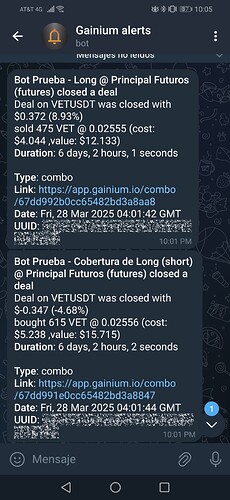

Now on the other hand, this is an example where it goes against me, and the hedging pretty much let me out without loss. Something to note in this strategy is that, if your main bot makes a profit and you make compound interest, the next trade will increase the margin BUT the bot that does the hedging will remain the same, so it will be disproportionate in the event that you take 2 or 3 wins in a row. The bot that is going in favor of the trend will be increasing the margin while the hedging bot is falling further and further behind, and will lose its objective of Cover you.

That’s right, the bot would become unbalanced, so it’s best to always start them at the same time if you want to change the amount of money. Although you’d need to find a balance in this case, so that there isn’t too much of a difference between the trend and hedging bots, and then temporarily shut them down and reconfigure them.

Thanks!

That’s right, in my case, I just turn them off and leave the “leave” option for both bots (the main and the hedging bot) because in the end, both would have to close at the same time once the Supertrend changes direction. But always leaving a higher proportion of capital to the bot that goes in favor of the trend (60.40 or even 70.30) and you could also make micro adjustments in the volume multiplier factor of the DCA orders in the hedging bot, in order to be able to average in a way that is not in the best possible way.That’s right, in my case, I just turn them off and leave the “leave” option for both bots (the main and the hedging bot) because in the end, both would have to close at the same time once the Supertrend changes direction. But always leaving a higher proportion of capital to the bot that goes in favor of the trend (60.40 or even 70.30) and you could also make micro adjustments in the volume multiplier factor of the DCA orders in the hedging bot, in order to be able to average lightly More aggressive.

Great! This way of stopping the bots and manually balancing them is well thought out.

Another thing that raised my doubt (taking the long bot as an example) is why the trend bot has a top price of 50% but its short bot covers 66%. Shouldn’t it cover the same distance as the trend bot, which is 50%?

And another minor question: do you run the bots in different accounts or subaccounts, for example: account 1 (long: trend/edge bot) / account 2 (short: trend/edge bot) to better manage the balances?

There is an explanation for that, in a long bot you can cover a maximum of 100% in a fall, in a short bot you can go up to 200, 300% or more. The drawdown for a short bot is much larger, for that reason the short bot has a price multiplier factor, if the price pumps it is too strong, That way I try to cover more of the price range, not in percentage terms but in absolute terms. As for your doubt about opening the long bots (trend and hedging) on an account, and opening the short (trend and hedging) on a sub-account, do not consider it because if for some reason there is an error at the time of closing the trade of any of the bots, the trade that was accidentally not closed could be cushioned by the trades in the opposite direction and give you the opportunity to close it manually or wait for the better time to close it, since everything is on a cross margin.

On the other hand it could be covered by the profits of other pairs that have profits and go in the opposite direction, if you concentrate all the shorts in one place and for some reason the market explodes, all the bots would go naked at a loss and probably the hedging bots are not enough, so you can move the liquidation price away by taking the profits of the main bots long.

Thank you, dear, for clarifying this and for your patience. I apologize for asking another question. It’s about your margin calculation.

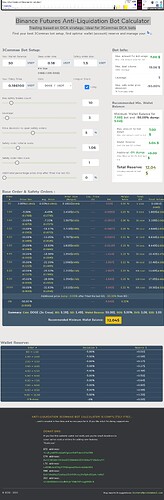

The orders you assume in the example (bot long), if I’m not mistaken, $1.5 per order in the DCA Minigrid, and you assume the cost in approximately $6. This is somewhat true, since a volume factor of 1.06 gives approximately $6.69 with that leverage. However, when I use the Binance DCA calculator, although it’s somewhat outdated since it was captured from an old website, it approximates what the maintenance and leverage costs would cost when the price deviates.

