Hello Gents,

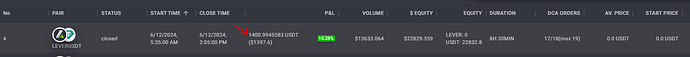

As we discussed in the telegram I noticed some discrepancies in PNL on deal calculations.

Both are on the same settings.

Can you explain what the discrepance is and what values were you expecting?

Ares, I do understand that you are very busy with other things, but I would like to mention that those small bugs could lead to potential loosing of clients, and platform will have bad reputation, we all see the benefits and your hard work on it, Dont get me wrong, but results are not correct, try to run yourself and you will see.

-

I found already that there is a differece between configuration in regular DCA and COMBO bots, related to leverage selection. [on DCA you can set +1% profit,and it will apply leverage - on the COMBO still i need to set -800% to have my -40%[at 20x cross] stoploss with -40% expected stop loss] I hope i explained correctly.

-

Regarding the backtest results - How you can have +1400$ with +1% target in that short period of time. [We are talking about 1x leverage] the DCA bot are more less correct results - +240$

Please check)

To your points:

- That is how it works because DCA bases the TP on price %, while the combo bases the TP on deal value %. 1% price difference with 10x leverage results in 10% profit, while combo is already operating on deal value so 1% profit is 1% profit on any leverage (though it will require a significant less price movement to achieve it). Hence DCA TP is affected by leverage while combo TP is not.

- I checked and the result is correct. You have set a volume scale of 1.25. I can see one deal that filled 17 DCAs, if you do the math the last DCA would be a big amount. While the DCA bot closed the trade at TP, the combo bot continued grid trading on such big quantities, hence 6x more profit (with 6x more risk)

Ares, thanks for your reply.

I’m really sorry, but I can’t really get it.

Probably my crazy ideas doesn’t fit normal strategy testing.

But my mind about to explode: how I can have 1.4k$ pnl in around 8

hours difference in trading.

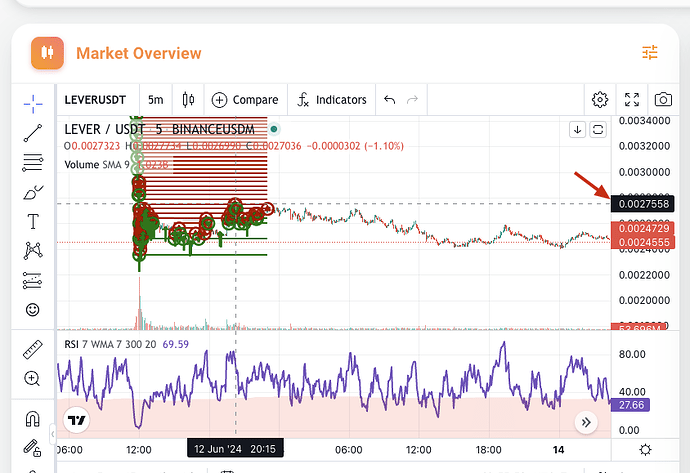

As I understood the combo has to sell some base with the price move up even if under the breakeven, so basically we will have negative profit value. And then the price bounce slightly and I will take 1400$ profit.

Magic.

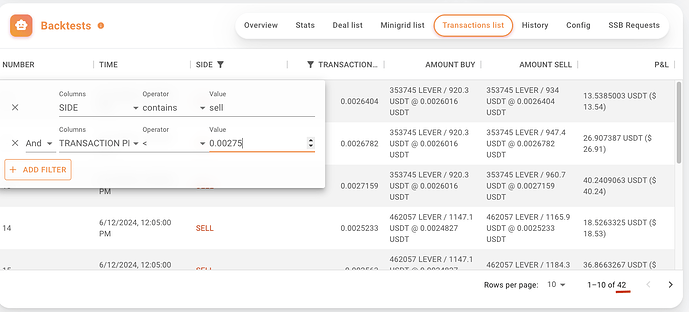

The price didn’t bounce slightly, it was a 20% bounce from the bottom. Take into account that the orders at the bottom are the heaviest, and right there is where most of the sell orders happened. 42 sell transactions happened under 0.00275. Each grid line is around or over 1k. The math checks out.

That doesn’t mean you will have such good result in live trading, is just a backtest. But I am pretty sure the combo would have killed the DCA in this case.