I have used these settings but sometimes bot take ages to be in profit on some backtests maybe two years

Agreed. Turning off before bear market is preferable. But the idea of having many very cheap bot deals is that you can write one off as a loss eventually (I never have) with very small impact to your total bankroll. It’s a risk mitigation strategy.

Also be cautious of what coin. What pair ended up open for 2 years. That would mean a huge drop without a bounce. That’s fairly unusual in top 50 coins.

And also also, I’m trying to work on preventing the “blow off tops” in mini pumps. Alts are prone to pumps where they fall off after a massive pump. Hence me asking:

OH sweet!

Do you add his signals in under webhooks? I’ve never used them here.

Can you give me a quick how to?

Thank you Ares!

Don’t know what you mean by “his signals” and webhooks. I’ve not set up anything like that yet. Work in progress

Which coins got stuck for 2 years in backtest? And what dates?

As far as I know, The Trading Parrot has a service to start/stop bots with webhooks, the links can you find when you enable the bot controller.

I’m also looking for a proper method to switch the bots off or de-risk them at the right time.

@Brandon, do you have experience with the TTP Orchestration service?

edit: some typos

Ah ok, I haven’t tried that with Gainium but last year I had my bots TP being controlled by my own service running in the cloud (AWS).

I’ll hook that up again as I want to vary TP % based on number of DCA orders filled.

I also want to get the mechanism in place for blacklisting coins. The actual algorithm for blacklisting still illudes me though.

Last couple of days have been rocking. Still expecting a big drop some time soon, it never works this well without a correction and Urma bots don’t run at 0.8% daily ROI for long.

But I’m expecting it and the default Gainium DCA bots being fully covered is a big reassurance.

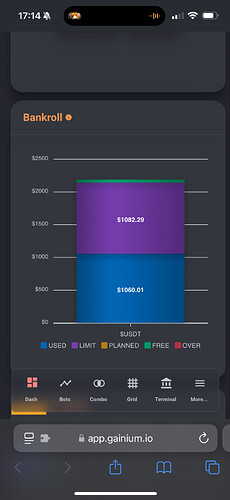

Recent profits have added enough for another $125 deal, so now running 17 max deals for approx $2125 bankroll.

So that’s plan, earn profit to cover more deals (kinda like compounding). When I get to 20-25 deals I’ll consider increasing order amount from $5.

Anyway, encouraging start, but I’m not kidding myself. It won’t be this good indefinitely!

And also note that I’ve been manually identifying coins that have been overcooking and swapping them out for coins that have been just starting to warm up.

Seems very interesting to cover a lot of coins with a smaller budget. How many deals do you approximately need to have before you can open a new deal? How much $ profit do you achieve per closed deal?

Also isn’t it possible that when you achieve your 20-25 deals you just enable the “reinvest profits” in your bot settings so it will use the profits to get a bigger BO and SO?

I’m not sure how the reinvest works. I know I’m in control of deal counts and pairs when I do it manually.

In terms of the returns, you can see average and daily returns, and my bankroll was $2000 from 24/11/2024. The speed of $ value return will increase as bankroll increases. So it’s not something I can give a number to

Auto-reinvest takes the profits from a successful trade and automatically adds them to the next trade. It’s like reinvesting your earnings to build up your position gradually. This feature is particularly powerful if you aim for exponential growth over time.

You can also choose how much of the profits it should reinvest. Like 25% for example.

Another example I can give you is: I have reinvest profits turned on for 100% on a bot I created myself. Started with 50BO and 50SO and now the BO is increased to 55,04USDT in just 26 deals, running for 8 days now.

Ah ok so it increases the BOSO to fit within your balance. Might do that when I have enough deals. But also gotta remember to take profits. Bots aren’t an indefinite money printer.

Yes indeed, I’m looking to get 10 permanent bots as I can’t run more with my current subscription. But I will enable the reinvest profit option till it gets to a good BO and SO for nice returns, then turn it off, do the change manually and then take profits.

How many pairs per bot?

1 pair per bot

As someone who s been using DCA bots since 2012, be VERY careful once the market goes into bear. You might end up losing your entire profits and more. In crypto, it s very easy to make money in bull, the problem s how to keep your profits. Have fun.

Running DCA bots in 2012? Wow, what platforms were around then or were you running your own code?

Yes, bear markets are hard, but also 2021/2022 results for me, and backtests I ran, showed that typically there’s a bounce (weeks/months later) to give you an out for many coins. But you’re right, I even lost entire coins like LUNA and FTT! This time I’d rather take bot profits early during bull market. So just like I’ve scaled into DCA bots as alt season starts up, I’m looking to scale out as it shows signs of getting high risk (fear and greed, BTC risk metric etc).

There’s no silver bullet to crypto trading, it’s all about risk management and ultimately the most important rule…

never invest in crypto what you can’t afford to lose ENTIRELY.

first BTC was mined in 2008 and ppl were running DCA bots in 2012?

Mt Gox probably ![]()

Hey Alex,

No, I am a VIP member, but I haven’t used is ORC signals, only BAQL pair selection.

Finally! First decent test of the Urma strategy. For me; I love when the bot loads up the DCA safety orders. Urma has 8 DCA orders total (1+7) down to 60% drop. Currently I’ve got 3 deals on 7th with 1 more to go. Bankroll half used in deals! Lovely ![]()

Example of loaded deal on 7 of 8 DCA orders

I’ve increased TP on these deals to maximise return on bounce (if we get a bounce ![]() )

)