Yes sir. Wait i will Give screenshot

Appreciate your questions brother.

My suggestion is to run it in real with small funds - you can use OKX or Kucoin.

Starting long/short is only a small part of the whole process.

The more you look at the short in spot the more you see the potential - leave the theory and look at the whole logic. This is a market strategy.

Investment in spot is safe because you own the asset and you already paid for it.

Market fluctuations is your best friend as long and short work together in both directions.

Most of the traders think short is for downtrends only but when you hold the asset that base also increase in value. Same for long.

Long and short are the same even if look different.

My suggestion is to run it to see how they cooperate while the market moves up and down.

Whats your recommend to make bot in GAP price. Did bot cover 10-15% range or just choose near sell and buy

You are running a different version of long/short I won’t be able to help you brother

Oh yeah i want ask strategy in your 10k. Did u lock it All your bot? Or some dca like 10% fund is accessible

Market orders

But I do the math before starting the bots and I stick to the plan - this strategy is all about method. If you start taking loans from your bots they will get poor quickly up to a point that they won’t be able to repay the debt - corruption

Are you using the same strategy as whale hunter or do you have your own version?

I don’t understand why you expect 2/3 of the portfolio to be in base currency after the start of all bots. I described it like

“One could also say that the strategy uses a less-than-half-in approach in uptrends, if we look at the sum of values in base currency. And it becomes an up-to-all-in approach in downtrends.”

Of course, if you are half exposed to the market, then bull runs are your friend. But regarding

I respectfully disagree with the suggestion to ignore the theory. While the strategy is performing well in the current bull market, it’s crucial to consider its potential limitations in different market conditions.

“Short” spot deals are best for bull market. But do you really want to enter a bear market with already half of your funds invested? And even more, how do you want to bail out your “short” spot deals with only half of your funds left, that are also already planned for the long and not for the “short” spot deals?

Well long bot uses 100 and short uses 200 worth off base coin

If all pairs long/short are started at once then all base need to be bought ie 2/3rd of the capital

The links show that both require initial funds of around $103 per deal. Maybe the used funds of “short” deals seems to be higher because they sell when the price increases. But since you have to buy the base currency upfront you buy all of them for the lowest price.

same strategy + 2 more strategies

the best answer for you is to try it by yourself

You could use zignaly, then people can invest in you, and get paid the profits on a pro rata basis. I’ve have a service active there for a few weeks now, and it works pretty well. It also allows me to trade on Binance again.

Wanted to try out this strategy as those who use it say it keep saying its amazing.

I wanted to test two scenario which come out of this strategy:-

Scenario 1. Mega pump like XLMUSDT

At such pumps the price is no longer between the avg long deal and avg short deal.

In the image

Avg long is at 0.4759

Avg short is at 0.16

All short SOs are taken meaning you dont have any base XLM left to sell.

This is a great position to be as this means

- Your long bot is making profit

- Your short bot which keeps selling XLM from the base order is doing multiple TPs ie you bought all base at once and sold it little by little when pump has exceed 400% ie big gains

Now in this scenario the best thing to do is cancel your short deal and open a new short deal at current price which involves buying lump sum XLM and triggering short deal.

Happy days.

Scenario 2. Dump like AGLA

Well lets see a different coin AGLA. To try out the strategy,

I have been running hedge strategy on it. I picked this coin specifically as it was at ATH and i started long short bot at price 0.0116

As i write price went to 0.007

Meaning coin is down -40%.

Now what happens

My long bot with 1$ base order needs 20$ and short bot basecoin worth 20$ was bought at 0.0116

Long is carrying uPnL of -3$

Short is carrying uPnL of -8$

At the current price many short deals closed and made me 2.45$ profit

Longs didnt make any profits

So to summarise uPnL is -11$ out of which 2.45$ is recovered due to volatility

uPnL Net loss is -8.55$

Now what the guys who are running it are claiming is all the uPnL will over time convert into positive due to volatility. If not we run say 100 pairs and some might generate loss but most others with generate enough profits to make up

Part truth but not completely. If market goes down then most coins have uPnL generated at much faster rate than the short bot produces profit

So i will let you guys decide if strategy is for you or not as I feel i have given enough info to make a informed decision.

Phase 2 of spot hedging

After i have explained to everyone what the strategy is,

The guys running the strategy talk about a Phase 2 where words like “traps” and “min/max” are being said without giving any amount of details as usual.

