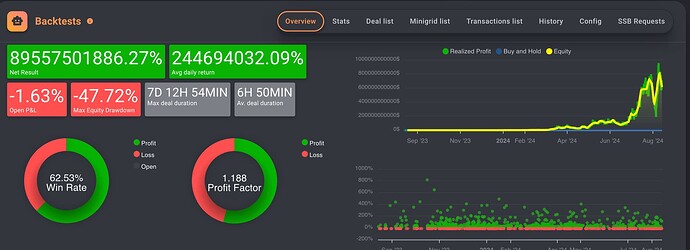

SOL

14X Leverage

$1000 account size - Using % FREE

5% Base Order / 15% SO

Back test 365 days.

No Liquidations

Testing 3M timeframe

There is a tab in the backtest showing in what month you did most of the gains and how much each month - looks like the actual gains come from last month

@Rossano - I;m not seeing the months tab, where can I find that.

Also, why would that be that over the course of a 4 year period (current backtest), that I am seeing most of the deals from July onwards this year?

Why would the bot not be making deals during the other years?

Oh i didn’t notice that. Yeah, would be better to see a nice smooth upward equity curve, the sharp spikes are dangerous.

Thanks for sharing this strategy Brandon.

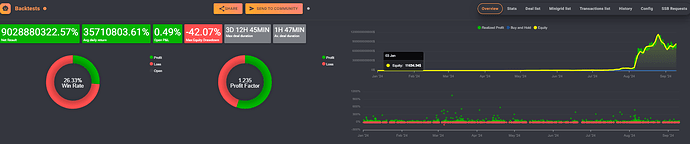

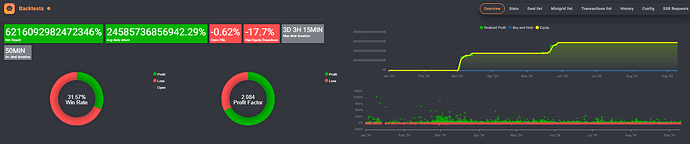

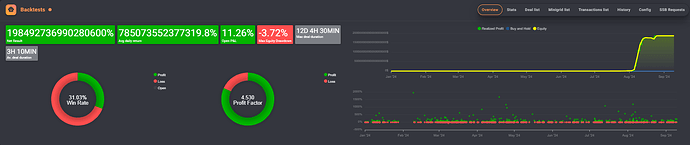

Been testing this strategy today also on some other tokens and made some adjustments (eg. 20x leverage, -8% SL). Backtest results are to good to be true ![]()

Winrate is low but that’s because of the tight SL. Backtested on a lot of tokens and different time period and it seems to work on almost all tokens.

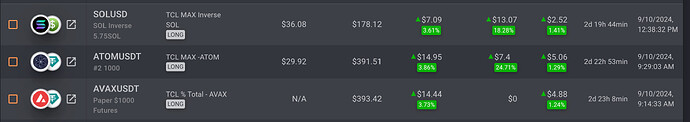

See some results from my backtest.

https://app.gainium.io/combo/backtests?a=2263&aid=share-backtest&backtestShare=841507ad-bcd3-4b25-b869-da81fb3e2c10

https://app.gainium.io/combo/backtests?a=2263&aid=share-backtest&backtestShare=d9a3eddc-e908-4b29-b260-7f99342e95d3

Even without a start indicator (ASAP) the results are amazing.

Running this one paper and live and noticed that it doesn’t work as it should.

Something is going wrong with the DCA and SL but not sure yet.

SL is not used and DCA orders seems missing sometimes. Anyone have this running on paper or live as well?

You’re very welcome! Yes, been testing on different token as well on 4year backtests.

I’m looking for the sweet spot in having an over 52% win rate and max equity DD.

The higher the stop loss, the higher the win rate, but the bigger the draw down.

I’ve got a few paper bots running and one live on SOL with a small amount.

I haven’t dug into any of them to see if the DCA’s are working correct. Will check that out now.

