Hello, once again congratulations for your good job on gainium. I am huge fan of grid bots.

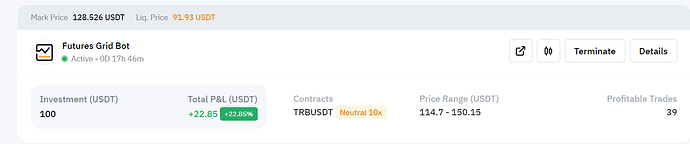

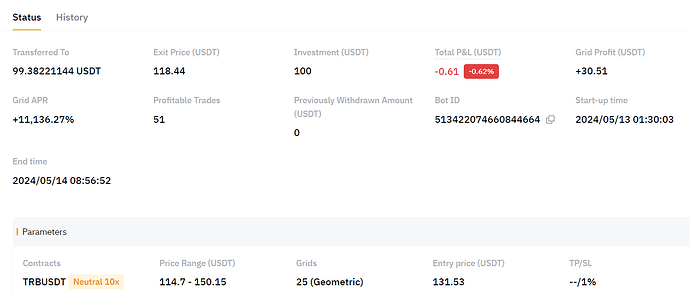

As everybody knows, the problem on those type of bots is they don’t lock the profits. For example a neutral bot may produce a PnL 20% and then if the price breaks out and goes out of grid the bot may end up with a negative PnL or a liquidation.

The stop loss provides some kind of safety to escape from the big losses but it is not good enough.

And here is my idea. If I could place a trailing stop loss e.g 5%, I could secure the 15% PnL of total 20% profit by auto closing the bot. Knowing that, I could leave the bot running for an infinite time to see how far it can go.

In addition:

1. You can add on trailing TP a configurable delay. Eg. If PnL reduce bellow 15% only for a short period of time e.g for 1 min or 30 sec, the delay would prevent the bot closure.

-

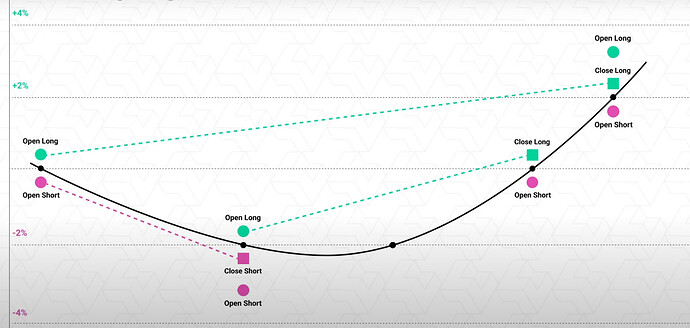

On neutral bot you a can add cycling closures. Example: Let’s say I am opening a neutral grid bot on BTC. When I start the bot the BTC is on 63,000$. Then the price increases up to 63,500. The bot will open shorts from 63,000 up to 63,500. When the bot reach back on 63,000 all the shorts will be closed and the unrealized PnL will be 0. That I mean as a cycle. You can add a function to auto close the neutral bot on completion of a configurable number of cycles.

-

Tradingview alerts. Let’s say I am getting from my tradingview indicator a buy signal. So, I start a long grid bot. As long as the price action remain bullish the bot will produce profits.

The point is when the trend change from bullish to bearish the bot profits will be ruined if I am not in the front of computer to stop it. A tradingview alert triggered by a sell signal could resolve that issue by stopping the bot automatically. A similar function have the OKX grid bots. Check it and you will better understand what I mean.

If you indent to develop any of the above mentioned please give priority on Trailing stop loss as in my opinion is the most important.

Regards