Hedging with futures

Hello, traders. I want to share a strategy I developed, inspired by Ross and HunterWhale. For those unfamiliar with it, this is a strategy called Plankton, which basically covers a 2% range both up and down. It runs on SPOT, and interestingly, it also operates in short.

Yeah, I also struggled to process the idea of shorting in SPOT (because, well… there’s no leverage or short selling), but once you understand it, it makes sense. Sure, it’s a simple concept in theory, but not so easy to grasp when you come from the world of more traditional strategies.

Now, there was one detail that bothered me: the base currency tokens used for shorting lose value over time. So, while you may be generating “profits,” you could be watching your equity curve plummet… not exactly the best feeling. I’m not saying the strategy doesn’t work—I’ve been following its performance closely, and it’s actually doing quite well. The issue is something else: if you don’t properly calculate the number of pairs you’ll be trading and don’t buy enough base currency, sooner or later, you’ll run out of liquidity. And what happens then? The bots stop. At that point, you’ll need to inject more base or quote currency to get everything running again.

So I started thinking: How can I replicate this strategy in futures, minimize risk as much as possible, and keep a “healthy” positive equity curve?

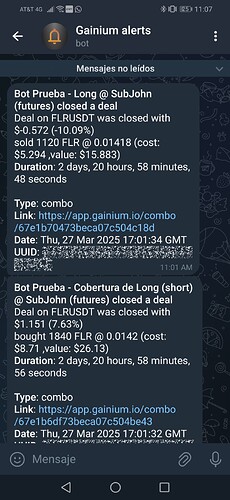

That’s where my idea was born: a hedging strategy using futures and cross-margin ![]() . Yes, it comes with risks (like everything in trading), but the key is capital management, which is where I’ll place the most emphasis.

. Yes, it comes with risks (like everything in trading), but the key is capital management, which is where I’ll place the most emphasis.

Does my strategy have a name? No. Am I going to name it? Also no. Call it whatever you want.

Strategy Structure

The strategy has a trigger indicator, which—without dragging out the suspense—is simply a Supertrend. Why Supertrend? Well… no special reason. It’s a strategy script I already had in TradingView, and honestly, I didn’t feel like diving into Pine Script to build another one from scratch. So I recycled it.

Now, aside from my laziness with coding (which I’m sure many of you can relate to), this script helps me find an optimal configuration for the indicator’s parameters. I mainly use it in TradingView to test different settings and evaluate their performance before moving to Gainium for a deeper backtest with the best adjustments.

By the way, I’ll leave my Supertrend script somewhere around here in case you want to download it and experiment with your own settings. This way, you can fine-tune the parameters before backtesting in Gainium.

Gainium Setup: This is Where the Magic Begins

Once you have a decent configuration for the asset you want to trade, it’s time to take it to Gainium and let the Combo Bots do their job. For those unfamiliar with them, this engineering marvel created by Ares, Gainium’s CEO, can make almost anything profitable… with a little bit of sugar, spice, and everything nice. (Well, actually with good capital management, but a little love never hurts.)

To trade a single pair, we will need four Combo Bots (yes, it’s a small but well-trained army):

![]() 1 Short bot

1 Short bot

![]() 1 bot that hedges the Short (in Long)

1 bot that hedges the Short (in Long)

![]() 1 Long bot

1 Long bot

![]() 1 bot that hedges the Long (in Short)

1 bot that hedges the Long (in Short)

All of them will be in cross-margin mode, and as a recommendation, a maximum leverage of 3x (because there’s a difference between taking risks and going crazy).

I won’t go into too much detail about the configuration since I’ll leave the bot link so you can replicate it directly. The important thing here is capital management, so I’ll explain how to allocate funds correctly to avoid portfolio imbalances.

Practical Example with GALA (Because It’s Cheap and Convenient)

Let’s say you decide to trade with GALA, as it allows working with small amounts.

![]() Defining the capital: Suppose we allocate $20 to trade GALA in Short.

Defining the capital: Suppose we allocate $20 to trade GALA in Short.

![]() Distribution:

Distribution:

- 60% of the capital goes to the bot that follows the trend (Short) → $12

- 40% goes to the hedging bot (Long) → $8

![]() Dividing within the Short bot:

Dividing within the Short bot:

From the $12 allocated to the Short bot:

- $6 goes to the Base Minigrid

- $6 goes to the DCA Minigrid

For the hedging bot you will do the same, but with $8, they divide it into 4 for the basis order and 4 for DCAs.

(![]() Important: When configuring this, make sure to adjust the order cost, not the notional value, as the latter is affected by leverage.)

Important: When configuring this, make sure to adjust the order cost, not the notional value, as the latter is affected by leverage.)

