We released this one recently, and I think it would be good to share how I am using it. Perhaps you can get some ideas for how to use it in your own strategies.

The ATH Drawdown indicator, as the name suggests, measures the drawdown from the highest price in the lookback (it is important to mention the lookback because if the real ATH happened a long time ago, you would need to increase the lookback to measure from that point).

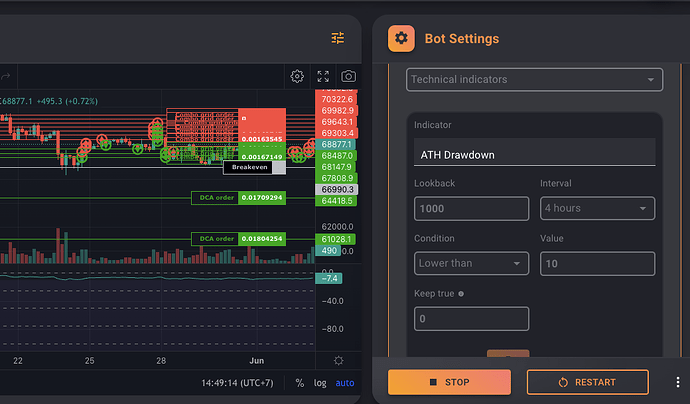

I use this indicator to filter out deals. For a long bot, I wouldn’t want to start a deal within 10% of the ATH. There is a high risk of reversal at this point, as many traders will be taking profits within that area putting a lot of sell pressure.

Please, don’t be this guy:

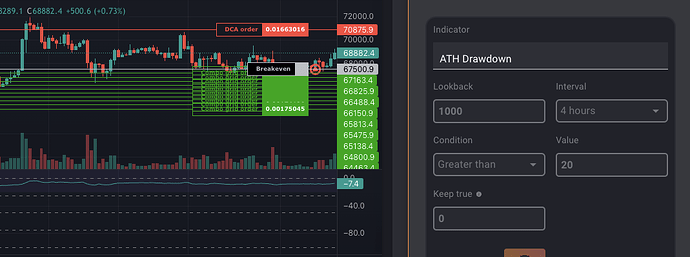

The other use case is for profiting with short bots on my long-term bags. I have been accumulating BTC and ETH for a while and would like to sell when the price is high. The advantage is that if the price goes up and dips back down, I would have made a profit in base for free. If the price doesn’t come down enough to buy everything, that is also ok. I would have sold at a higher average price than trying to time the peak. So, I added the ATH filter to start selling near the ATH (within 20%) for this kind of short bot.

In both cases, I use it as a filter to start new deals. The other use case would be to turn off the bot automatically and close any opened deals; in that case, you could use the indicator in the bot controller instead.

I am using this one on the strategy I posted earlier: Accumulation/Distribution Combo Strategy. But I think it could also be a good addition to @Rossano’s S-series for those who want to manage risk further.

Note: If you plan to backtest adding this indicator in your strategies, keep in mind that the backtester currently works without any funds limitations. So, for example, if you were to backtest a short bot on your 1 ETH, the result is likely higher without the ATH filter. But when your funds are limited, it may be another story. We will introduce limiting funds in the backtester later on.