Hello!

Orderblocks could be a nice indicator to add for the SMC series. I know that this is something that that dev team has already in mind but I wanted to have a look at what is available and open-source on Trading View as orderblocks are tricky to identify and not all the algos perform equally.

I first looked at what indicators showed when dislayed and I choosed the ones that seemed quite ok. I then backtested them on the replay mode really fast (as no strategy was available to backtest them in Trading View > if someone from the Trading Parrot community wants to take a look at the code to make a strategy from these indicators, it would be super useful before adding the indicator to Gainium ![]() ).

).

I looked at around 50 Trading view signals supposed to detect order blocks (also looked for trapped trader patterns) and here is the list of what I fund more useful:

-

- Pros: quite precise signals visually (don’t stop at what you first see as when an orderblock has not worked it disapears from the charts, only the ones that worked stay there, it can create a bias).

- Cons: few signals

-

Order Blocks & Breaker Blocks [LuxAlgo]

- Pros: less precise signals visually

- Cons: moderate quantity of signals

There are also the orderblocks from the SMC indicator from LuxAlgo that are similar to these previous ones but not equal. I know that the market structure indicators that have been added recently come from this author, so maybe it easier for the dev to use something familiar.

-

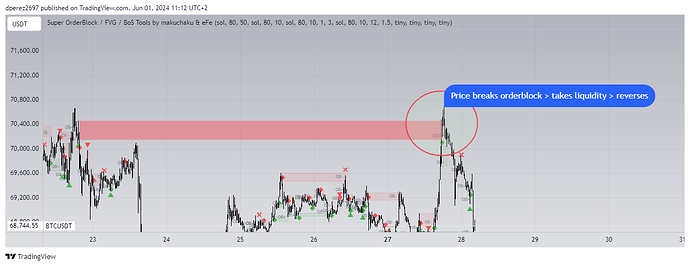

Super Orderblock by makuchaku & eFe

- Pros: a lot of signals on all the timeframes

- Cons: less precise visually (probably can be corrected by using other indicators to determine the trend).

I may have a preference for the nº3 but this needs a more precise look to know what would work best.

Then I started thinking at how to use the orderblocks on Gainium, and what would be nice is to use the R:R indicator with them but the main problem is where to put the SL order. There are some options that need examination and may differ depending on when we consider that the orderblock is not valid:

1. When the price cross the orderblock

2. When the price goes further than the orderblock (what can be considered as further is an important question also). Something that happens a lot of times is that a lot of people saw the orderblock and put their SL at the crossing line, this means a lot of liquidity for the big hands so they reverse just after the orderblock

3. Market structure Lows and Highs as SL: everything is said in the title, we could consider the next market structure low after entering a bull orderblock or market structure high after entering a bear orderblock.

Sorry for this long post, eager to know your thoughts on this and relly looking for this feature implementation!

See you around ! ![]()