![]() Strategy: Mom Bot !

Strategy: Mom Bot ! ![]()

I’ve developed Mom Bot, a robust bot that combines the Momentum indicator and Bollinger Bands to capture bullish movements with precision. Here are the key details:

![]() Mom Bot Strategy:

Mom Bot Strategy:

- Long Entry: Triggers when Momentum 4H > 0, Momentum 1H crosses above 0, and the price crosses the 1H Bollinger Band midline.

- Take Profit (TP): +3%.

- Stop Loss (SL): -2%.

- Risk Management: 100% reinvestment and 50% risk reduction.

- Trailing Stop: Moves SL to secure at least 1% profit.

![]() Backtesting Results:

Backtesting Results:

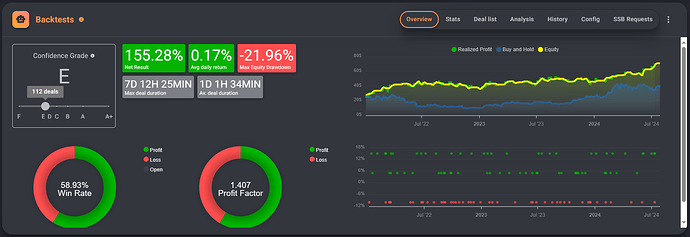

![]() Over 2 Years (Jul 2022 - Jul 2024): Achieved an impressive 155.28% net return with a max drawdown of 21.96%. The strategy executed 112 trades with a 58.33% win rate and a profit factor of 1.467. The equity curve shows steady growth, outperforming “buy and hold.”

Over 2 Years (Jul 2022 - Jul 2024): Achieved an impressive 155.28% net return with a max drawdown of 21.96%. The strategy executed 112 trades with a 58.33% win rate and a profit factor of 1.467. The equity curve shows steady growth, outperforming “buy and hold.”

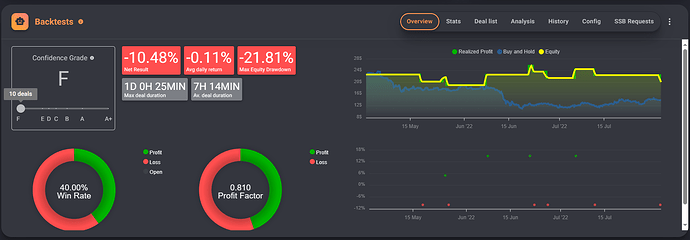

![]() Bear Market (May 2022 - Jul 2022): In tough conditions, the bot returned -10.48% with a 21.81% drawdown. It executed 10 trades, with a 40% win rate and a profit factor of 0.819, reflecting challenges in high-volatility environments.

Bear Market (May 2022 - Jul 2022): In tough conditions, the bot returned -10.48% with a 21.81% drawdown. It executed 10 trades, with a 40% win rate and a profit factor of 0.819, reflecting challenges in high-volatility environments.

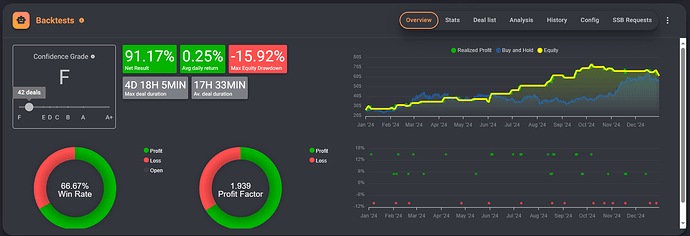

![]() Year 2024 (Jan 2024 - Dec 2024): Delivered a 91.17% net return with a 15.92% drawdown. It executed 42 trades, achieving a 66.67% win rate and a profit factor of 1.93. The equity curve shows a solid upward trend with good consistency.

Year 2024 (Jan 2024 - Dec 2024): Delivered a 91.17% net return with a 15.92% drawdown. It executed 42 trades, achieving a 66.67% win rate and a profit factor of 1.93. The equity curve shows a solid upward trend with good consistency.

![]() Why Mom Bot? It’s designed to capitalize on clear trends with strict risk management, perfect for traders seeking automation and consistency.

Why Mom Bot? It’s designed to capitalize on clear trends with strict risk management, perfect for traders seeking automation and consistency.

Pros and Cons Analysis of Mom Bot

Pros:

-

Strong Long-Term Performance:

- Over 2 years, it achieved a 155.28% net return, outperforming “buy and hold.” This shows the strategy can deliver consistent gains over an extended period.

- In 2024, it posted a 91.17% net return with a controlled drawdown (15.92%), suggesting adaptability to varying market conditions.

-

Decent Win Rate:

- The 2024 win rate was 66.67%, and over 2 years, it was 58.33%, indicating that more than half of the trades are profitable—a good sign for an automated strategy.

-

Effective Risk Management:

- The trailing stop securing at least 1% profit helps lock in gains on winning trades.

- The 50% risk reduction and tight SL (-2%) limit losses, as seen in manageable drawdowns (15.92% in 2024, 21.96% over 2 years).

-

Positive Profit Factor:

- With a profit factor of 1.467 (2 years) and 1.93 (2024), gains outweigh losses, signaling strategy robustness.

-

Reasonable Trade Duration:

- Trades last an average of 1 day, 3 hours, and 34 minutes (2-year backtest) and 17 hours, 33 minutes (2024), reducing exposure to prolonged market risk.

Cons:

-

Weakness in Bear Markets:

- During the bear market (May 2022 - Jul 2022), the bot posted a -10.48% net return, with a low win rate (40%) and a profit factor below 1 (0.819). This shows the strategy struggles in downtrends and could lead to significant losses in such conditions.

-

High Drawdown:

- While the 2024 drawdown was manageable (15.92%), it reached 21.81%-21.96% in the 2-year and bear market tests. This may concern traders with low risk tolerance, as such drawdowns can be psychologically challenging.

-

Low Trade Frequency in Bear Markets:

- In the bear market period, it only executed 10 trades, suggesting the strategy may be less active in adverse conditions, limiting opportunities for recovery or adjustment.

-

Dependence on Trending Conditions:

- Relying on Momentum and Bollinger crossovers makes it more effective in trending markets. In sideways or highly volatile markets, as seen in the bear market test, performance can decline.

-

Risk of Over-Optimization:

- While backtest results are promising, they may be tailored to historical data. Without live or forward testing, there’s a risk that real-time results may not match the backtest.

Recommendations:

- Bear Market Adjustment: Consider adding a filter to avoid trading in high-volatility or bearish conditions, such as a 200-period moving average on 4H.

- Drawdown Reduction: Adjust the SL or trailing stop to lower the max drawdown, though this may impact overall returns.

- Live Testing: Conduct real-time forward testing to ensure backtest results hold in current market conditions.

Bot:Gainium app

Json:

MOM Bot Long(Multi) (copy).json (13.2 KB)

*with another AI ![]()