The telegram group seems to be full of interest around the hunterwhalehunter strategy on spot

So in this trading strategy post I will,

- Summarise my understanding of the hunterwhalehunter Market Maker bot strategy

- Provide a reasonable capital requirement for all of Gainium community to run the strategy

- Ask if Ares and Maksym can provide us a way where we can run with multiple people invested in it to meet the capital needs

Summary of hunterwhalehunter Market Make Bot Strategy

I will try to keep it simple and with as less words as possible.

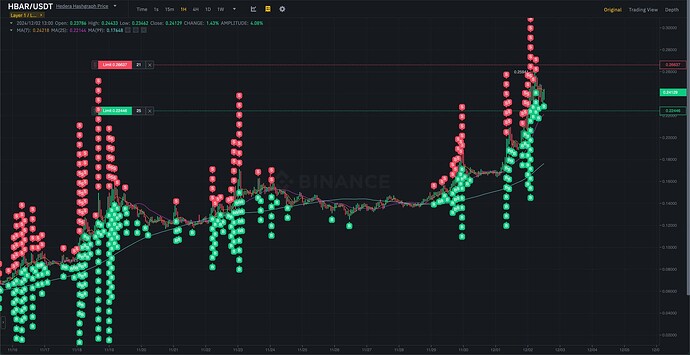

1. Initial setup for a single pair

Long spot bot covers -91%

https://app.gainium.io/bot/670f03ed720e8c31b02a7e87?share=4fd5f407-1d93-4d94-ad64-04a25e8cd6ec

Short spot bot covers +403%

https://app.gainium.io/bot/6704874a3d0e13072ec435c3?share=70f5be70-d5af-4019-b2b4-1af7988bc2c1

To put it into perspective if BO starts at 100$ price

Last long bot SO is at 9$

Last short bot SO is at 503$

ASAP as the price range is massive

Long bot needs ~110$ capital

Short bot needs ~110$ base coin worth capital to be bought at start

So ~220$ per pair is needed

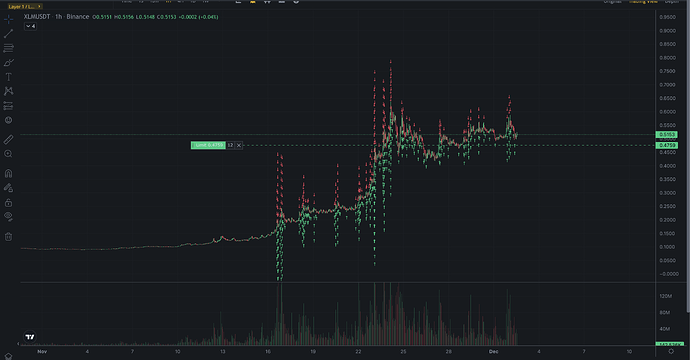

2. Fill in the gap (compounding) for that pair

The above two links are used to create the initial bot for a pair. But there are follow-up steps that are meant to fill in the gap (compound) once the price has moved a little.

Long spot bot covers -4.2%

https://app.gainium.io/bot/673bd14e60528c8e132a29f6?share=50c85fc1-f399-4510-bc47-82fd011f6189

“Short” spot bot covers +4.2%

https://app.gainium.io/bot/673bd1cb60528c8e132a390f?share=91a5bb64-e857-4aab-a08b-334c9b882106

The long spot requires ~$18 to execute its safety order.

The “short” spot requires ~$16.5 base coin worth capital to be bought at start

So ~$34.5 per pair is needed

(Source of links: https://t.me/gainiumio/26049)

