Hello all !

I wanted to post my results and thoughts about Hunter strat after using it during almost 1 month, I think that my point of view can be interesting as I am using only LONG bots.

- Context :

- Side : Long

- BO/DCA : 5 USDT

- Total investment per coin : 95 USDT

- Platform : Bybit with unlimited trading on Gainium

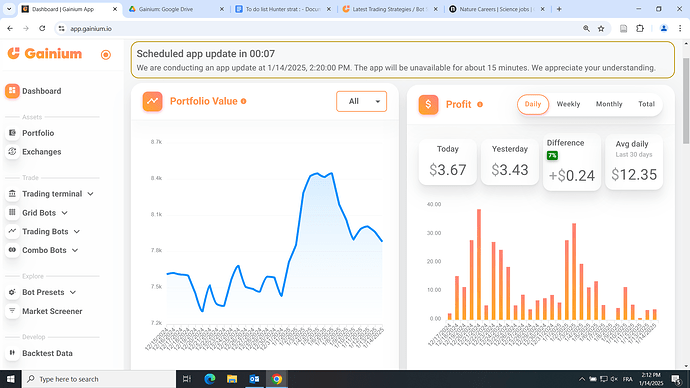

- Initial investment : 6677.66 USDT

- Inital number of bots : 64

- Results :

- Days : 27

- Net profit : 352 USDT

- Mean profit per day : 13.02 USDT

- Total ROI : 5.28%

- Mean ROI per day : 0.20%

- Personal changes to the strat :

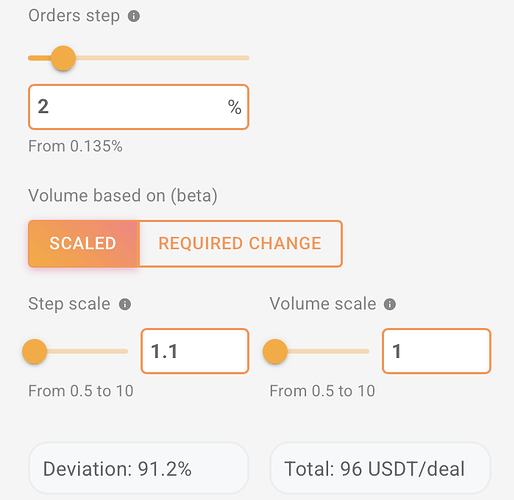

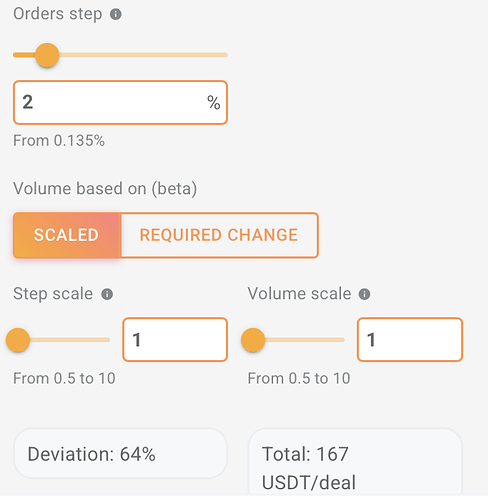

- I have reduced % step scale from blue chips from 2% to [1.0-1.5%] - BTC/ETH/BNB/LINK/DOT/ADA to make more deals. By doing this I bet that these coins are not going to -91% from ATH in case of a bear market (I cover up to 61.39% from the beginning of the deal). For the “shitcoins” I let the % scale to 2% but it’s up to you and your risk aversion to change it

- Compounding by creating new bots : I know that in the classic Hunter strat is also the way to compound but instead of trying to add all the coins of the exchange, I prefer to only focus on the best performing coins which are the ones that present more volatility and have more bull momentum, this helps to achieve TP faster but also to open more trades with lots of DCA. I think that if a coin is working well, it has more chances to continue working well in the future than a random coin.

