Hi,

I was inspired by the BB%B short discussion here: BB%B scalping strategy - tests & optimizations

I tried to improve the short strategy with another Indicator: Supertrend 15min up trend. I think with this aditional indicator, one can get rid of the last deals which are many times responsible of the big drawdowns after a pump period.

I’ve added a supertrand 15min uptrend + dynamic ATR /ADR takeprofit and a stoplos of -10% (on some periods -20% are even better like the bear period of 2021) I’ve also changed the %USDT to USDT (whitout compounding) as i think the results are more “real”.

I have not tested a multi coin version of it yet and also not other coins than BTC

https://app.gainium.io/bot/backtests?a=4591&aid=share-backtest&backtestShare=05400024-a551-49ee-8378-486d48084bd1

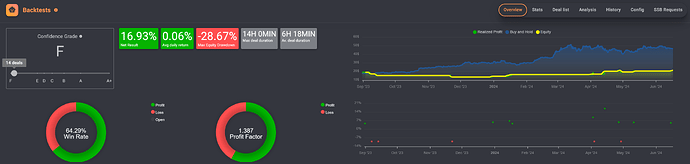

Bear 21 - 22

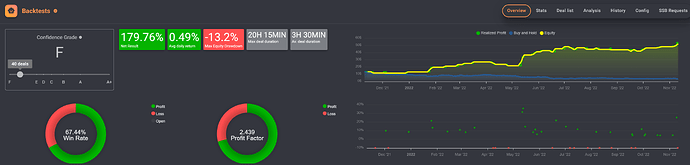

Bull Sept23 - now

It’s not perfect yet but I think it’s sometimes not easy to create a short bot with a proper risk management.

I’m happy about improvements.