How @hunterwhalehunter does it

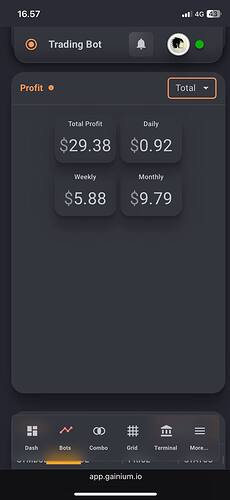

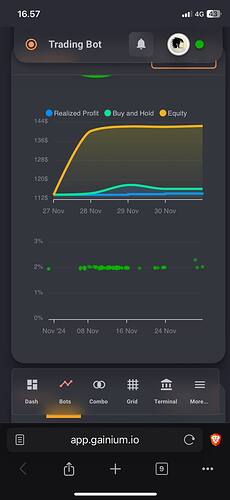

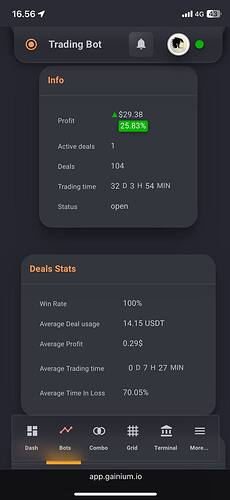

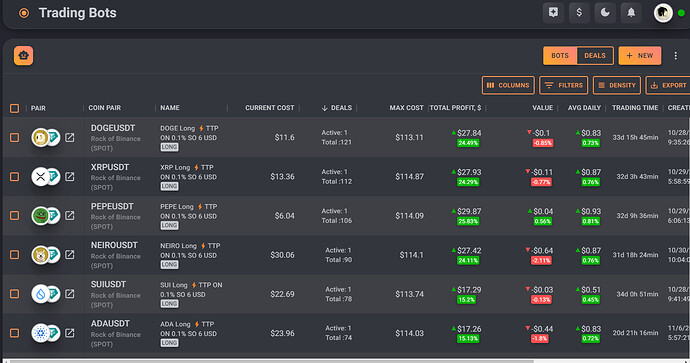

Now from what I read on telegram hunterwhalehunter trades 370 binance pairs with BO 5.6$ needing a 111k capital and is generating ~ 300$ per day gains. Impressive numbers for spot.

To make this work he has an Enterprise plan, if you are planning to run more than 300 bots talk to the team about the cost.

How it could work for us

Now to provide a way for anyone in the community to replicate it

Bybit exchange offers 1$ order sizes for 100+ pairs on spot with decent liquidity.

If BO can be 1$ instead of 5.6$ and trading pairs are 100 instead of 370 then

Per pair we need = 300 / 5.6 ~= 50$ per pair

Capital needed to run a similarish strategy on Bybit = 100 pairs x 50 per pair = 5k capital

Not same as running 370 pairs but somewhat comparable doing 100 pairs

Still 5k is a lot of money and running it will need 100 x 2 = 200 bots to be created manually.

Yikes no one wants to do that.

Unsure if short spot bots can be multipair? Never ran them

How could Gainium help us

Ares and Maksym providing a way to copy the strategy

In my mind this is how it would work.

Every interested Gainium community member pays a Market Maker bot fee like subscription fee lets say 100$

This gets pooled into a fund ( bybit subaccount which gainium controls). Once 5k is pooled maybe Ares,Maksym can have a setup config in the backend to run 100 long bots and 100 short bots run on this Bybit subaccount

This prevents users tons of manual time and effort and reduces server loads too.

A new webpage can display the subaccount portfolio value every day as a tracker for the people who have paid the strategy fee

Maybe Gainium can charge pooled users 10% of strategy fee for the setup and hassle free buy in into this Market Maker strategy.

If pooled funds increase then wait till say 10k and make the BO 2$ for the bots.

And so on…

This can be a great unique Gainium only feature which benefits the interested community members and also Gainium through the 10% strategy setup fee

Disclaimer and questions

Lastly the disclaimer and questions,

- I do have reservations about this strategy as somethings dont add up

- Firstly when 200$ worth of base is bought then the portfolio rise and fall becomes heavily connected to the market direction.

- Even though we might not see it in the coming months a big drop will result in base coin bag losing value alot while longs also accumulate uPnL so portfolio value drops.

- What happens when an interested user pays the strategy fee sees the declining portfolio value and wants out. A minimum lock up period of 30 days might need to be mentioned.

- Keeping the strategy fee low makes sure people arent asking their strategy fee to be withdrawn for every little dump

Thanks for sharing the strategy hunterwhalehunter