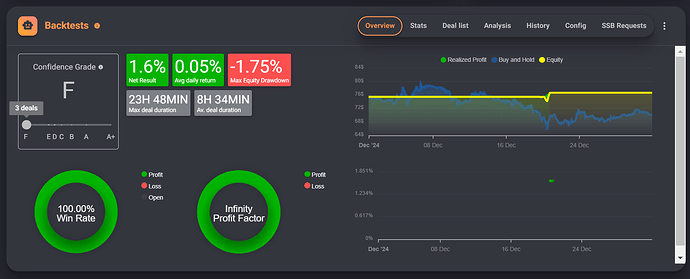

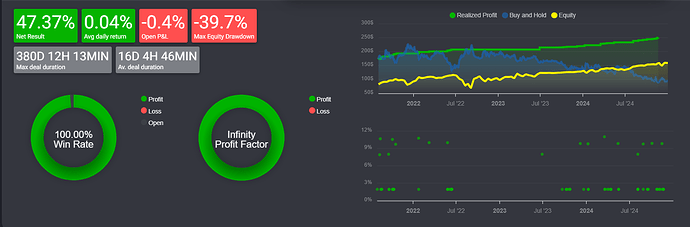

I’ve tested all of these approaches to varying degrees, often using a mix depending on the market and my goals. For example, I combine regular accumulation (e.g., DCA) with strategies that leverage BTC collateral on Futures.

Before we go into the discussion of the set-up and configuration of bots, which will follow below, I’m curious about is your take—have you tried any of these methods, or do you have your own approaches to accumulating Bitcoin?

As mentioned, over time I will be sharing setups / results in follow-up posts in this thread, so also feel free to share your feedback or ask questions.