Continuing with my research, I have filtered the top 40 cryptocurrencies by capitalization, using the @aressanch strategy, and trying to find the ones that best adapt to it (I will leave the link here)

Now, based on this, I was able to observe that there are 13 of these cryptos that have better behavior, standing out for their performance compared to the rest, and in the same way I did a backtest using the latter (which I also show in the previous link)

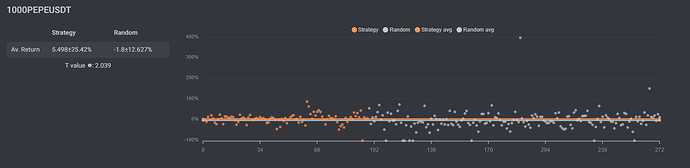

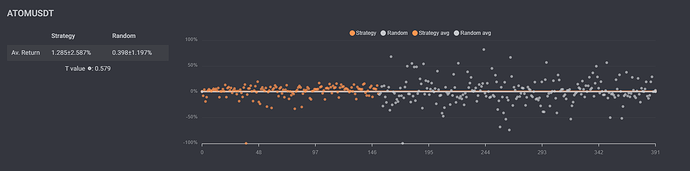

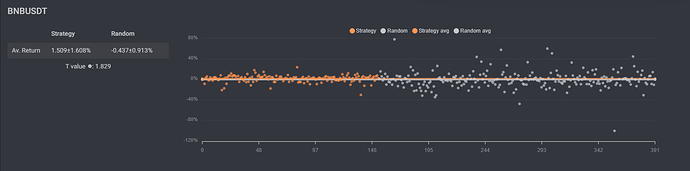

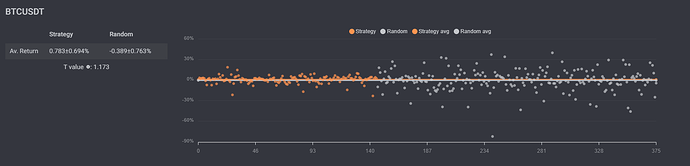

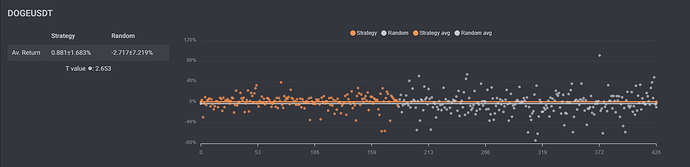

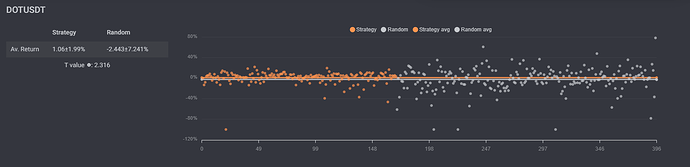

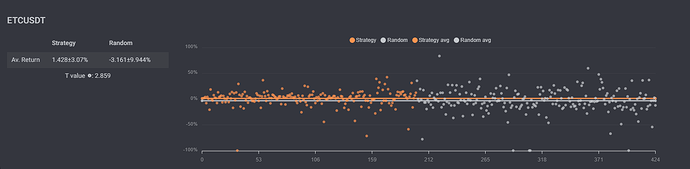

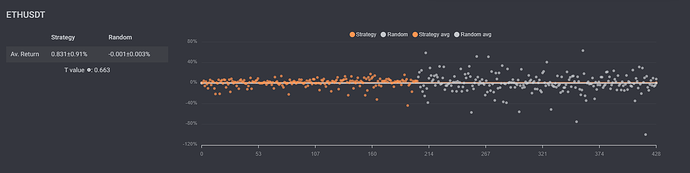

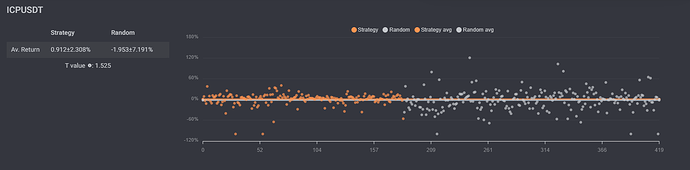

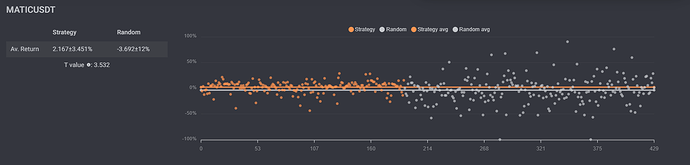

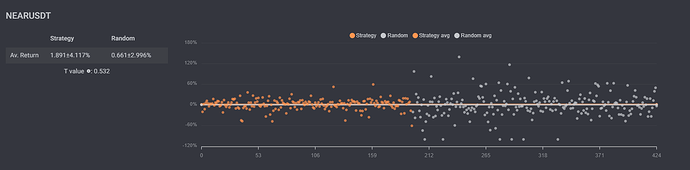

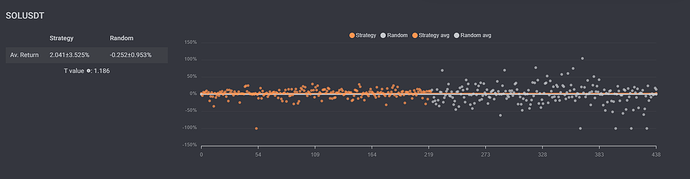

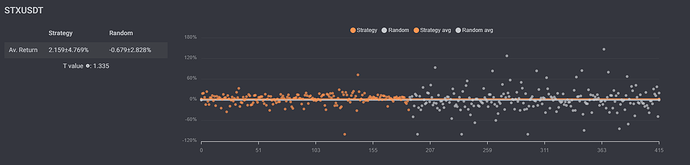

After observing the results, I continued debugging, and now I performed a backtest of these last 13 coins against a backtest of Random operations, to be able to see which ones give me a true statistical advantage, and discard those that could have given me good results just because “luck” or very specific conditions in the market.

