Today, I spent some time backtesting the full year of 2024 using various algorithms to trade BTC/USDT on Spot. I like to think of trading BTC/USDT as one of my risk-averse strategies, so my focus was on finding strategies with the highest ROI during the backtest.

Most of the algos I tested yielded around 50% ROI per year, although I’m not done exploring all the possibilities yet. Then, I had an idea to backtest a very simple grid strategy — but with a twist.

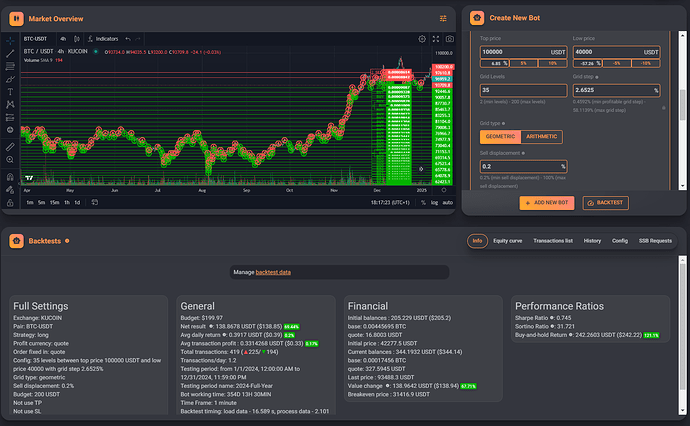

The twist was using hindsight: the knowledge that Bitcoin eventually reached 100k. So, I set up a basic grid ranging from 40k to 100k, starting at the price of Bitcoin on December 31st, 2023 (around 43k), and ran the backtest. The result? 69.44% ROI.

Better than any of my algo bots. And with some tweaking to the grid settings, I could probably push the ROI above 70% per year.

To be honest, this result left me a bit disappointed. It’s surprising (and somewhat frustrating) to see that even the most sophisticated algorithms often fail to outperform a straightforward grid strategy.

What do you think?