If you want some help to choose some coins, here are my Top-20 performer coins in ROI per day :

| Column 1 | Column 2 |

|---|---|

| PAAL n°1 | 1,23% |

| PAAL n°2 | 0,89% |

| L3 | 0,83% |

| TAI | 0,68% |

| MOVE | 0,61% |

| VIRTUAL | 0,56% |

| PUFFER | 0,52% |

| CHILGUY | 0,42% |

| GOAT | 0,41% |

| HBAR | 0,39% |

| CRV | 0,34% |

| SEND | 0,30% |

| W | 0,28% |

| SAND | 0,25% |

| ENA | 0,25% |

| PRCL | 0,24% |

| SUPRA | 0,24% |

| XLM | 0,23% |

| APE | 0,22% |

| LDO | 0,22% |

- Personal opinion on Long only vs Long/short strategy :

- Lower $$ amount per bot necessary > more bots (and coins) > better coverage of the market

- Compounding : more dynamic and fast compounding because less $$ per bot necessary

- Portfolio value only depends on the profits

- Don’t need to manually purchase assets before opening bot

- Drawbacks : in bear season you won’t make a lot of profits, (but shorts on spot will be in also in red even if they make some profits)

- Possible community collaboration :

If you you are running a similar strategy, I would (and also probably the community) be super happy to know which are the best coins that you are using and their daily ROI, this can help opening bots that will probably be more efficient and will make higher and faster returns to everyone. IN the next paragraph I will share the complete table of the ROI of all my bots on this strategy, this can be helpful for those who are willing to start this strat as you will know which coins worked best than others Just a reminder that, even if a coin has been doing well, It doesn’t mean that it will continue to do well but in my opinion there are better probabilities to have better returns than a random coin. Good luck on the market!

Just a reminder that, even if a coin has been doing well, It doesn’t mean that it will continue to do well but in my opinion there are better probabilities to have better returns than a random coin. Good luck on the market!

Complete table of daily ROI per coin

|PAAL n°1|1,23%|

|PAAL n°2|0,89%|

|L3|0,83%|

|TAI|0,68%|

|MOVE|0,61%|

|VIRTUAL|0,56%|

|PUFFER|0,52%|

|CHILGUY|0,42%|

|GOAT|0,41%|

|HBAR|0,39%|

|CRV|0,34%|

|SEND|0,30%|

|W|0,28%|

|SAND|0,25%|

|ENA|0,25%|

|PRCL|0,24%|

|SUPRA|0,24%|

|XLM|0,23%|

|APE|0,22%|

|LDO|0,22%|

|VANA|0,22%|

|PEPE|0,21%|

|MNT|0,20%|

|AAVE|0,20%|

|UNI|0,19%|

|NOT|0,18%|

|GALA|0,18%|

|ADA|0,17%|

|BRETT|0,17%|

|ICP|0,16%|

|DOGE|0,16%|

|SEI|0,15%|

|RENDER|0,15%|

|TIA|0,14%|

|KAS|0,14%|

|ONDO|0,13%|

|XRP|0,13%|

|DOT|0,12%|

|BLUR|0,11%|

|STRK|0,11%|

|SHIB|0,11%|

|SUNDOG|0,11%|

|LINK|0,11%|

|BABYDOGE|0,10%|

|TON|0,09%|

|DOOGS|0,08%|

|INJ|0,07%|

|EOS|0,07%|

|OPU|0,07%|

|BNB|0,07%|

|ARB|0,06%|

|POPCAT|0,06%|

|NEAR|0,06%|

|1INCH|0,06%|

|SOL|0,05%|

|BCH|0,04%|

|TRX|0,04%|

|APT|0,03%|

|ETH|0,03%|

|ARKM|0,03%|

|PYTH|0,01%|

|ETC|0%|

|CARV|0%|

|POL|0%|

|ATOM|0%|

|WIF|0%|

|RUNE|0,01%|

|BTC|0%|