I want to share the combo strategy I have been using for a few months (since the combo was released in July 2023). However, I was using a similar version before combos with grids only. It’s the same setup, just more manual action.

Motivation

I am a big believer in the potential of crypto in the long-term. I have been accumulating BTC and ETH for a few years. While I am convinced that the value of BTC and ETH will be significantly higher in 5 years from now, I am aware of the volatility I will have to endure until then. Like many long-term investors, watching your portfolio going up and down like crazy can be emotionally taxing. The constant hindsight trading “I should have sold there” or “I should have bought there.” I’ve always wanted to develop a strategy with low risk and minimal oversight that would allow me to accumulate BTC and ETH (beyond what I can get by stacking) by taking advantage of that volatility. The grid strategy is the perfect fit for this. I have been using this concept since December 2021.

Setup

The main idea is to use a stack of grids covering different price ranges so that you are steadily profiting from the fluctuation no matter what the price does tomorrow or in a few months. I named this strategy The Super-Wide Range Grid Stack and wrote about it a few years ago. The combo bot simplified the strategy by automatically stacking the minigrids, it’s still the same concept.

Step 1: Planning

The first step is to define your goal and make a few predictions. This strategy has a few variations depending on your timeline for accumulating and distributing (if you want to distribute at all) and where you think the price might be in a few months or years, so this step is the foundation for the setup.

Once you have defined your timeline, the prediction you need to make is:

In which price range do you think there will be the most sell pressure in this timeline?

The answer to that question is your Distribution Zone. The rest is your Accumulation Zone. You can optionally have a No-Trade Zone in between those two if you want to be on the safe side.

Example: BTC

We can all agree that BTC is here to stay despite the many changes in coin dominance over the years. I wouldn’t say that about any other coin. For BTC, my timeline is around 5 years. This means that in the next few years, I should have distributed most of the BTC I have today. Realistically, I will have a few chances to sell at extreme greed. So, I must recognize the opportunities when they present themselves.

My prediction → Many people hope that BTC will hit 100k by the end of 2024. When too many people expect something, it’s a bad sign. So I think that BTC will indeed hit 100K at some point, but most likely when the fewest people are expecting it. So, I believe it will happen sometime in 2025 (happy to be wrong, though!). I will start distributing as soon as it hits 70k and enters price discovery all the way to 100k.

This is not set in stone; if my beliefs change, so will my distribution zone. If I were in my 20s, I might not want to sell for the next 5 years or so, so I would not even bother about where my distribution zone is; I can always figure it out later.

Step 2: Accumulation

Now that we know where we should be selling, we can consider any lower prices as our accumulation zone.

For this zone I use high-coverage long combo deals (at least 45% for BTC and ETH; I would cover more for smaller cap tokens). I use minigrids 5% tall (the default setting) with 10 grids inside (0.5% spacing is only recommended for BTC and ETH; any other coins should be around 1%). Profiting in base.

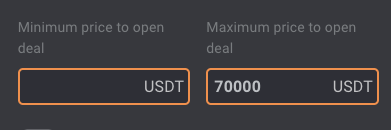

The key setting is the static price filter; you should set the max price to open a deal as the beginning of your distribution zone.

Depending on when you start accumulating, you can consider other options than combo bots. Combo bots are meant to be used to take advantage of the steady profit, but if I were to start today while BTC is in the 60-70k, the combo might be a bit slow to get enough BTC so that when we get to 70k, I wouldn’t have accumulated enough. I will not throw all my funds into buying BTC right now either, so I would consider having a portion of my funds in a long combo and another in DCA (same rule for static price filter).

Step 3: Distribution

In this zone, I will use a short combo deal spanning from 70,000 USDT to 100,000 USDT. We must set our combo with an ASAP deal start and a static price filter “Minimum price to open deal” 70000 (refer to the above screenshot; just swap max for min).

The profit currency depends on your long-term expectations. I will still profit in base because I believe that in the long term, BTC could surpass 100k. For me, this means that I am “mostly” distributing 70-100k. If you want to get rid of your holdings by 100k, you should be profiting in quote.

Results

In my experience running this strategy, the daily ROI averages around 0.1% for BTC and ETH. This means the bot will comfortably accumulate 2-4% of BTC and ETH per month (not bad for a low-risk strategy). Your mileage will vary for other coins, but generally, the more volatility, the better (if you can stomach it).

To copy my settings:

Tips

What I love about this strategy is its simplicity. It’s a very easy-to-understand concept with no indicators and no worrying if the strategy has an edge. It also provides psychological relief from hindsight trading, I know I won’t be able to time the bottom or the top perfectly, but I know that I will be able to take at least some advantage of bottoms and peaks. It’s also a simple cycle of Planning → Accumulation → Distribution → Repeat.

I like to separate the coins into subaccounts. This allows me to easily account for what’s going on.

This is a long-term strategy, so ensure you are comfortable holding the bags for months or years. Only for projects you truly believe in. There are plenty of better strategies for short-term gains.

Let me know what you think in the comments.