If you are searching for the current one, have a look at the next message.

Before we dive into the old strategy, here are two links that may help to explain what “short” spot deals are.

@hunterwhalehunter’s old spot hedge strategy

Translation of the description:

Sharing a Hedging DCA Long & Short Bot Strategy in the Spot Market

The advantage of this strategy is that we can profit from both directions. Whether the price goes up or down, we don’t worry because we still profit.

In a DCA bot strategy, settings play a crucial role in determining whether our bot performs well or not. Therefore, one important thing we must pay attention to after finishing the setup and before running the DCA bot is to check the results table of our settings.

Things to pay attention to are the total % Deviation that can be covered by our DCA bot at the last SO position, the Required Change % needed for the bot to close a deal, the total size of Base & Volume Quote required to run the bot. One way to assess whether our bot is good enough or not is by looking at the ratio between (Required Change %) and (Deviation %).

The method is to divide the two components: Required Change % / Deviation %. Aim for a value of at least 0.5; if possible, lower is better. A smaller ratio means our bot can close deals faster, while a larger value means our bot will have more difficulty closing deals.

The factor that significantly determines and influences the resulting value is the Safety Order Volume Scale. The larger the value, the smaller the ratio will be. However, it’s important to understand that reading this table is only useful for DCA settings that use SO. If SO is not used, reading the table won’t be as helpful.

In this hedging strategy, the first thing we need to do is create 1 DCA bot each for Long & Short without max/min price limits to restrict their movement.

After creating each bot, don’t immediately create the next bot to overlap the initial bot’s position. Instead, we must patiently wait for the right moment to create the next bot to overlap the first. Several situations can be used as benchmarks for overlapping the next bot, such as observing the empty area in the middle to see if it’s more than 10% apart. Based on advice from the Master who discovered this strategy, the most appropriate time to add the next bot is when the gap distance is at least 10% or more.

A 10% gap will only occur when either the long or short bot hits and triggers the last SO. As long as neither the long nor the short bot is triggered, a 10% gap won’t occur.

However, based on my experience running this strategy, sometimes waiting for a 10% gap takes quite a long time. Therefore, I’ve made some modifications for the appropriate time besides waiting for the gap to reach at least 10%, namely by waiting for a few SOs from either my Long/Short bot to be executed before I add a new bot. But this needs to be considered based on each trader’s budget. The method of adding new bots can also be adjusted according to individual strategies, such as adding only 1 bot in the Long/Short position or adding 2 positions at once, 1 bot each in the Long & Short positions.

It’s also recommended that the Long & Short bot settings be identical so that the bot can become a mirroring hedge in its trades. For the second bot settings and onwards, both for Long & Short bots, it’s recommended to keep them identical to the previous settings. The only difference is that the second bot and onwards must have “Max Price” filled for the Long Bot and “Min Price” filled for the Short Bot. This is done to limit the bot’s movement range to be actively working so that not all bots collide at the same price position when triggered and restart.

So, the system works like a garden lamp using a sensor. When a person moves from point A to B, when they reach point B, the lamp at point A will turn off, and the lamp at B will turn on (working alternately). The logic is more or less like that.

The goal of this strategy is to create a trap as wide as possible using a 2-way DCA method but can cover the area like a Grid strategy. The difference is that the trap formed in the DCA bot is a live trap, unlike Grid, where the trap always stays in its position.

This strategy does not use indicators to initiate trades, so all deal start conditions are always ASAP and do not use STOP LOSS either because this strategy is run in the SPOT market. However, it is possible to use it in Perp as well for those who are familiar and experienced in the Perp market, although it is not recommended. The essence of this bot strategy is more of a scalping bot, so it is very important to be able to set the bot so that it can quickly trigger a TP Deal.

Here are some columns that must be filled in to run this strategy:

- Name

- Exchange

- Bot Type (Single Pair / Multi Pair)

- Pairs

- Strategy (Long / Short)

- Profit Currency (Quote / Base)

- Base Order Size (Quote / Base / % Quote)

- Start Order Type (Market / Limit)

- Deal Start Condition (Recommended ASAP)

- Take Profit (%)

- Take Profit Type (Recommended % Total Volume)

- Safety Order Size

- Price Deviation To Open SO (% From initial order)

- Max Safety Order Count

- Max Active Safety Order Count

- Safety Order Volume Scale

- Safety Order Step Scale

- Minimum Price To Open Deal (for Short 2nd Bot and onwards)

- Maximum Price To Open Deal (for Long 2nd Bot and onwards)

