You started with the wrong value 0.2817 instead of 0.2943.

Oh, sorry, my mistake. Your value is correct.

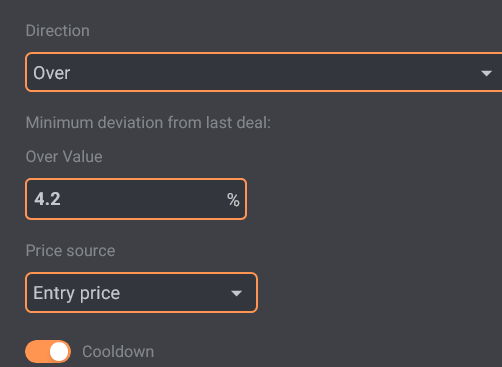

What if we use the direction “Over”? Will it make a difference?

I just want to slow down new deal openings when the price drops a lot. There seem to be fewer deals in the upper range and a lot more deals in the bottom range. Is that normal?

The bot seems to consume a lot more capital when the price drops compared to when the price is in the top range.

If you have 100 apples and add 10% you have 110 apples.

If you have 50 apples and add 10% you have 55 apples.

Dynamic price filter doesn’t slow down or speeds up. It builds a geometric grid of DCA deals in the configured direction. If you wanted changing geometric spacings you would need a scaling factor for each direction. Or an option to choose between geometric and arithmetic.

So, according to this, it’s better to use the Gainium grid bot with arithmetic mode rather than DCA bots with multiple deals + dynamic price filter for spacing. ?

I cannot tell you what’s best for you. Arithmetic grid keeps the same absolute distance between prices. If the price declines the deviation and thus take profit between grid lines increases and vice versa if the price increases.

1 -> 2 = 100.0% 10 -> 11 = 10.0% 100 -> 101 = 1.0% 1000 -> 1001 = 0.1%

When we start, bot deals consumption slow, but when the price drops deeply, they consume faster. Is that normal? If it is, I think I should increase the dynamic price filter % when the price moves far from the open price.

For the Dynamic price filter the percentual distance stays the same.

1000 -> 990.00 = -1% 100 -> 99.00 = -1% 10 -> 9.90 = -1% 1 -> 0.99 = -1%

The absolute distance decreases.