The results were the following.

As you can see, there are some that, although they showed good results in the backtest, their T value is still very close to the value 0, which suggests that they are ALMOST similar to randomly opened trades, so filter and eliminate the assets that have a T value less than one, leaving only PEPE, BNB, BTC (FOR VERY LITTLE), DOGE, DOT, ETC, ICP, MATIC, SOL, AND STX.

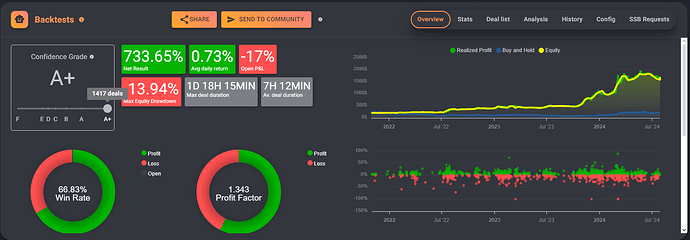

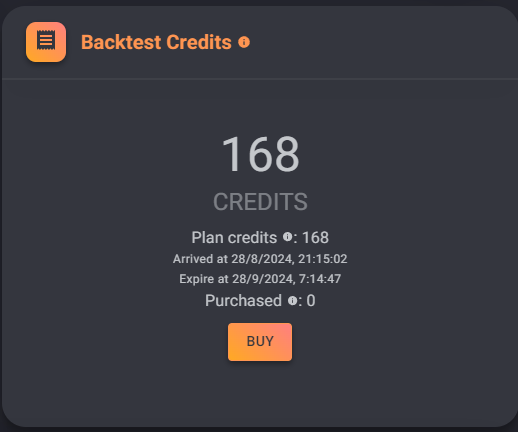

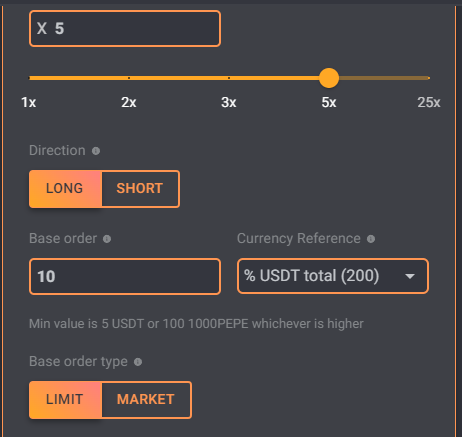

Now, knowing that these 10 cryptocurrencies are the ones with the best performance, the best results, and with a clear statistical advantage, I will do a new backtest but with a little more aggressive management. I will use 10% of my portfolio that I use for testing (real account) which is 200 dollars, and the margin per position will be selected as a % of the entire account (isolated subaccount for this example)

Since there are 10 pairs, I will use 10% of the account to open a trade.

Here I show the results. I hope they are helpful and hopefully give you some ideas to create another strategy, or perhaps optimize it to suit your taste.

I also leave you the link in case you want to review it in more detail.

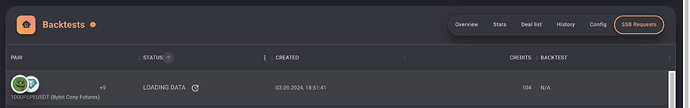

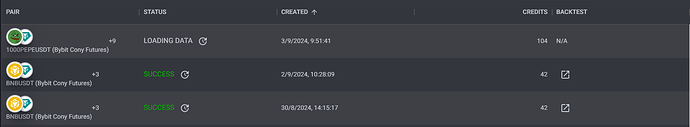

(The pairs are exclusively from Bybit)