Hello!

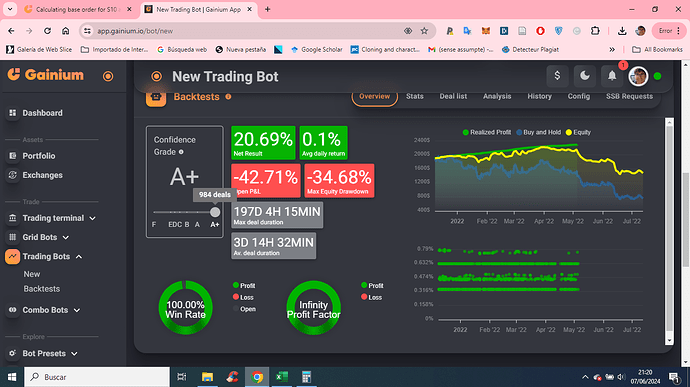

I was trying to think of a way to use the S10 strategy that could fit everyone without having to think too much about the risk of being stuck in case of a big drawdown. Also, I wanted to deal with the risk of being overexposed or underexposed to the market, yes “underexposition” is also a thing that you don’t want if you want to make as much profits as possible ![]()

At the beginning I was thinking that the best move would be to use a compound strategy with %free USDT or %USDT total. But after looking it closer, the problem with that strategy is that you are not really getting the benefits of the ups and downs during a drawdown. Long story short, if your position is a percentage of the total and you are making some wins during a big drawdown (bear market), these wins will not allow you to cover more than the total drawdown (might be wrong, the experts on S-strategies can confirm?). At the opposite, using a defined amount of dollars each deal, allows you to cover a bigger drawdown because if the coin you are trading is not the worse shitcoin, it will be doing ups and downs during the downhill and you can profit from them in order to open more positions if the price is going lower. The key point is the possibility to open more positions with the profits generated during the downhill.

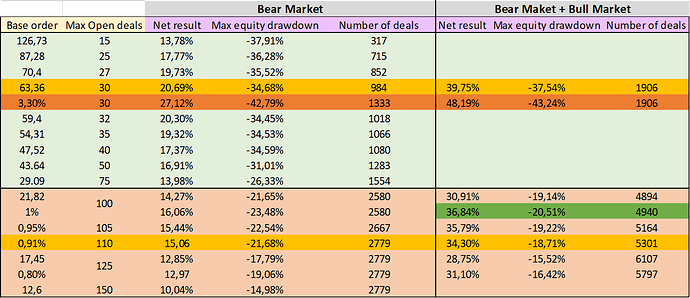

The first step to define how much base order you should invest in a S-strategy is to try to identify the number of deals that seems secure. To do this, I got inspiration from @d_yo_r table and made my own with -1,00% deviations:

