A short summary of its idea

Consider we are at price P_1 and we e.g. expect the market to go upward. Therefore we open an order L_1 with direction long at this price with size S1 and a take profit price T_1.

If we are wrong and the price reverses for a certain deviation D_1, then at this price P_2 we open an order S_2 with direction short and a take profit T_2.

The required change from P_1 to T_1 and from P_2 to T_2 shall be the same. Further T_1 serves as stop loss price for S_2 and T_2 for L_1.

The size of S_2 shall be chosen in a way that there’s a total gain when closing all orders at T_2.

If we don’t reach T_2 but instead cross P_1 we open another long deal L_3. The size of L_3 shall be chosen in a way that there’s a total gain when closing all orders at T_1.

If we don’t reach T_1 but instead cross P_2 we open another short deal S_4. The size of S_4 shall be chosen in a way that there’s a total gain when closing all orders at T_2.

Etc.

Notice that at T_1 all long orders take profit and all short orders lose. And that it’s the other way around for T_2.

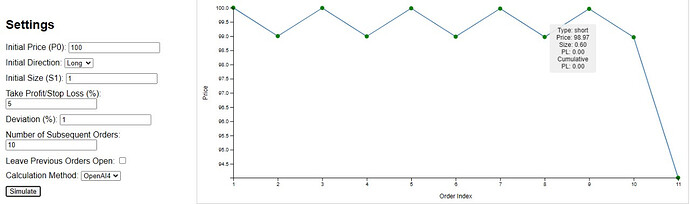

Order size tool

Let’s see whether my little tool can help to find appropriate order sizes for this futures strategy.

The tool adds a part of my Generalised DCA strategy idea, to not hold onto losing orders but instead close them to reduce the losses that we have to regain.