![]() Configuring DCA Minigrid orders:

Configuring DCA Minigrid orders:

We want 10 DCA orders, so we take the $6 allocated to the DCA Minigrid and divide it by 10 → Each DCA order will be approximately $0.6.

(Exactly the same for the hedge bot, $4 you divide it by the number of DCA orders)

Note: If the bot’s total cost turns out higher or lower than what you initially calculated, slightly adjust the DCA orders until it’s as close as possible to the $12 allocated for the main bot.

(Again the same thing, but trying to adjust it to the $8 of the hedge bot)

Putting the Bot to Work

The bot will start operating ASAP and will be controlled by the Bot Controller, which is where the trigger indicators come into play. Here, you’ll need to replace and adjust the Supertrend values you previously optimized for the asset you’re trading.

![]() Stop Loss and Hedging:

Stop Loss and Hedging:

The only bot with a Stop Loss is the hedging bot (in this case, the Long bot). Its Stop Loss will be set right at the limit of the total DCA orders.

![]() What does this mean?

What does this mean?

If the hedging bot’s Stop Loss is triggered, it means that the trend-following bot has already closed with profits. Mission accomplished.

What If No Bot Hits Its Stop Loss?

If neither bot triggers its Stop Loss during the trade, both will close at market price when the Supertrend changes direction.

![]() Example: Suppose we were trading Short, and the Supertrend shifts to an uptrend. At that moment:

Example: Suppose we were trading Short, and the Supertrend shifts to an uptrend. At that moment:

![]() The bot that followed the trend (Short) closes with profits.

The bot that followed the trend (Short) closes with profits.

![]() The hedging bot (Long) averages its entry price to try and close with the smallest possible loss.

The hedging bot (Long) averages its entry price to try and close with the smallest possible loss.

The key here is that the hedging bot’s loss will be smaller than the profit made by the trend-following bot.

In other words: if everything is configured correctly, the result remains positive.

And What Do We Notice in This Scenario?

![]() The hedging bot can also close with profits, but the bot that follows the trend always takes the biggest piece of the cake.

The hedging bot can also close with profits, but the bot that follows the trend always takes the biggest piece of the cake. ![]()

![]()

Backtest Data

Why Did I Use a SHORT as an Example?

Simple: because shorting is more difficult and riskier.

![]() In a Short, profits are limited (the price can’t drop below 100%), but losses can exceed 100% if the price skyrockets uncontrollably.

In a Short, profits are limited (the price can’t drop below 100%), but losses can exceed 100% if the price skyrockets uncontrollably.

![]() In contrast, in a Long, the price can rise infinitely, meaning there’s no theoretical profit limit.

In contrast, in a Long, the price can rise infinitely, meaning there’s no theoretical profit limit.

That’s why, if this strategy works for Shorts, which are the most challenging, don’t freak out when backtesting in Long, because you’ll probably be able to generate even more profits.

But be careful: stay disciplined.

![]() “Before learning to win, you should first learn how to lose.”

“Before learning to win, you should first learn how to lose.”

Losing can also be useful and rewarding (like when you lose weight, for example ![]() ).

).

What’s Your Job Here?

The bots cover a 50% range both up and down, so your only tasks are:

![]() Find a solid configuration using the script I’ll provide.

Find a solid configuration using the script I’ll provide.

![]() Manage your capital properly, following the guidelines I shared.

Manage your capital properly, following the guidelines I shared.

What If You Lose Money?

If you lose money and think it’s my fault or that the strategy “doesn’t work”, then I have two recommendations:

![]() First, read my book The Art of Quantum Trading, available on Amazon (I’ll leave the link below).

First, read my book The Art of Quantum Trading, available on Amazon (I’ll leave the link below).

![]() Amazon Link

Amazon Link

![]() And if after that you still believe you can get rich with $20 leveraged at 100x, then I suggest you visit a psychologist.

And if after that you still believe you can get rich with $20 leveraged at 100x, then I suggest you visit a psychologist.

I hope you find this information useful and apply it responsibly and consciously.

I’m not a fairy godmother, so think carefully before diving into this.

Trading isn’t magic, but with discipline and strategy, you can make it work in your favor.

Have fun, and always remember:

![]() “In trading, you don’t win by predicting the future, but by managing the present well.”

“In trading, you don’t win by predicting the future, but by managing the present well.” ![]()

Links and Settings

— Backtest URL:

– Bot URL:

– Magic Script:

Magic Script.txt (3.5 KB)

Credit to @Rossano , @cestjf86, and @aressanch, as these ideas are created and inspired by their previous work, and of course, to @maksym.shamko, the genius behind these Gainium tools that make all this possible.