Great work, please check both DCA and SL something is not working ok, results are totally different then the backtest. lets keep eachother posted.

Thank you @Brandon and the community for this bot! Amazing work! I’m currently testing the bot on paper trading because the backtests seem a bit off.

I frequently encounter buggy backtests, and I’m not sure what to make of it, as I’ve seen similar anomalies with my TradingView backtests. For instance, using a similar strategy with the same backtest parameters, I don’t get consistent results between Gainium, TradingView + TTP extensions, and Python… Which one should I trust? @aressanch

@Rossano I don’t fully agree with your previous statement. While backtesting with BTC can be a step in the process, I don’t think it’s mandatory for several reasons.

- Yes, altcoins are correlated with BTC, but instead of validating the strategy solely based on its performance on BTC, why not use indicators tied to BTC’s price movements for opening, closing, or adjusting our positions? (A simple example: closing a SOL/USDT trade when BTC/USDT drops 10%, or using volume, BTC dominance, etc.)

- Many entities engage in algorithmic trading—not just retail traders like us but also big firms and even the exchanges themselves. Personally, I’ve noticed that some trading pairs respond much better to technical indicators than others. (For example: RNDR/USDT has been responding very well to RSI on Bybit for the past two years, while on Binance, not at all. In this example, a BTC-based RSI strategy doesn’t trigger any response.)

It’s precisely our job to find these small adjustment variables. Maybe @aressanch super backtest automator could be a huge help in this. Vote here for its implementation.

Something is not good with those numbers, bot needs more than 60% winrate and a really consistent profit factor above 1.2 to be profitable because sintetic test do not reflect small variations that in time will be bigger.

I suggest duplicate the fees also put a lower take profit. The profit is too marginal and could affect the results.

Hard to say, I guess it depends on the backtest. There are things that tradingview doesn’t know but we do, such as your user fees. Also we emulate liquidations and TV doesn’t. It may also be that the settings are not exactly the same.

I think must be a difference in how combo works, but for me its a new door to knock. I was trying to emulate this TCL MAX but I will needs another round of test and it will not be enough to reproduce the original ![]()

https://app.gainium.io/combo/backtests?a=1895&aid=share-backtest&backtestShare=e9944c65-d91e-48f2-b41b-14309c5c7316

You don’t agree with my statement but you confirmed what I said with your statement.

I didn’t say to test it SOLO on BTC but to use BTC as a basic/main reference to understand if the logic of the strategy is correct - I won’t trust 3 type of backtests if not associated with a BTC backtest: new coins with not historical data, poo/meme coins, tokens (practically more than 95% of the crypto).

BTC can prove for you if the strategy has any potential simply because you are dealing with a NORMAL chart not influenced by other factors.

Bear in mind that indicators are ONLY indicators and they don’t have anything to do with the coin or the exchange neither with the price - If RSI works better on Binance is only because accidentally it works better. Similar to Fibonacci - it works only because people use it to make their decisions therefore orders are placed on those lines but there isn’t ANY other reason, in fact Fibonacci is based on the golden ratio and not on the market.

Price movement driven by liquidity is what really matters.

Not very popular with my statement as most of the times against what traders believe and changing mindset is quite difficult to accept ![]() - my brother after 5 years of working together everyday told me I was right

- my brother after 5 years of working together everyday told me I was right ![]() poor lad

poor lad

Yes Tradingview has limitations and integrated backtest into Tradingview strategies are more reliable than the one integrated in Tradingview - with a TV strategy the fees, liquidations data etc can be accurate but if you rely on TradingView only NO those aren’t true

Does your bot (paper & live) work correctly?

Nice. Only remember that there’s an uptrend currently.

An update after 37 days of live trading - Gainium app

It’s seen a 365% gain

@Brandon can yu share strategy link…its not working

Can u Share the Bot? the one i am seeing has different outcome

I just lost 1900 usd on a bot like this, 20x , can the bot recover?