If you had bought Solana 4 years ago and kept it until today you would have made 48 times your money. If you had bought Solana 4 years ago and sold everything each time WMA7 crossed down over WMA25 and reinvested all you did get from selling them when WMA7 crossed up over WMA25 you would have made 85 times your money in 36 risk-free deals spread over 4 years. Is there a bot that can do this for me (instead of just “buy-and-hold”)?

Well for every SOL there are like 5 coins which would have net you losses if you bought with the indicators.

This is why backtest performance rarely matches future performance.

Dont fall for it.

You be better off by buying say 1$ worth of top 10 coins same time daily for a year no indicator no analysis

This diversifies you as well so that if you get a LUNA like coin then SOL like coin will offset it.

-IamtheonewhoKnocks

Better than buying is profiting in BASE, as the first needs to raise in price to be profitable the second are free money so you are always in profit

The most important thing is your exit strategy and when did you buy - if you bought before SOL crashed and then sold at the bottom you would be in negative. You can get free BASE either using long and/or short in SPOT - there is where real profit comes in

This “free money” talk is kind of distracting.

If you open a deal with a stable currency as quote and a non-stable currency as base and take profit in

- quote, you will have a stable gain in USDT

- base, you have a floating gain in USDT

If you use volatile currencies on both sides of the pair, then the profits in USDT will fluctuate accordingly.

In either case, you will get the funds of your deal back.

The point isn’t about using base or quote but investing vs profiting.

If you only buy and hold you are investing which means you are not necessarily locking profit

If you buy and sell (as TP) then you are printing free money as generated by a trade e not locked anymore. Those free money are considered profit as are generated from the investment even if you sold your bought asset.

I only trade with coins with high ratings so I’m not afraid of “LUNAs”

Since I didn’t get any kind of answer to my question please let me rephrase it:

Can I use technical indicators (like Moving Average) as a sell and buy triggers in any Gainium bot?

Yes, with Trading Bots you can configure technical indicators to start deals and to take profit.

Thank you. Then I’ll dig into that.

If I understood it right, technical indicators can start and stop a trading bot, but that is not what interests me. I want Moving Averages (MA) to trigger buy and sell, not only once but forever. Every time the short MA crosses the longer MA going down I want it to trigger a sell and every time the short MA crosses the longer MA on its way up I want it to trigger a buy. This must be considered a foolproof strategy because as long as you only trade with high-rated coins they will go up after they have gone down and if you add all increases in value and remove all decreases in value you will make a profit in the long run and that profit will be greater than with “buy-and-hold”.

My question is; is there a Gainium bot that can use MA to trigger buy and sell?

Yes, the Trading Bot. You configure the bot and it continuously opens and closes deals according to your configured technical indicators.

What you describe is indeed possible with the bot on gainium using the indicators at deal start and take profit. What you do have to take into account is that your strategy may close deals at a loss. Just a simple example using the RSI indicator. If you set it to start a deal when it is above 20, and close the deal when it is above 70. There is a chance that the price at RSI 70 is lower than when RSI was around 20. With various tests in the past I have also seen this behavior with other indicators.

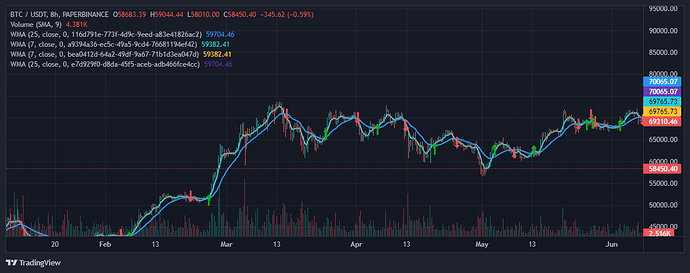

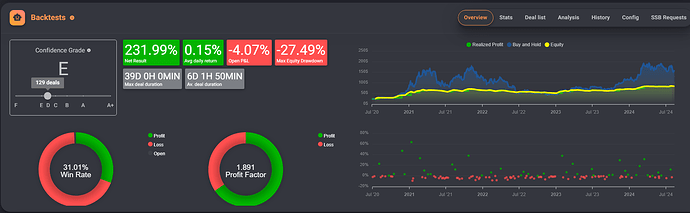

Hello, The backtesting tool can clarify things for us. I conducted some tests following your description and tried to align with your suggestions, and here are the results, in an 8-hour timeframe, which is the one with the best results.

Now we can open the discussion.

I think it needs some improvements - if you remove those bigger trades the strategy will be in negative. My suggestion is to add some security measure and to clean the entry point this way you can increase the win rate

Looks good! I have some project bot with that focus, mostly relaying in a big trade from time to time, The problem is the DD if you can manage the time of red numbers at the end you will win.

You can explore multiple take profits or you can try run the bot first testing 1% profit if mostly of the trades are winned over there you can set a Move Stop Loss as a protection, Maybe you will profit less but more consisitently in time, also is good test starting in a bad scenario cos reality can give you that. start in red for weeks… Good Luck there and post it in Strategies!

Where can I read more about how to do this?

Configure a Trading bot. Select Technical indicator in section Deal Start and Take Profit.

In my initial example with SOLANA over 4 years I got 9 deals giving 0% and 2 deals giving -1% but all the 25 positive deals added up to 513%.