Hello traders!

I am super excited to introduce you the latest feature, the Risk:Reward ratio. This feature can make a big difference in your trading, read on to find out why.

What is Risk:Reward?

In trading, the risk:reward ratio measures the potential reward for every unit of risk taken. For example, a 1:3 risk:reward ratio means that for every $1 risk, there is a potential $3 reward. This ratio helps traders evaluate the potential profitability of a trade relative to the risk involved.

Why is the Risk:Reward Ratio Important?

- Risk Management: Effective risk management is crucial in trading. The risk:reward ratio allows traders to assess if a trade is worth taking based on potential gains versus losses. It helps maintain discipline, preventing emotional or impulsive decisions.

- Profitability: Consistently profitable traders focus on trades with favorable risk:reward ratios. Even with a lower win rate, a good risk:reward ratio can ensure overall profitability. For instance, with a 1:3 risk:reward ratio, a trader must win only 25% of their trades to break even.

- Consistency: By adhering to a predefined risk:reward ratio, traders create a systematic approach. This consistency is key to long-term success, as it removes the guesswork and reduces the impact of market volatility.

Applying Risk:Reward with Gainium

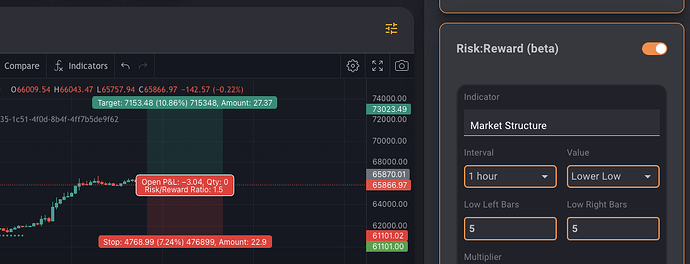

Gainium’s new Risk:Reward feature brings advanced functionality to both manual trading and automated trading bots. Here’s how you can use it:

-

Activate the Risk:Reward section from the settings panel. Note that activating this section will hide the order amount (as this will be calculated by the tool), the Stop Loss, and DCA settings (DCA is not compatible with R:R).

-

Choose an Indicator: Users can choose one indicator to define their risk. Whether it’s support and resistance levels, moving averages, or market structure, Gainium provides flexibility to suit different trading styles. Note that not all our indicators are supported, only those that can output a specific price can be used.

-

Other settings:

-

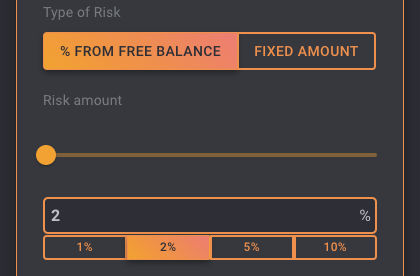

Type of risk: You can risk a % of your free account balance (typically 1%) or a specific amount like 50 USDT.

-

Min and Max position size, this is useful to limit how much funds the bot can use.

-

Min and Max SL. If you are using % from free balance as your account risk, the minimum SL will default to this value. This is because any value lower than that will require more than 100% of your funds. Example: If you set the account risk to -2%, and when the bot is going to start the deal the SL is -1%, you will need 200% of your funds to make that trade, which is obviously impossible.

-

-

Optional Reward Setting: Users can set their reward as a factor of the defined risk. This automates part of the decision-making process, ensuring trades adhere to the desired risk:reward ratio without manual calculations. Note that activating reward will disable the Take Profit settings section, as this is managed by R:R.

-

Backtesting and Paper Trading: Before committing real funds, traders can backtest and paper trade with the Risk:Reward feature. This helps fine-tune strategies and provides confidence in the chosen risk:reward parameters.

Understanding and applying the risk:reward ratio is vital for successful trading. Gainium’s new feature empowers traders with the tools needed to implement this crucial concept effectively. Whether you’re a manual trader or rely on automated bots, this feature can enhance your trading strategy, leading to more consistent and profitable outcomes.