Once more with a little more explanations

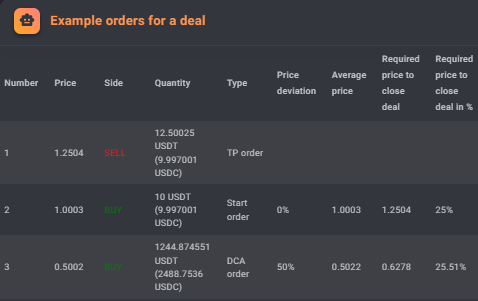

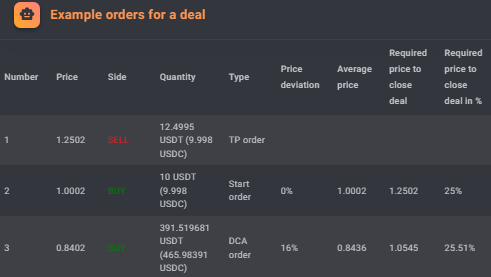

Example with Take Profit

Starting Information:

- Take Profit (TP): 5%

- Base Price: $100

- Base Size: $10

- Required Change (RC): 25%

- DCA Price: $50

Step 1: Calculate the Take Profit Price

To find the take profit price, add 5% to the base price:

Take Profit Price = 100 × 1.05 = 105

Step 2: Calculate Deviation at DCA Price (from Last Order)

The deviation is the difference between the DCA price and the base price:

Deviation = (50 / 100) = -50%

This shows that the DCA price is 50% below the base price.

Step 3: Calculate Deviation at DCA Price (from Current Take Profit)

Next, calculate the deviation between the DCA price and the new take profit price:

Deviation = (50 / 105) = -52.38%

This shows the DCA price is 52.38% below the take profit price.

Step 4: Calculate Required Change to Break-Even (Before Adding a Safety Order)

To break even at the DCA price, calculate how much the price would need to rise:

Required Change = (100 / 50) = +100%

So, the price needs to rise by 100% from $50 to reach the original base price of $100.

Step 5: Calculate Required Change to Take Profit (Before Adding a Safety Order)

Next, calculate the required change to hit the take profit price at $105:

Required Change = (105 / 50) = +110%

The price needs to increase by 110% from $50 to reach $105.

Step 6: Calculate the Volume Scale (for Safety Order)

To figure out how much volume we need to add, use this formula:

Volume Scale = ( (1.05 - 1.25 × (50 / 100)) / (1.25 - 1.05) ) = 2.125

This gives us the multiplier for adjusting the volume of the safety order.

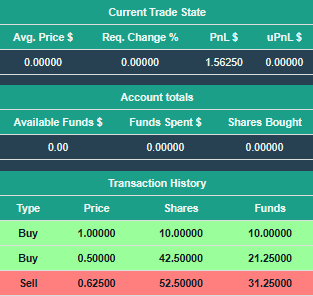

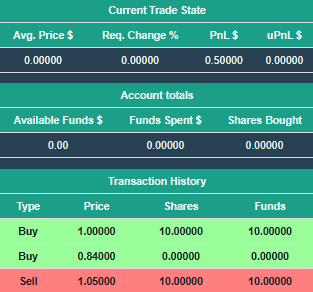

Step 7: Calculate the New Volume

Now, find out the total volume needed for the safety order:

New Volume = 10 × 2.125 = 21.25

So, the required volume for the new safety order is $21.25.

Step 8: Calculate the New Average Price

The new average price after adding the safety order can be calculated as:

New Average Price = (100 × (100 / 10) + 50 × (50 / 21.25)) / (100 / 10 + 50 / 21.25) = 59.52

So, the new average price of the position is $59.52.

Step 9: Calculate the New Take Profit Price

With the new average price, calculate the new take profit price by adding 5%:

New Take Profit Price = 59.52 × 1.05 = 62.50

So, the new take profit price is $62.50.

Step 10: Calculate the Required Change to Take Profit (from Current Price)

Finally, the required change to hit the new take profit price from the DCA price is:

Required Change = (62.50 / 50) = +25%

Result

As we have configured it, a 25% increase is needed from $50 to reach the new take profit price of $62.50.