Lets break it down a bit using the Scenario 2

In Scenario 2 for AGLA

Lets say AGLA keeps falling and the long avg price is now far away from the short avg price

If price rises now there is a price window created where short SOs are being taken.

Long deal doesnt generate any $$$ nor does the short deal close.

In this window of price (traps), using min/max price filters the guys talk about adding a new long or short deal or even both.

This means new deals will close based on the price action.

But will need more capital to trigger the new deals.

Again this is my opinion of the Phase 2.

As the guys who run the strategy dont give much detail no way to know for sure.

I think this strategy is meant to be run over a long period of time regardless of market conditions. So if you test specific scenarios you may end up with vastly different pnls but when run over years it should be profitable.

Maybe but one of the main benefit which is endorsed of this strategy is constant cashflow.

I bet there will be months where very few $$$ are made and portfolio drops alot.

When portfolio drops alot preservation psychology kicks in and people absorb the loss especially when trading coins which no one knows will get to the next cycle

The strategy in other words.

Start with two long bots per pair

The first doesn’t use safety orders but has a multiple take profit where the first is at 0% and with increasing spacing and slightly increasing order sizes for the others. It also uses a “trailing stop and restart” that re-buys the base currency that was sold during previous orders once rebuying requires less funds than were gained before.

The second uses only slightly increasing safety orders that cover a wide range down. The deeper the price goes the harder it becomes to get the deal closed.

The first may give good gains in bull runs. But without safety orders it will struggle in downtrends. The second will only give little gains then. But it could somehow cope with a reversal if the price should recover as much to get the deal closed.

I also run deals with only a single buy order and conditional take profit and of course, this market please them. But you need a long breath if the market goes deep in red first. Maybe that’s only something for currencies that you are willing to keep for a long term e.g. because of their continuous growth even in a chart with logarithmic scale?

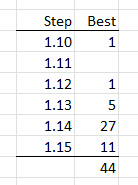

I looked at the original strategy and being unable to create bots for 300+ coins, I tried to optimize it a little bit. I’ve traded using DCA bots for many years; Step and Volume multipliers looked the obvious candidates.

Goal is to cover as much as possible in case of a Black Swan event occurring and at the same time lower the initial cost of creating the bot. This way I thought I will be trading more coins with the same capital. This means Step multiplier is the target.

For reference I picked USDC/USDT pair, practically both has the same value so this frees us from the inherent properties of each coin (min trade value, trade amount steps, etc.)

The original setup:

Step Scale : 1.10

Deviation: 91.18%

Total: $107/deal

Effective DCA orders #: 18

I backtested 44 coins, 6 times each by modifying Step Scale by 0.01, i.e. 0.1,0.11,0.12…0.15 total 6x44=264 backtests. The duration is from October 1st, 2023 to December 1st, 2024. This is 14 months. I picked the Step Scale with the best Total Profit %. The quick result: a Step Scale of 1.14 is significantly (mostly %10 more than 1.10) better.

In light of this finding a modification to the Step scale as follows looks promising:

Step Scale : 1.145

Deviation: 91.33%

Total: $90/deal

Effective DCA orders #: 15

Here we have a saving of $17. We can create one more bot for every 6 bots with the same capital.

Our (I have a very close friend with whom I exchange ideas constantly; we joined Gainium at the same time) experience on the crypto currency market is any Black Swan event results a maximum drop of 60% for most of the coins. A coverage of 70% looks good to avoid most of the red bags that can occur after such an event, so these parameters can also be considered:

Step Scale : 1.145

Deviation: 66.4%

Total: $79/deal

DCA orders: 13

Step Scale : 1.145

Deviation: 78.02%

Total: $84/deal

DCA orders: 14

I created some paper bots with this one change only: Step Scale = 1.145 instead of 1.1 I will also continue to backtest coins. So far 44 consists of coins from AI and Gaming categories with high recent volume. I also backtested 10 more from Binance new listings with less than 2 months of data. 8 of them performed best on 1.14 and 2 on 1.15 .

Burak

I would suggest to create a new topic for that.

looks like bull market. Did you also test it for bear and sideways market and combinations?

I consider 0ct 2023 to March 2024 a bull period and then until Oct 2024 sideways. That is for BTC. I think many alt coins cycled between bearish and bullish in that total period.