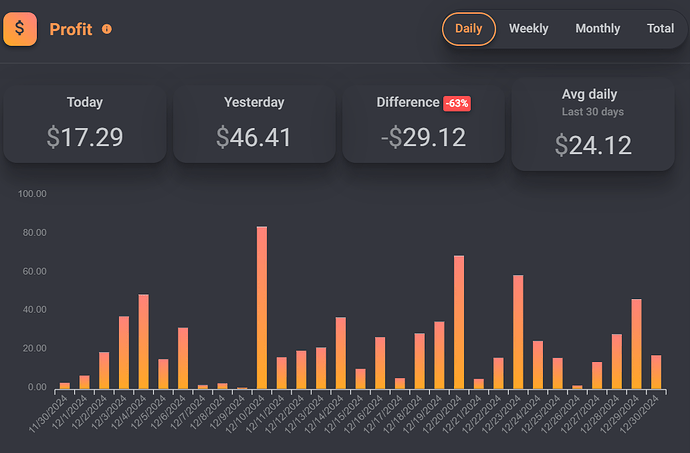

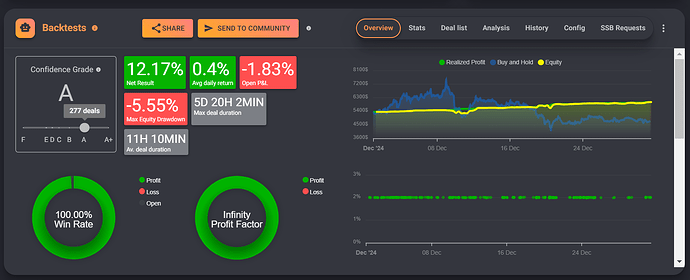

After (almost) 2 months it is time to share my current Spot Bot, called Volatile Velocity.

This bot tries to trade as much as possible with popular coins, and I do this through the relative volume filter.

And to prevent the deals from starting at the top, I have built in some safety features for that through the ATH drawdown indicators and the Moving Average indicator.

I also want to prevent him from trading with ‘new’ coins, so for that reason I ‘abuse’ the Moving Averate Ratio indicator in combination with the ‘use percentile’ option. That way he only starts deals with coins that are newer than 33 days.

Because they are mostly volatile coins, it happens often enough that they dip, and for that reason I applied a fairly (to my opinion) aggressive DCA strategy. This allows me to handle a dip of ~19.25%, with a required change of 6.79%.

In the coming months, I want to slowly increase my volume scale to 1.25 to get out of deals even faster.

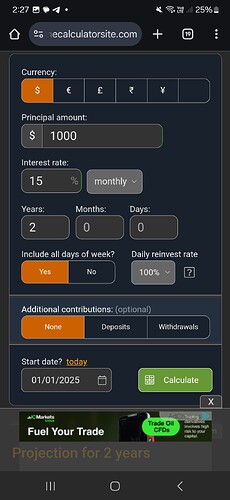

I have the BO/DCA ratio set at 4:1 for now (BO 32/DCA 8), and every X days I increase my BO/DCA values with the profit I made. Should I be satisfied with the average profit per deal in a few months (or years), I will slowly lower the ratio to 3:1 or 2:1.

For now, I have my main bot with these settings active on Binance, and am now testing a mini variant of it on Bybit, I occasionally increase the BO/DCA with the profits from the Binance bot.

In the future I also want to run 1 on CoinBase but with USDC.

On USD pairs this bot works very well in my opinion, on BTC or other pairs I have not tested it yet, I leave that to you guys ![]()

Leverage is also a possibility, but I don’t really dare to do that yet.

Since I am also using the bot for a service on Zignaly (it will soon be on the Marketplace there), I have made my profits/deals/info transparent to everyone. Volatile Velocity will also be on 3C’s Marketplace soon (or is that a forbidden word ![]() )

)

So you can see what the profit is in my Google Sheet, and in the Telegram Channel you can see which deals are started, and with how much profit they are closed and how long the deal was open ![]() I get that info from the standard @GainiumAlertsBot channel through a python script, and format it to the text as I see fit.

I get that info from the standard @GainiumAlertsBot channel through a python script, and format it to the text as I see fit.

Botlink: Gainium app

Google Sheet: Volatile Velocity - Google Диск

Telegram Channel: Telegram: Join Group Chat

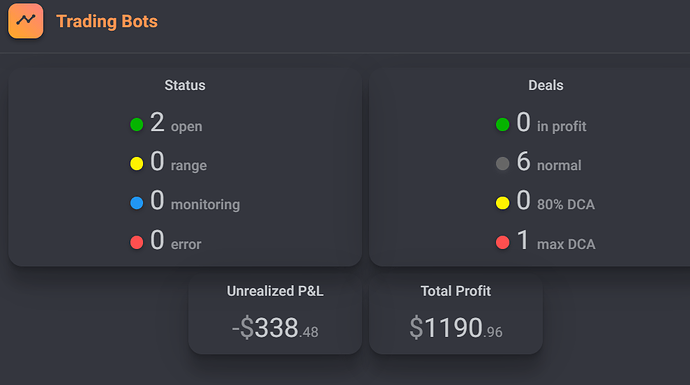

All in all, I am very satisfied with the profits it brings me, but weekends tend to be quieter in terms of deals etc. Also, right now I am still stuck in a SUSHI deal, but I will provide it with extra DCA moments in the coming period and I am sure it will work out.

And since some people also consider the UPNL very important, here you go ![]()

However, this is from both the Bybit and Binance bot.