Besides the columns above, it is optional for each trader whether to fill them or not. In setting the DCA bot for this strategy, the most crucial component is the safety order volume scale. The larger the factor we can afford to use, the easier it will be for the bot to Take Profit (Deal) so it can restart at a new starting position. Try to check the values in the [Example orders for a deal provided by Gainium] after each setting to evaluate the quality of our settings. Here’s how to read the table:

Volume Scale 1x

This is an example setting using a 1x volume scale. The result to note is the ratio between (Required Change %) / (Deviation %) at the last SO position. We can see that the value is 3.6579 / 5 = 0.7316, which means it’s less suitable for scalping settings. A good setting is one with a ratio of at least below 0.5; if possible, smaller is better.

Volume Scale 3x

This is an example setting using a 3x volume scale. The result to note is the ratio between (Required Change %) / (Deviation %) at the last SO position. We can see that the value is 1.549 / 5 = 0.3098, which means this setting is quite good because the ratio is below 0.5.

Volume Scale 10x

This is an example setting using a 10x volume scale. The result to note is the ratio between (Required Change %) / (Deviation %) at the last SO position. We can see that the value is 1.1185 / 5 = 0.2237. From the comparison of the 3 settings above, it can be concluded that Volume Scale is one of the components that greatly influences the setting for the better.

The example settings above are random examples, so they are not recommended settings, but only for comparison purposes.

After creating the first bot for each Long & Short, the next bot, both for Long & Short, must have Maximum Price filled for the Long Bot and Minimum Price filled for the Short Bot. This part is the most difficult to understand how to determine the max & min price values. There are tips from the Master who created this strategy to determine the Min & Max Price for the next bot, namely by looking at the closest limit of the bid price for buy & sell from the current price position. However, keep in mind that it is recommended to add the next bot if the gap between the nearest buy & sell bid prices is at least 10%. It should be understood that the conditions that can cause a price gap of more than 10% are if one of the Long/Short positions has hit the last SO and is Floating quite far from its Take Profit position (stuck), or if both positions are stuck, a 10% gap will also occur. This is the most appropriate time to add a new bot to the same pair. Adding bots can be done by immediately adding 1 bot each in the Long & Short positions (total 2 bots) or by only adding a bot in the stuck position. In this case, if Long is stuck, add the next Long bot so that both positions move again, or vice versa.

Here’s how to determine the Min Price limit (Short Bot) & Max Price (Long Bot):

If you look at the chart below, you can see that:

Current price = $0.074917 (green arrow)

Closest buy bid = $0.074085 (yellow arrow) (this is the Min Price for the Short Bot)

Closest sell bid = $0.076172 (red arrow) (this is the Max Price for the Long Bot)

The gap distance is the price difference between the red arrow and the yellow arrow. For this example, the gap is 2.817% (blue vertical line).

You can use a Percentage Calculator application to calculate this gap distance.

The benchmark distance for a 10% price gap is the gap between the nearest buy bid and sell bid prices. However, determining the Max & Min price can also be done in other ways according to each trader’s strategy because the purpose of using Min & Max price is to limit the DCA bot’s movement position so they don’t cluster at one price position.

In this strategy, many traders are confused about how to run a DCA Short in the spot market. A DCA bot in the spot market can only be run if we have a BASE. The next question that arises is how do we run a DCA Short if we don’t have any assets? The answer is that we must buy the asset just before the DCA Short is run. The next question that arises is whether we will lose if the DCA Short we run reverses direction (price goes up high)? The answer will be explained in the following case example:

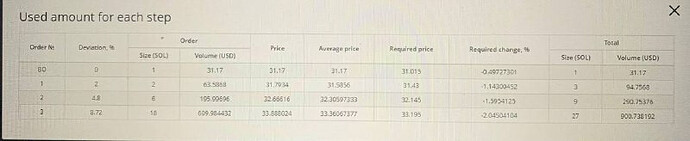

From this table setting, assuming we buy the base for the DCA Short capital just before starting the bot and can get it at $31.5 for the strategy’s requirement of 27 SOL, the capital is:

27 x $31.5 = $850.5

Assuming that after creating the DCA Bot, the price rallies up to $40, logically, our DCA Short is Floating loss. But pay attention to what the DCA Short bot does during the process of rising to $40:

Sell Position:

BO = 1 x $31.17 = $31.17

SO1 = 2 x $31.7934 = $63.5868

SO2 = 6 x $32.66616 = $195.99696

SO3 = 18 x $33.888024 = $609.984432

Total Short Sales = $900.738192

The BO sell position is a loss.

