How would you configure the SAR indicator? Also, would you use it on the TP or deal start? If i’m not mistaken, you can’t use percentage and indicators on TP. Thanks in advance!

Hello everyone,

After the discussion the other day about the group’s strategies and after seeing and testing the Scalpello strategy, which at first seemed counterintuitive since the short sell signal appears late, almost like it should be a long buy signal, but I also consider that it is a very good strategy.

I decided to test and analyze the signals, buys, and sells on the charts. I understood the logic and set out to improve it by adding some filters. Since selling below the lower Keltner Channel line risks a reversal, which can be mitigated with DCA (dollar-cost averaging) and a low TP (take profit), the improvements might not be significant in terms of gross profit, but they do enhance safety and net gain.

This aligns with what I mentioned a few days ago: the investor’s profile defines the strategy. I can show you three variants of Scalpello for three different risk levels.

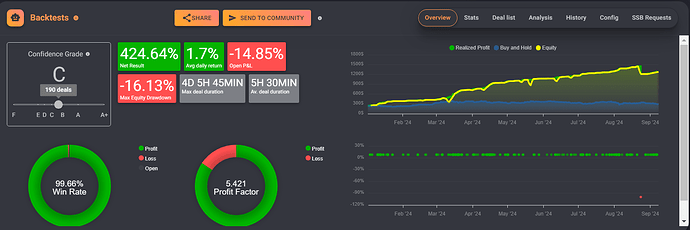

The first variant is a proposal from another colleague in the group who uses high leverage. It results in substantial profits but also carries a high risk of liquidation on several occasions.

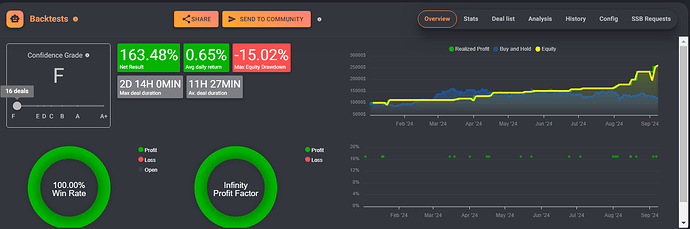

The second variant is a bit more conservative, aiming to capture the entry signal a bit earlier before it hits the bottom, allowing for a take profit (TP) in one or two candles. This reduces the average time, increases the number of trades that realize profit more quickly, and allows the possibility to raise the TP to 1 or more. There are fewer trades overall but fewer stop losses (SL) and less DCA.

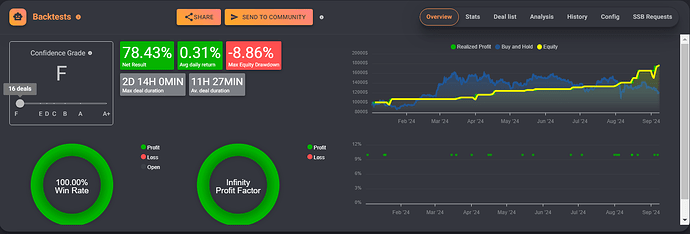

The third variant is the safest, adding RSI to avoid opening positions close to a reversal. It results in very few SL and DCA, but the trade-offs include reduced profit. However, it provides a safer trading operation.

This demonstrates Rosano’s methodology: after establishing a base concept or strategy, one can create variations based on different investment objectives and risk levels.

Once again, I open the discussion, as I believe this is the purpose of this group.

Bye

PEPE

I use SAR as is without changing any settings - crossing down fro TP and crossing UP to start a deal and usually on 1 or 3 minute - 1 min to close the deal and 3 min to clean the entry point.

You can set a min TP % and also add a moving SL in positive - how? simple - select SL and webhook condition then activate move SL and enter a positive value - this way the SL will work as a stop profit. If you min TP% is at 1.5% you can set the move SL to be at 1% this way we have that 1% in your pocket as soon as the price moves over the 1.5%

Hope it makes sense

Thanks @ppalba344 for share ! I really like this Risk Variation i will look forward to see how you implement the Solutions.

You are right about this bot it should be a Buy signal, this is because this combination of indicators was in another one to try to detect and exploit Consolidation->Manipulation->Distribution also I share another bot (ATR Bot) wich are findings for the same quest.

Hello @diegopiolo can you share the link for EdleArth Variation as it is not working and opening.

Hello @EdleArth can you share the link of this result i want to backtest it ???

Hello everyone, unfortunately my history doesn’t go back that far, so I’m not sure if this is the exact configuration that would have shown higher results.

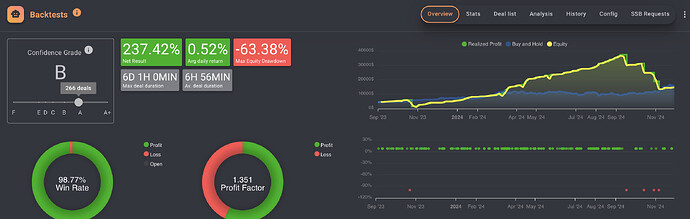

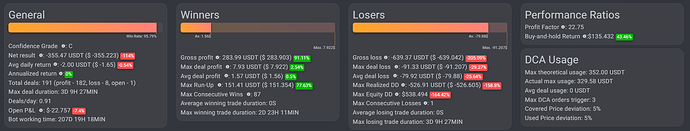

This is a strategy that I’m not currently using, but here is one that I have kept in my archives, which might help the community and that I will review again at the beginning of the bear market. Bot Scalpello (Short)

Hey! Sorry for the delay, Im not sure if I created a copy of that config, I will check it. meanwhile…

I would recomend see other variatons more conservatives, and experminet lower time frames or even biggers, less leverage, Etc.

Volatility of BTC is above the clouds and parameters were created before this happened. however the bot could still be valid if volatility goes down and BTC enter in downtrend o range

Please, dont forget create first a Paper Bot or (then) one with a very smal amount of money for more accurate results based on the Exchenge ![]()

What a big blow for my config on this Bot. Even with a lot of tests the uptrend was too much… still suffering lets see…

hope you are on toilet paper not real ![]()

Lol yes toilet paper bot ![]()