The Weekend Whale

Description

Some time ago I stopped trading alts, as the current market does not lend itself to that (at least, in my opinion).

So I now have 2 new strategies for myself:

-

On weekdays I manually trade BTC Perpetual on Kucoin (Coin-M margined contracts), this way I can use my BTC to trade/gain BTC. This is mainly a long-term learning process, but that’s not what this topic is about.

-

On weekends, BTC often goes sideways with very little movement.

So I created a bot for that situation (again BTC Perpetual on Kucoin (Coin-M margined contracts), I switch the bot on on Saturday morning (depends what time I’m awake), and I then check what the current price of BTC is, and I set the ‘Minimum price to open deal’ 2% lower than the current price and the ‘Maximum price to open deal’ 2% higher than the current price.

The bot automatically turns off on Sunday night at 11pm, I control this through a script that sends a webhook signal.

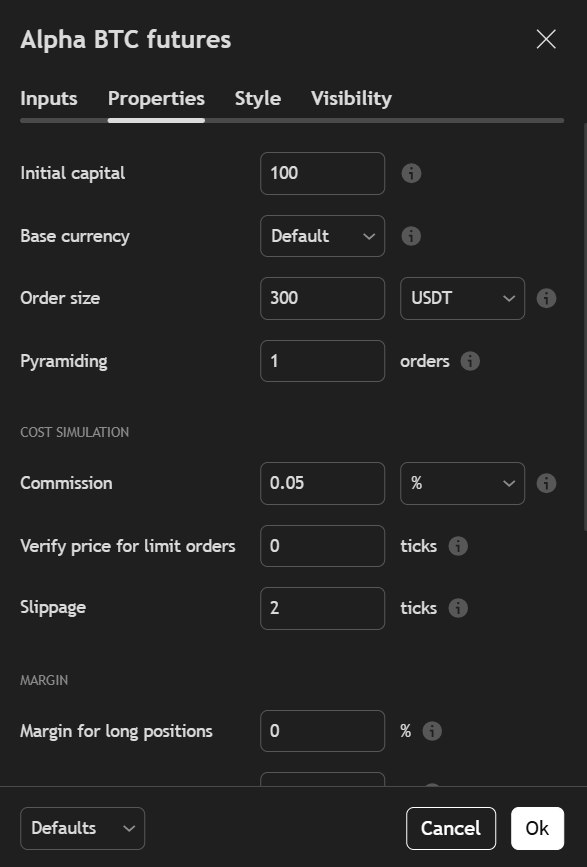

As you can see, in terms of volume scale the bot is set rather aggressively, and in terms of further SO settings it is relatively limited in terms of what it can capture in terms of percentage/dips. The reason for these settings is because BTC is so slow on the weekends, you want to catch the small dips, but get out quickly. And that is also the reason the TP is so low.

How I apply this strategy for myself:

On my Kucoin Main account I have my manual trade strategy, every Saturday I transfer 10% from that account to my Kucoin Sub account, which this bot gets to trade with. If the market suddenly goes down really hard over the weekend and the sub account gets liquidated, at least I don’t lose everything. On the Monday, all funds from my sub account goes back to my main account.

(The weekend of 29 March I was not at home, so I did not turn on the bot.)

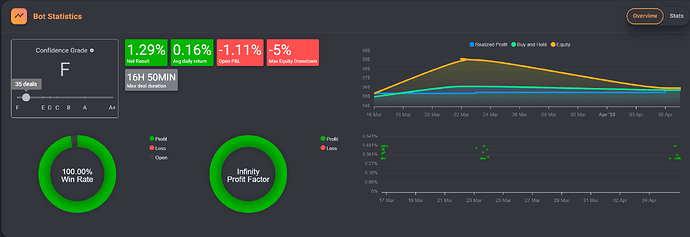

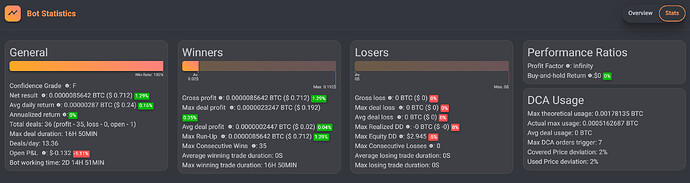

As you can see, the bot doesn’t make a whole lot of profit, but this way my BTC is not doing nothing over the weekend.

If you guys have any tips/ideas to improve this strategy, I would love to hear them!

For now there is only a small amount of BTC in my Kucoin account, should I have more confidence in my own trading strategy then more BTC may go there.

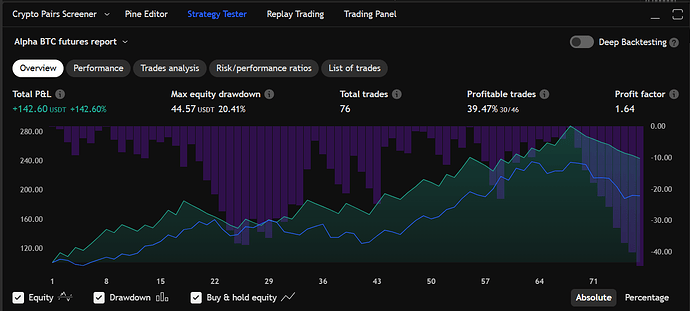

Backtest Data

A while back, using this idea, I backtested 12 weekends over the past year (and set the minimum and maximum price properly per weekend), and all times it closed everything on that weekend, and sometimes closed the last deal on the Monday.

Unfortunately, I no longer have the backtest results, apparently I was stupid enough to delete them…

Links and Settings

- Backtest URL: (optional)

- Bot URL: Gainium app

- JSON settings: The Weekend Whale.json (4.4 KB)