The SO1 – SO3 sell positions are profitable.

I call this DCA Short a “DCA Short that feels like a Long.” Logically, we are Floating loss in this short because we ran out of base and failed to buy back at a lower price. But if our logic is to get a profit in Quote currency, we have actually profited around $50. Just stop the bot, and we have realized a $50 profit in quote currency, provided that we don’t hold any base anymore. So, our thinking of Floating loss in short is because the purpose of shorting is to be able to buy back the base. But if we simplify it and just want profit in quote currency, we have actually profited.

However, this also depends on the settings. If the case is a DCA Short without SO, it will definitely be a loss in the scenario above because what happens is buying the base at $31.5 and then immediately selling it at a loss at $31.17 without getting a chance to buy back at a lower price.

Writer: Telegram: Contact @Denvin1721

Partners to discuss during the experiment:

Strategy Designer, Source of information & insight:

Source: @Commasid_bot > Dca > Strategy hedging DCA 3Commas di Spot Market

Sharing strategy hedging DCA Long & Short bot di Spot Market

Kelebihan dari strategy ini adalah kita bisa dapat untung dari 2 arah, jadi harga mau naik atau turun kita tidak pusing karena kita tetep untung

Dalam strategy DCA bot settingan sangatlah berperan penting untuk membuat bot kita cukup baik ataupun tidaknya, karena itu salah satu hal penting yang harus kita perhatikan setelah selesai setting & sebelum menjalankan DCA bot adalah kita harus mengecek tabel hasil settingan kita

Hal hal yg perlu diperhatikan adalah total % Deviation yg dapat di cover DCA bot kita saat diposisi SO terakhir, required change % yang dibutuhkan untuk bot close deal, total size Base & Volume Quote yg diperlukan untuk menjalankan bot,

Salah satu cara membaca apakah bot kita sudah cukup baik atau tidak adalah dengan melihat perbandingan antara (Required Change %) dengan (Deviation %)

Jadi caranya adalah membagi kedua komponen tersebut

Required Change % / Deviation % usahakan nilainya minimal 0,5 jika memungkinkan lebih kecil lebih baik, karena jika semakin kecil rasionya maka artinya bot kita akan bisa lebih cepat untuk closing deal, semakin besar nilainya maka bot kita akan semakin sulit untuk closing deal

Factor yang sangat menentukan & mempengaruhi nilai yang dihasilkan dalam hal ini adalah Safety Order Volume Scale, semakin besar nilainya maka akan membuat rasionya menjadi semakin kecil

Namun perlu dipahami pembacaan tabel ini hanya berguna untuk settingan DCA yg menggunakan SO, jika tidak menggunakan SO tidak akan terlalu berguna untuk membaca table

Dalam strategi hedging ini yg pertama kali harus kita lakukan adalah membuat masing masing @ 1 Bot DCA untuk Long & Short tanpa batas max / min price untuk membatasi gerakannya

Setelah masing masing bot dibuat jangan langsung membuat bot berikutnya untuk menimpa posisi bot awal, tetapi kita harus sabar menanti saat yang tepat untuk membuat bot berikutnya untuk menimpa bot pertama, ada beberapa situasi yg dapat digunakan sebagai patokan untuk melakukan timpa bot berikutnya yaitu dengan melihat area kosong di bagian tengah apakah sudah berjarak lebih dari 10% atau belum, karena berdasarkan saran dari Master yg menemukan strategy ini saat yg paling tepat untuk mengisi bot berikutnya adalah saat gap jaraknya sudah minimal 10% atau lebih

gap sebesar 10% hanya akan terjadi pada saat salah satu antara long atau short bot menyentuh SO terakhir & sangkut, selama kedua posisi long & bot tidak ada yg sangkut maka gap 10% tidak akan terjadi

Namun berdasarkan apa yang saya alami selama menjalankan strategy ini kadang menunggu sampai terbentuk gap 10% butuh waktu yg cukup lama karena itu saya membuat bebrp modifikasi saat yg tepat selain menunggu gap menjadi minimal 10% yaitu dengan menunggu bebrp SO dari salah satu bot Long / Short saya tereksekusi maka saya akan menambah bot baru, namun hal ini perlu mempertimbangkan berdasarkan budget masing masing trader, cara menambah bot baru juga bisa sesuai strategy masing masing seperti menambah 1 saja diposisi Long / Short atau menambah 2 posisi sekaligus di posisi Long & Short masing masing 1 bot

