Strategy: Bot Acumulador

I developed a trading bot that operates using a straightforward yet effective strategy: it utilizes the 50-period Exponential Moving Average (EMA) on the 1-hour timeframe to trigger buy orders when the price crosses above it. The bot then sells upon achieving a 3% profit, with the capacity to hold up to 50 simultaneous trades. This strategy is applied in the Spot market and does not include a stop-loss mechanism.

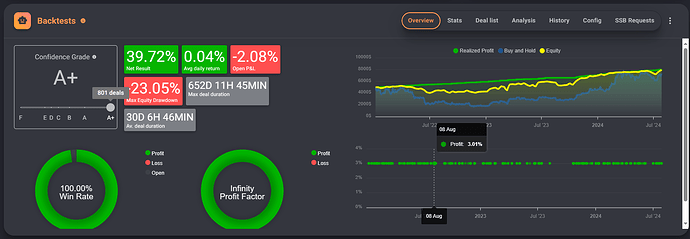

General Backtest Results (2+ Years of Data)

General Backtest Results (2+ Years of Data)

The bot has been tested over more than two years, with results showing:

- Net profitability: +39.72%

- Success rate: 100%

- Maximum drawdown: 23.05%

- Number of trades: 801

This backtest confirms the bot’s consistency across different market conditions, maintaining stable growth over time.

Bearish Market Backtest

Bearish Market Backtest

To evaluate its performance in adverse conditions, the bot underwent backtesting in a bearish market, producing the following results:

- Total profitability: +4.61%

- Maximum equity drawdown: -22.04%

- Average daily return: 0.05%

The bot successfully adapted to bearish conditions, though profitability was lower, and drawdowns were more significant. This suggests that during prolonged downtrends, the bot could benefit from a more dynamic exit strategy.

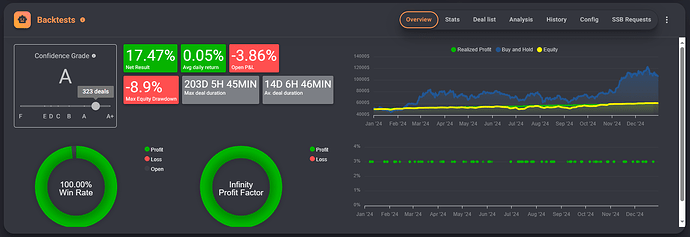

Year 2024 Backtest

Year 2024 Backtest

To analyze its most recent performance, a dedicated 2024 backtest was conducted, revealing:

- Net profitability: +17.47%

- Success rate: 97.4%

- Maximum drawdown: -8.9%

- Number of trades: 323

The year 2024 exhibited higher volatility, reducing the bot’s success rate compared to previous periods. Despite this, returns remained positive, with lower drawdowns than those observed in prolonged bearish conditions.

Strengths & Performance Insights

Strengths & Performance Insights

- Versatile execution across different market environments.

- Profitable even in bearish trends, though with increased drawdowns.

- Proven consistency over more than two years, with sustained net returns.

- High success rate, particularly in stable market conditions.

Areas for Improvement

Areas for Improvement

- Market adaptation mechanisms could help optimize performance during high-volatility periods.

- The lack of stop-loss exposes trades to extended drawdowns.

- A dynamic exit strategy (e.g., trailing profits or volatility filters) could stabilize returns during market downturns.

Optimization Suggestions

To enhance risk management, testing additional indicators such as RSI, MACD, or volume-based strategies could help filter false entries and improve stability across different market cycles.

Bot x1 leverage: Gainium app

Json:

Acumulador (copy).json (6.1 KB)

Just Testing make the post better wit AI ![]()