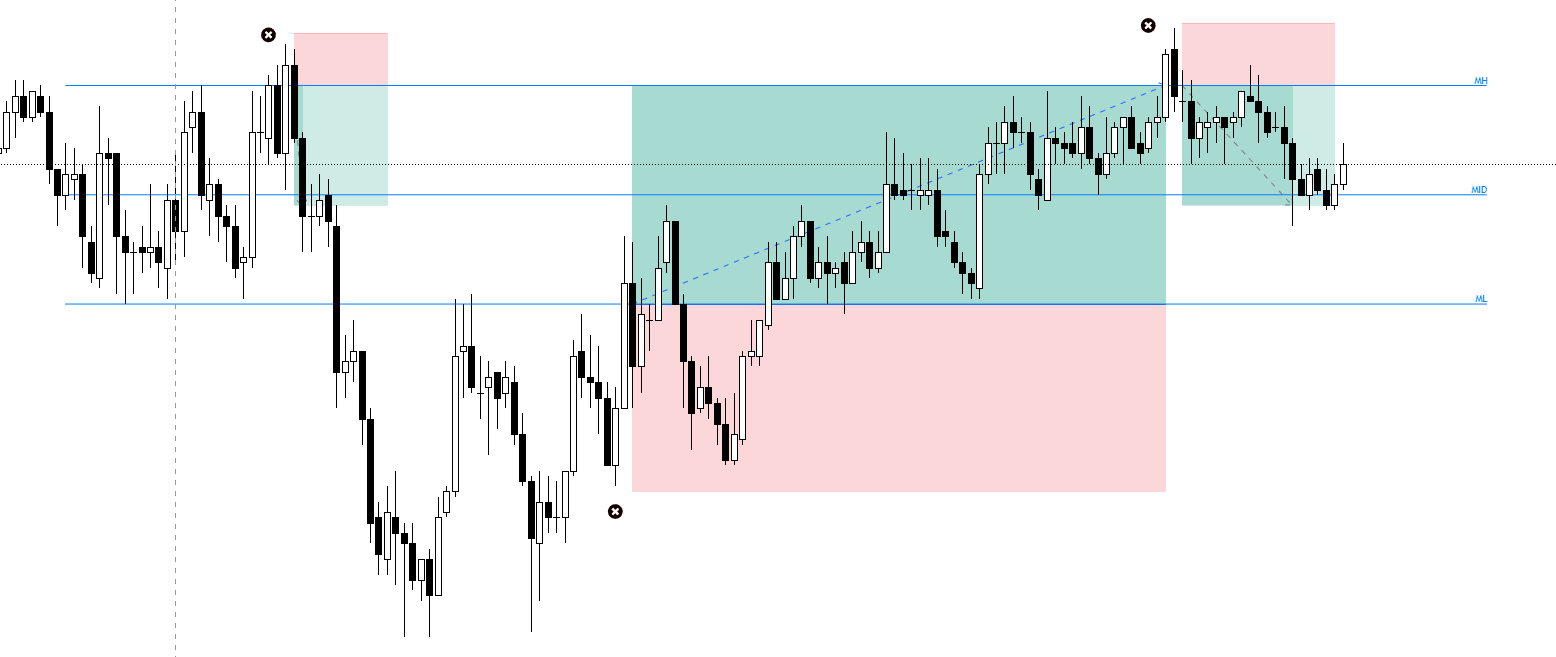

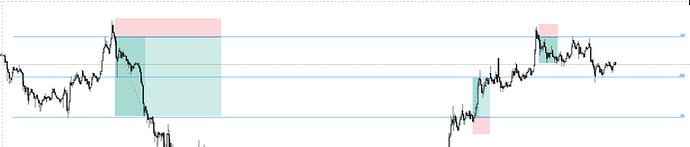

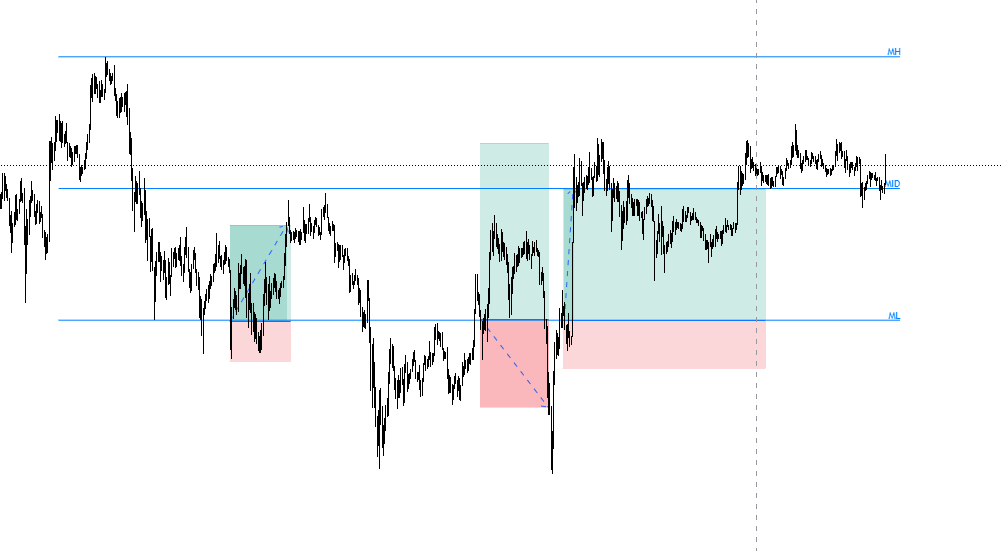

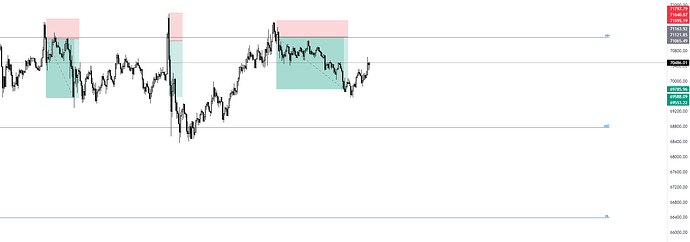

Would be nice to have “Monday Range” indicator ported in gainium, there is an opensource one in tradingview.

//@version=5

indicator('Monday Range (Lines)', overlay=true)

var market_open_day_of_week = input.string(title='What day of the week does the market open?', options=['Sunday', 'Monday'], defval='Sunday') // Some exchanges open sunday evening vs crypto std monday

var bars_extended_to_week_end = input(title='Extend bars to end of week?', defval=true)

var bars_extent = input.int(title='Length of bars', defval=20, minval=1, maxval=100)

var line_colour = input(#007FFF, 'Line colour')

monday_open_time = request.security(syminfo.tickerid, 'D', time('D'), lookahead=barmerge.lookahead_on)

monday_high = request.security(syminfo.tickerid, 'D', high, lookahead=barmerge.lookahead_on)

monday_low = request.security(syminfo.tickerid, 'D', low, lookahead=barmerge.lookahead_on)

monday_midpoint = math.avg(monday_high, monday_low)

is_monday() =>

dayofweek(time('D')) == (market_open_day_of_week == 'Sunday' ? dayofweek.sunday : dayofweek.monday) and close ? true : false

var can_show_monday_range = not timeframe.isweekly and not timeframe.ismonthly and not timeframe.isseconds // dont show above daily or below minutes

line_end_bars = if bars_extended_to_week_end

// Calculate the bars until the end of the week

// timeframe.multiplier is either daily or minutes

if timeframe.isdaily

7

else

1440 / timeframe.multiplier * 7 // (mins in day / multiplier) * days in a week

else

bars_extent

line_end_right = monday_open_time + (time - time[1]) * line_end_bars // extend line until the end of the week or number of bars chosen

if is_monday()

// Monday high

monday_high_text = 'MH '

var monday_high_line = line.new(x1=monday_open_time, x2=line_end_right, y1=monday_high, y2=monday_high, color=line_colour, width=1, xloc=xloc.bar_time)