Settingan yg disarankan juga sebaiknya untuk Long & Short bot sama Persis agar bot bisa menjadi mirroring hedging di tradenya

Untuk settingan bot kedua & seterusnya baik untuk Long & Short bot disarankan selalu sama persis dengan settingan sebelumnya hanya bedanya bot ke dua & seterusnya wajib di isi posisi “Max Price” untuk Long Bot & diisi “Min Price” untuk Short Bot hal ini dilakukan untuk membatasi posisi pergerakan bot untuk active bekerja agar tidak semua bot akan bertabrakan diposisi harga yang sama saat sangkut & start Kembali

Jadi sistem kerjanya bisa di ibaratkan seperti lampu taman yg menggunakan sensor, saat orang bergerak dari titik A ke B maka saat sampai di titik B posisi lampu di titik A akan padam dan posisi lampu B akan menyala (bekerja bergantian) ,kurang lebih seperti itu logika kerjanya

Jadi tujuan dari strategy ini adalah membuat perangkap selebar lebarnya dengan metode DCA 2 arah namun dapat mengcover area selayaknya strategi Grid, bedanya perangkap yang terbentuk di DCA bot adalah perangkap hidup berbeda dengan Grid yang perangkapnya selalu tetap posisinya

Strategy ini tidak menggunakan indicator untuk memulai trade jadi semuanya deal start conditionnya selalu ASAP dan tidak menggunakan STOP LOSS juga karena strategy ini dijalankan di SPOT market namun tidak menutup kemungkinan dapat digunakan di Perp juga bagi yg sudah paham & berpengalaman di Perp market walaupun tidak disarankan, inti dari strategy bot ini adalah lebih ke scalping bot karena itu penting sekali untuk dapat mensetting bot agar bisa cepat terjadi Deal TP

Berikut ini beberapa kolom yg wajib di isi untuk menjalankan strategy ini

- Name

- Exchange

- Bot Type (Single Pair / Multi Pair)

- Pairs

- Strategy (Long / Short)

- Profit Currency (Quote / Base)

- Base Order Size (Quote / Base / % Quote)

- Start Order Type (Market / Limit)

- Deal Start Condition (Recommended ASAP)

- Take Profit (%)

- Take Profit Type (Recommended % Total Volume)

- Safety Order Size

- Price Deviation To Open SO (% From initial order)

- Max Safety Order Count

- Max Active Safety Order Count

- Safety Order Volume Scale

- Safety Order Step Scale

- Minimum Price To Open Deal (for Short 2nd Bot dan seterusnya)

- Maximum Price To Open Deal (for Long 2nd Bot dan seterusnya)

Selain kolom di atas optional untuk masing masing trader mau di isi atau tidaknya

Dalam mengsetting DCA bot untuk strategy ini komponen yg sangat menentukan adalah safety order volume scale, semakin besar faktur kali yang kita sanggup pakai maka bot akan lebih mudah melakukan Take Profit (Deal) sehingga bisa restart Kembali diposisi start yang baru, usahakan setiap habis membuat settingan periksa nilai pada Tabel DCA yang disediakan 3Commas untuk mengevaluasi baik atau tidaknya settingan kita, berikut ini adalah cara membaca table

![]() Volume Scale 1x

Volume Scale 1x

Ini adalah contoh settingan menggunakan volume scale 1 kali, hasil yang perlu diperhatikan adalah rasio perbandingan antara (Required Change %) / (Deviation %) diposisi SO terakhir

Dapat kita lihat bahwa nilainya adalah 3,6579 / 5 = 0,7316 , yang artinya kurang cocok untuk settingan scalping, settingan yang baik adalah settingan yg minimal nilai rasionya dibawah 0,5 jika bisa semakin kecil semakin baik

![]() Volume Scale 3x

Volume Scale 3x

Ini adalah contoh settingan menggunakan volume scale 3 kali, hasil yang perlu diperhatikan adalah rasio perbandingan antara (Required Change %) / (Deviation %) diposisi SO terakhir

Dapat kita lihat bahwa nilainya adalah 1,549 / 5 = 0,3098 , yang artinya settingan ini sudah cukup baik karena nilai rasionya sudah di bawah 0,5

![]() Volume Scale 10x

Volume Scale 10x

Ini adalah contoh settingan menggunakan volume scale 10 kali, hasil yang perlu diperhatikan adalah rasio perbandingan antara (Required Change %) / (Deviation %) diposisi SO terakhir

Dapat kita lihat bahwa nilainya adalah 1,1185 / 5 = 0,2237 , dari perbandingan 3 settingan diatas dapat disimpulkan bahwa Volume Scale adalah salah satu komponen yg sangat mempengaruhi settingan menjadi lebih baik

Contoh settingan diatas adalah contoh settingan random jadi itu bukanlah settingan yg di sarankan, tetapi hanya untuk dijadikan contoh perbandingan saja.