In this example case, I used Doge since the additional requirement to calculate the base is very small. So, I used the example case, and as a result, the bot needs double ($12) of what you mention, even though I didn’t add any additional deviation, since in that case, it would use more capital. Which leaves me in doubt about the real calculation of the cost of the margin in which to operate.

I share the link to the calculator and the capture so that if you have time you can check.

Binance Futures Anti-Liquidation Bot Calculator Trading based on DCA strategy

Well, if you look at PnL you have almost exactly the 6 dollars that I’m calculating as lost, That’s what you would technically lose on the trade should it reach the maximum of dca orders taken, however the $12 you’re looking at at the end is a SUGGESTED MARGIN, This is because I imagine that the calculation is being done with isolated margin and suggests that you have at least twice as much to avoid premature liquidation because it is with isolated margin. It’s the only thing I can think of at the moment. Or maybe not, it simply tells you that at least you have to have $12 in the portfolio with cross margin to avoid liquidation before, however I can come to the same conclusión. But for that reason I put 20 dollars in one direction (main bot in favor of trend and coverage) and 20 dollars in the other direction, since, obviously, the margin will only be taken in one direction at a time, always having the same amount of margin free waiting for the opening of the bots in the opposite direction while the previous ones are closed simultaneously. @offspring2x5

That’s a very good observation, sir. In the case of the calculator I linked above, it’s cross-margin, if I’m not mistaken. I’d have to take a chance with a small balance and experiment. Thank you for your very clear answers.

Nothing to be thankful for, surely it is just about that, it recommends you to have a minimum of 12 dollars so as not to have an early liquidation of the position. Best regards.

Hi friend how are you? Could you reshare the bot links please. Thanks

Sorry to say, but, simply put, this strategy won’t work and will hardly give any consistent returns in the long run. There are quite many reasons for that.

-

Indicator for deal start: Supertrend is hardly super if you use it as standalone indicator. The best to buy is already long gone when supertrend turns green. You need to actually find something that possibly buys around the bottom. In the boring sideways markets, Supertrend does nothing and doesn’t work.

-

Stop loss: In sideways markets, 7 out of 10 times, your tight stop loss will always hit.

-

Leverage: No matter how minimum it is, it won’t work in your favour.

-

Strong one-sided trends: One side will lose in pounds while other will only make pennies.

By definition, hedging is a safety mechanism and it isn’t intended to capture every market movement if you are on leverage and DCA.

It will work the best if you have a grid bot with levels that “mirror” each other on both long and short grids. This is very important. Again, if you are on leverage, some cannibalisation might happen and realized losses will only turn into profits with a strong favourable trend. The overall gains will still not be enough.

My ideal scenario for a hedged bot would be:

Let’s say BTC is at 85k and I expect it touch 80k before moving upwards towards 90k.

Now, the best way to manage this is to start a long and short simultaneous grid bot between 75-95k with grid levels that are same for both.

When price goes down to 80k, long will lose heavily, but short will make some decent amount. Same will happen when price goes up towards 90k. So, the bigger picture here is to look at the overall gains. Your ultimate gain will be what when the price begins to stabilize at around 85k once again.

So you need an asset that will not move around much and might fluctuate in a fixed range. Only BTC fits the bill because everything else is simply garbage.

Having said that, I’d like to see your results and experience of running the same.

Thank you for your comment. Actually I don’t want to be right, nor did I mention that it was a magic strategy (the magic script was clearly sarcasm) I just wanted to show an idea that I raised, I am even working on that and to this day I have made some changes, the main idea of the post was to simply show an idea, a template in which everyone could base themselves and hopefully, to reach a better result, the results of my experiment were shown in the screenshots, If anyone has an idea of how to optimize and improve it, it would be good if they raised it, in the meantime I will continue to do tests on my own and see what I can find.

“This is the Way…”

This is the way brother. ![]()

![]()

Friend, was the post meant to share a strat or to sell a book? The bot link doesn’t exist ![]()

Hey, how are you? I’m sorry the bot isn’t available. I’ve been tweaking and trying out new settings, and I had to modify it. I’m also testing an ALPHA version of another bot that isn’t yet public on Gainium, but it will surely simplify things a lot. That’s why I haven’t updated it yet. And my apologies for replying so late; as you can imagine, I’ve been a bit busy.

Thanks friend, good luck with that!