var monday_high_label = label.new(x=line_end_right, y=monday_open_time, text=monday_high_text, style=label.style_none, textcolor=line_colour, size=size.small, xloc=xloc.bar_time)

line.set_x1(monday_high_line, monday_open_time)

line.set_x2(monday_high_line, line_end_right)

line.set_y1(monday_high_line, monday_high)

line.set_y2(monday_high_line, monday_high)

label.set_x(monday_high_label, line_end_right)

label.set_y(monday_high_label, monday_high)

// Monday low

monday_low_text = 'ML '

var monday_low_line = line.new(x1=monday_open_time, x2=line_end_right, y1=monday_low, y2=monday_low, color=line_colour, width=1, xloc=xloc.bar_time)

var monday_low_label = label.new(x=line_end_right, y=monday_open_time, text=monday_low_text, style=label.style_none, textcolor=line_colour, size=size.small, xloc=xloc.bar_time)

line.set_x1(monday_low_line, monday_open_time)

line.set_x2(monday_low_line, line_end_right)

line.set_y1(monday_low_line, monday_low)

line.set_y2(monday_low_line, monday_low)

label.set_x(monday_low_label, line_end_right)

label.set_y(monday_low_label, monday_low)

// Monday mid

monday_mid_text = 'MID '

var monday_mid_line = line.new(x1=monday_open_time, x2=line_end_right, y1=monday_midpoint, y2=monday_midpoint, color=line_colour, width=1, xloc=xloc.bar_time)

var monday_mid_label = label.new(x=line_end_right, y=monday_open_time, text=monday_mid_text, style=label.style_none, textcolor=line_colour, size=size.small, xloc=xloc.bar_time)

line.set_x1(monday_mid_line, monday_open_time)

line.set_x2(monday_mid_line, line_end_right)

line.set_y1(monday_mid_line, monday_midpoint)

line.set_y2(monday_mid_line, monday_midpoint)

label.set_x(monday_mid_label, line_end_right)

label.set_y(monday_mid_label, monday_midpoint)

We could use this as a deal start condition like: “start deal if ABOVE or BELOW monday’s High/Low” or “price crossing down/up monday’s low/high” to play the deviation of monday’s low/high with the Marklet structure indicator and RR tool.