| Deal | Deviation (%) | Total drawdown | BTC Price ($) |

|---|---|---|---|

| 1 | 0.0000 | 0,00% | $100.000 |

| 2 | -1,00% | 1,00% | $99.000 |

| 3 | -1,00% | 1,99% | $98.010 |

| 4 | -1,00% | 2,97% | $97.030 |

| 5 | -1,00% | 3,94% | $96.060 |

| 6 | -1,00% | 4,90% | $95.099 |

| 7 | -1,00% | 5,85% | $94.148 |

| 8 | -1,00% | 6,79% | $93.207 |

| 9 | -1,00% | 7,73% | $92.274 |

| 10 | -1,00% | 8,65% | $91.352 |

| 11 | -1,00% | 9,56% | $90.438 |

| 12 | -1,00% | 10,47% | $89.534 |

| 13 | -1,00% | 11,36% | $88.638 |

| 14 | -1,00% | 12,25% | $87.752 |

| 15 | -1,00% | 13,13% | $86.875 |

| 16 | -1,00% | 13,99% | $86.006 |

| 17 | -1,00% | 14,85% | $85.146 |

| 18 | -1,00% | 15,71% | $84.294 |

| 19 | -1,00% | 16,55% | $83.451 |

| 20 | -1,00% | 17,38% | $82.617 |

| 21 | -1,00% | 18,21% | $81.791 |

| 22 | -1,00% | 19,03% | $80.973 |

| 23 | -1,00% | 19,84% | $80.163 |

| 24 | -1,00% | 20,64% | $79.361 |

| 25 | -1,00% | 21,43% | $78.568 |

| 26 | -1,00% | 22,22% | $77.782 |

| 27 | -1,00% | 23,00% | $77.004 |

| 28 | -1,00% | 23,77% | $76.234 |

| 29 | -1,00% | 24,53% | $75.472 |

| 30 | -1,00% | 25,28% | $74.717 |

| 31 | -1,00% | 26,03% | $73.970 |

| 32 | -1,00% | 26,77% | $73.230 |

| 33 | -1,00% | 27,50% | $72.498 |

| 34 | -1,00% | 28,23% | $71.773 |

| 35 | -1,00% | 28,94% | $71.055 |

| 36 | -1,00% | 29,66% | $70.345 |

| 37 | -1,00% | 30,36% | $69.641 |

| 38 | -1,00% | 31,06% | $68.945 |

| 39 | -1,00% | 31,74% | $68.255 |

| 40 | -1,00% | 32,43% | $67.573 |

| 41 | -1,00% | 33,10% | $66.897 |

| 42 | -1,00% | 33,77% | $66.228 |

| 43 | -1,00% | 34,43% | $65.566 |

| 44 | -1,00% | 35,09% | $64.910 |

| 45 | -1,00% | 35,74% | $64.261 |

| 46 | -1,00% | 36,38% | $63.619 |

| 47 | -1,00% | 37,02% | $62.982 |

| 48 | -1,00% | 37,65% | $62.353 |

| 49 | -1,00% | 38,27% | $61.729 |

| 50 | -1,00% | 38,89% | $61.112 |

I chose 25 max open deals (each deal opens after 1% deviation) because it seemed to me that it was quite secure and quite hard for a coin to do a 21,43% without some minimum recovery (it’s possible and already happened but I can assume this risk mainly because I’m trading BTC). What is important here is to divide your investment in that strategy by the number of deals that you can assume to have in red. In this case we can take the example of a 2500$ investment divided by 25 max open deals, this means that base order has to be 100$. Use the following formula to find your ideal base order:

B = I / D (B: Base order; I: Investment amount; D: max open deals that you can assume to risk based on the table before).

Now comes the good part. In order to maximise the profits what we don’t want is to have too much money that will not be used (obvious). So what I propose here is a manual compounding method that has not the drawbacks of the %free and %total that I presented earlier in this post. The method is quite simple, you only need to edit the bot and change the base order size each time that you have profits with the bot, BUT there is ONE RULE and it is that you can only do that if there is JUST 1 OPEN TRADE.

To adapt your order base, you only need to use the B = I / D formula.

Why these rules? Because when you do this you are doing compound but at the same time you are limiting the risk of being stuck in the market. By doing this you are going significantly faster than by having sitting bags waiting for a big drawdown, also you are limiting the risks of being stacked.

This solution is not perfect because in a bull trend it is way more optimal to use an automated compound strategy, but it has some potential to be automated, the only problem is that the automation should be only useful for this S10 strategy as the rule is quite specific and I don’t know if it’s worth it for the devs to work on something that will only be useful for this strategy.

I was also wondering if this could solve the problem of the compounding of the base not working on the S-strats.

@Rossano tell me if this makes sense, it has some similarity to what you have posted here AUTO-Compound profit %. Also I thought that this was the right place to publish this to have a separate conversation from the (S-10) DCA by Simultaneous Deals, but I can delete the post and copy it on this already existing topic.

Sorry again for this very long post!