Before introducing the strategy let me give you my prerequisites which suit my opinions, risk and reward preferences

- High frequency

- ROI per day ideally should high 0.25%+. I prefer high ROI because trading in futures is risky and you want to gain reward equivalent to the risk

- Makes $$$ every day by closing deals/grids

- Made for Bybit as thats the only place i can trade futures where I live

- Indicators/TA are useless. They work due to luck and can stop working anytime so I dont use them

Strategy:-

This is a long and short futures combo bot strategy for alts (not BTC ETH)

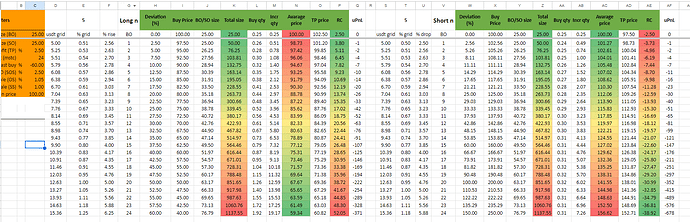

Unlike most strategies here where people use backtester I just use excel and good old maths largely to determine the risk and reward of strategy at every minigid/dca order level.

Also I dont feel combo bots can be properly back tested as movement patterns are lost in historical candles i.e you dont know if lows were made first or highs within a candle especially in volatility.

Hence I take the excel mathematical approach

Concept wise its simple.

Run combo bot on alt pairs with both long and short positions ASAP deal starts

Reasoning:

Crypto market is usually uni-directional or ranging for days/weeks/months before it changes direction.

Instead of making $$$ only when your strategy is in the market direction, this strategy is independant of direction.

When we have pump long positions close and shorts load up and viceversa.

When there is ranging like last few days the minigrids makes money

Base MiniGrid, Safety Minigrid, #of DCA Orders, Volume Scale and Step Scale

Long Combo bots dca orders cover 60% and short combo bots dca orders cover 150%

These numbers are not random as a long combo bot started at 100$ base order price has dca orders to 40$ i.e until last dca order -60%

Short deviation needs +150% for price to go from 40$ to 100$

So basically -60% and +150% are mirroring long and short deviations

TP 5% max used DCA

Combo bot settings

I use BO/SO 25/25$. Because i like to have 5 grid levels between each dca order.

then each min grid order size becomes 25/5 = 5$ as we have 5 grids

5$ is a gainium set min for order ( A major improvement suggestion about this at the end )

Volume Scale 1.05 as we can dca down a little bit. If you have more funds use higher Volume Scale. Risk and rewards increase with this.

I played around Minigrid levels and spacing so that we can get approx -60% and +150% coverage for long and short.

See excel pic to see how the math helps to determine these settings

Link for long combo bot

https://app.gainium.io/combo/67093ca1e52c35f92de4d20e?a=424&aid=share-bot&share=fb00f11a-dd17-42b2-8cff-1c1a5af323f6

Link for short combo bot

https://app.gainium.io/combo/67093e5fe52c35f92de50f11?a=424&aid=share-bot&share=219d7f9e-2aa9-4dc5-8432-e5089166ff09

Capital and Risk:-

At the last dca order long and short bots need 1137$ funds per pair per position

But as a pair cant be pumping and dumping at same time we dont need to cover both positions on same pair. Another big advantage of long/short on same pair

I personally use cross 20x for all most my futures strategies. This way locked margin is low and free funds are high

But the uPnL column gives a good idea of the drawdown at every grid level.

Example with 371$ funds long combo can be run with manageable risk till last minigrid and 678$ for short combo bot .

To pick a mid point 500$ per pair is a good estimate

Ideally I would run this strategy for a lot of pairs.

That way if say one coin pumps like crazy or coin gets delisted the impact on the portfolio is minimized.

Liquidation Risks

Just like every futures strategy there are risks here too

If say one coin pumps like crazy or coin gets delisted we risk liquidation

If entire market has massive pump or dump we risk liquidation

Depending on your risk level determine if 500$ per pair is enough or more.

Suggestions to Gainium :-

I am not currently running this strategy mainly as 25$ base miningrid and dca order size is too much for me.

If i want to run 10 pairs i would need 5k

If the min order size can be made 1$ then i can run the same strategy with 1k with 10 pairs.

I am sharing this strategy with the hope that like 3commas,

I hope Gainium also allows small order sizes for Bybit as it allows for third party brokers. I have already made a feature request for the same.

However if you have a bigger budget you can try it out or can try with just a couple of alt pairs

Ideally >=10 pairs should be good.

Thanks for all the people who share their strategies and keep Gainium community active and helpful.