how we gonna be careful when we did not see or used your optimized version ![]()

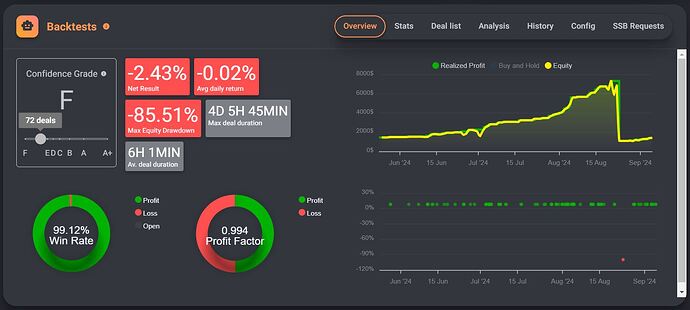

Of course, here is the backtest I was talking about. I’ve modified the leverage, the keeptrue, and the size of the base order and DCA. I’m curious to hear your feedback.

I see you are using very high leverage, for future DCA , i use this liquidation calculator

To see if there are chances of liquidation and and how to avoid liquidation with historical data. I will have to do some calculations to see if it is safe to run dca bot on 17x leverage. Thanks ![]()

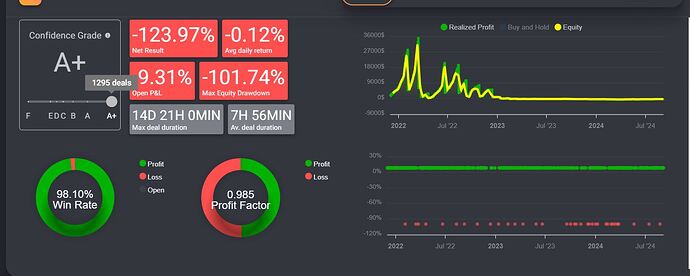

I backtested it on different time spans on Binance exchange , it has shown some liquidations and 1 liquidation means your 81% of account wiped out. risk can be minimized by lowering the leverage. imo

I had fun with this version looking at how far I could go without being liquidated. It was rather a test. Personally I will not use such a large lever arm and I will use a smaller part of my account.

I personally dont like DCA bots , long standing positions for days, it is better to use indicator based bots , quick and out of position and your funds are stuck for days and days.

Thanks @EdleArth ! the optimization was good I think theres is room for some adjusts but not much, could be possible anticipate the breaout in a lower time but because of the nature of the Flash Sell you have a small windows of time or candles to take advantage of this event. On Live Bot maybe the trailing take profit of ±0.2 can give a little more of Statoshis.

Can you share the concept logic and why the use of certain indicators, coins, leverage etc.? Asking because based on what you are trying to achieve maybe the solution for potential improvements could be easier than you think

Yep sure: The whole idea is try to capture a sudden movement of the price wich goes down and usually will put the price for a short time in a downward trend.

To exploit this Price change help to catch the start and the break of the Keltner Channel confirms this. The smal TP is because after this happen you dont have a lot of time and a pullback will ocurr soon. DCA comes to help after that pullback if you fail to end the trade in the first moments and the price dont want to go even more lower. SL is my estimation of the price if it goes far than 5% it could be changing or continuing the trend to bullish for the next hours. hope this help

I have a few tricks to improve the strategy - dynamic TP - try using a min TP (with the % a bit lower than your current TP) + SAR on 1 or 3 mins. Also reduce the amount of losses by making the SL dynamic with a moving SL or a trailing SL.

By the way I like the strategy idea behind it - well done brother

To get such a large number on the daily average and not face liquidation, what account size are you using to test this? This would play a huge part in reducing your liquidation risk.

What is SAR?

I know this as a Trailing Stop Loss - but I don’t understand what this would have to do with 1 or 3 min?

Thanks for teaching me ![]()

Not teaching just sharing brother

PSAR or parabolic SAR is a trend indicator (is known for its little dots around the candles.

I’m a big fan of it because it can be used on smaller time frame like 1 or 3 minutes to clean the entry point but also to close a deal as soon as the trend changes- this means it can be used as a dynamic trailing - hope makes sense if not please let me know

Two SPOT strategies can be expanded from this - one is a simple long strategy since the scalpello identifies a potential trend and a second is multiple simultaneous deals with very tight TPs - this means that if the condition is true for 10 candles we could open 10 deals with a TP of 0.25% for example mimicking refining scalpello movement - PS I have a master degree in art and graphic

Thanks @Rossano I really like your mindset wil see what I can do. I always keep in mind your aprouch to the Bot as a System.

PS Share your Art! ![]()

I dont think I fully understand @Brandon could be this for some of the other Bot Variation with higer risk?

By the way use Leverage to reduce the amount of money you put in the bot no to multiply your income or your risk will be near the clouds…

I think I answered my own question. thanks for the reply though! ![]()

I would even say that you may reduce the funds by using leveraged deals with possibly even smaller minimum order sizes. But if you wanted to reduce the risk if liquidations to spot market like levels, you still need those funds as margin and cannot use them without increasing your risk. And you possibly also have to pay commission and you certainly don’t own the asset. On a delisting the whole position is lost without any assets of the contract remaining in your possession.