I agree with you.

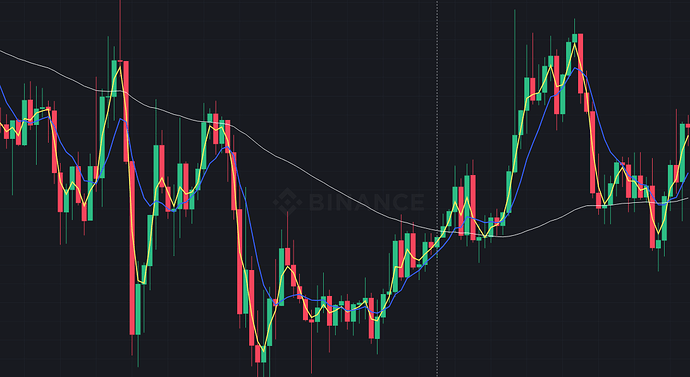

If we analyze the data, there are many unnecessary trades. It should be filtered by volatility to avoid buying in sideways markets where lagging moving averages buy high and sell at a loss

Hello,

you can use the link Gainium app

to the backtest that I created according to your strategy description and modify it as you like.

The goal of this group is to help each other and learn

good luck

When the BIG bull comes I want this “Guard Bot” to watch over my investment.

Designing the strategy that sell “on the other side of the top” wasn’t the hard part but making it into a decent bot is apparently over my pay grade.

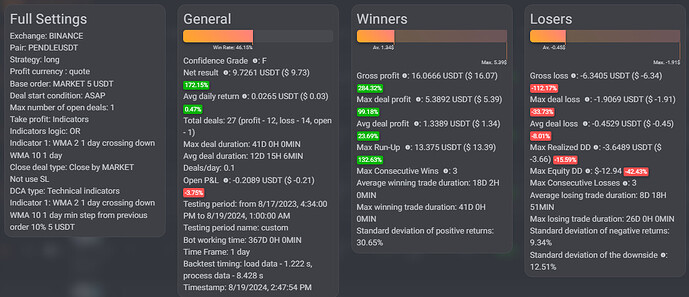

I think you still have too many losses $6K on $16k feels a big number for me

YES! I agree and that is my problem. How do I get rid of the losses?

the solution seems pretty simple for me - since you are not using SL you are closing at loss because you close your deals blindly without any safety measures. Try adding a min TP and a moving SL in positive - DCA may also be an option

But … the whole point was to have the WMA crossings trigger buy when the shorter goes up through the longer and trigger sell when the shorter goes down through the longer indefinitely and without any preset borders.

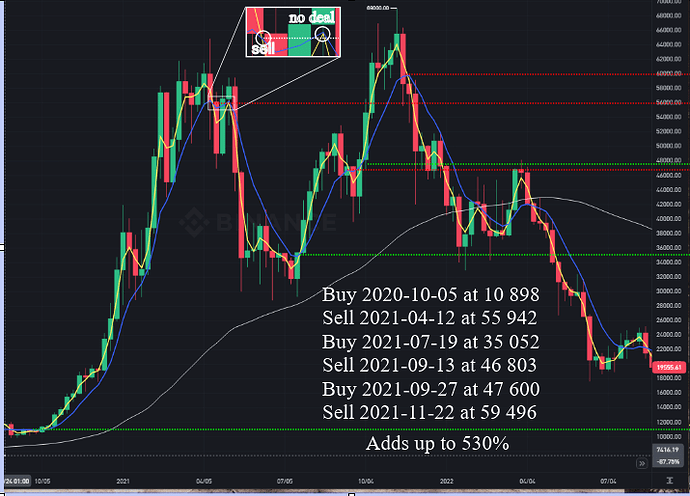

The BTC-spike 4 years ago would have been handled easily and without sweat in 6 deals over 2 years.

Those are manual buy and sell ? ,

Yes but the challenge isn’t to lock profit but to avoid losses - then after the losses are reduced to the minimum look at the potential profit - all long bots perform during the bull market (even not doing trading you profit from a bull market) the challenge is to support them when price goes opposite

Purely theoretical based on WMA3 and WMA10 crossovers.

I’m working on this strategy to find something that never goes “out-of-bounce” but is constantly looking for the best time to buy and sell established trends. It is easy to find these points in theory on Binance but it seems impossible (at least for me) to create something on Gainium that automates it. The positive numbers are great but with them come negative numbers that I don’t understand since they don’t exist in theory and Gainium does not give any information about where they come from.

Look at the deal list - these are the backtest closed deals. You can understand a lot by looking at them

Hello,

I am not an expert, just another curious person in the world of automated trading, but what I have noticed is that there is a lot of market manipulation, with large buys and sells moving the market in all directions. Most indicators fail under these conditions. I have seen thousands of videos and strategies, and one thing is certain: it is very nice to have the opportunity to buy and sell at the right moments. With daily or weekly candles, it’s simple—you buy when the moving averages cross strongly and wait for another good cross.

What happens is that after such a cross, there are many lateral market movements that a person might ignore, but not a bot, unless filters with other indicators like ATR, Bollinger Bands, other moving averages, etc., are used to prevent or limit buying in a sideways market.

You posted a chart with moving average crosses where some signals are ignored. It’s enough to try to replicate those conditions in a backtest at that precise moment to see how the bot reacts, make the necessary adjustments, and then you can observe the list of buys and sells, their position on the chart, and assess their quality. I did this for you and out of curiosity; I modified the parameters, ran several tests, and used the one that gave me the best results. But with your moving average crossover strategy, it’s enough to add a couple of conditions and run some tests to ensure it performs well under current market conditions.

Again, I am not an expert, just an enthusiast. Regards, PEPE

Looking for something like that to secure my funds in the long run. Which settings are you using? Interval? WMA settings?

Thanks

I’m running a small-scale test of a Compounding, “No Risk” Bot for bull markets with real money right now. It works as a “buy-and-hold” during bear markets and accumulates base coins rapidly during bull markets without needing any new installments, and it never closes a losing deal.

This bot is for us who believe this bull market will last until (at least) the end of February when we want to have lots of base coins to sell. I’ll be happy to share as soon as I know that it behaves.

Do you have an example for a trading strat such as you describe? Thanks

if you are on telegram I keep sharing information about different strategies using this logic

you can run 4 bots (2 longs + 2 shorts profiting in BASE and quote) or run an infinite grid of DCA using long/short DCA

I’ll check it out. How to find you there?

@rosstelegram

Did you mean those and run them together?

Thanks

Those are correct - some some pairings you can also decrease the min order size down to $5.6