Hi,

Lets say I want to create a flexible long grid bot but using DCA with multiple deals enabled and under filter. The setting is simple, open a new deal ASAP everytime price drops 5%, single TP 2% for every deal. Once in a while I’d like to merge or add fund to deals that are in deep floating loss.

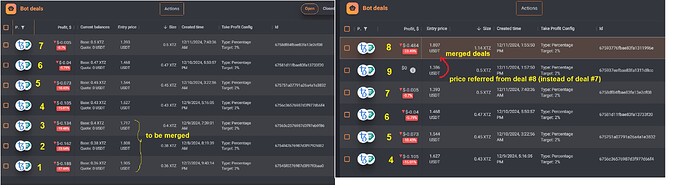

As per my screenshot, initially I have 7 deals opened in order, as expected deal #1 was the first to open and has the highest avg price, while deal #7 was the last to open and has the lowest avg price.

Then I merged Deal #1,2 3 (deals with highest averages), and they became deal #8.

So now the bot has 5 active deals (#4 5 6 7 8).

Now, what happened next was the bot open deal #9 straightaway because it referred to the avg price of the last deal #8 which is obviously high (more than 5% distance), eventhough the distance from deal #7 (“previous last”) is still very close.

I guess what will happen next is when deal #9 closes at 2% TP, it will open another one straightaway since it still refers to deal #8 as the last deal, and will potentially mess up the whole 5% distance grid structure.

What I propose :

While I think what happened here was the expected behaviour, but what I think makes more sense is for the bot to open another deal based on the distance (%drop) from the deal with lowest avg price (for long with “under” filter).

Therefore even if I have say 50 deals going on, I could for example, choose to merge deal #4 #26 #32, then Add Funds to deal #19 and #28… and the next deal would still open ONLY IF the price drops another 5% from the deal with lowest avg.

Does that make sense or does it overcomplicate things ? ![]()