Setelah membuat bot pertama untuk masing masing Long & Short maka bot berikutnya baik untuk Long & Short wajib di isi Maximum Price untuk Long Bot & Minimum Price untuk Short Bot, bagian inilah yang paling sulit dipahami cara menentukan nilai max & min pricenya, ada tips dari Master yang menciptakan strategy ini untuk menentukan nilai Min & Max Price untuk bot berikutnya yaitu dengan melihat batas terdekat dari bid price untuk buy & sell dari posisi current price, namun perlu di ingat bahwa disarankan menambah bot berikutnya jika kondisinya gap harga posisi buy & sell terdekat berjarak minimal 10%, namun perlu dipahami kondisi yg dapat menyebabkan gap harga bisa selebar lebih dari 10% adalah jika salah satu dari posisi Long / Short sudah terkena SO terakhir & Floating cukup jauh dari posisi Take Profitnya (sangkut) atau bisa juga skenarionya jika ke dua posisi sama sama sangkut maka akan terjadi gap sebesar 10% juga, maka saat inilah adalah saat paling tepat untuk menambah bot baru di pair yg sama, penambahan bot dapat dilakukan dengan cara langsung menambah masing masing 1 bot diposisi Long & Short (total 2 bot) atau dengan cara hanya menambah bot diposisi yg sudah sangkut, dalam hal ini jika Long yg sangkut maka tambah bot Long berikutnya agar kedua posisi bergerak Kembali atau sebaliknya.

![]() Photo

Photo

Berikut ini adalah cara menentukan batas Min Price (Short Bot) & Max Price (Long Bot)

Jika dilihat pada chart berikut ini maka dapat dilihat bahwa :

Current price = $0,074917 (panah hijau)

Bid buy terdekat adalah = $0,074085 (panah kuning) (ini adalah Min Price untuk Short Bot)

Bid sell terdekat adalah = $0,076172 (panah merah) (ini adalah Max Price untuk Long Bot)

Jarak celah gap adalah jarak harga panah merah ke harga panah kuning untuk contoh ini jarak gapnya adalah 2,817% (garis vertical biru)

Untuk menghitung jarak gap ini dapat menggunakan aplikasi Percentage Calculator

Jarak patokan gap harga yg selebar 10% adalah gap harga bid buy terdekat & bid sell terdekat, namun cara menentukan Max & Min price dapat juga dilakukan dengan cara lain sesuai dengan strategy masing masing trader karena tujuan dari digunakannya Min & Max price adalah untuk membatasi posisi pergerakan DCA bot agar tidak menjadi berkumpul di 1 posisi harga

Dalam strategy ini banyak trader yg bingung bagaimana caranya menjalankan DCA Short di Spot market, DCA bot di spot market baru dapat dijalankan jika kita memiliki BASE, pertanyaan yg muncul berikutnya adalah bagaimana cara kita menjalankan DCA Short jika kita tidak punya barang? Jawabannya adalah kita harus membeli barang sesaat sebelum DCA Short dijalankan, pertanyaan berikutnya yg muncul apakah kita akan rugi jika DCA Short yang kita jalankan ternyata berbalik arah (harga naik tinggi)? Jawabannya akan dijelaskan pada contoh kasus berikut ini :

![]() Photo

Photo

Dari settingan table ini anggap beli base untuk modal DCA Short sesaat sebelum start bot & dapat diharga $31,5 sebanyak kebutuhan strategy 27 SOL berarti modalnya adalah

27 x $31,5 = $850,5

Anggap setelah bikin DCA Bot harga rally naik sampai ke harga $40, berarti secara logika DCA Short kita sedang Floating loss, tetapi perhatikan yang dilakukan DCA Short bot selama proses naik ke harga $40

Posisi Jual

BO = 1 x $31,17 = $31,17

SO1 = 2 x $31,7934 = $63,5868

SO2 = 6 x $32,66616 = $195,99696

SO3 = 18 x $33,888024 = $609,984432

Total penjualan Short = $900,738192

Posisi jual BO jual rugi

Posisi jual SO1 – SO3 jual untung

DCA Short ini saya menyebutnya DCA Short rasa Long, secara logika pemikiran DCA short ini kita Floating Loss karena kita kehabisan base & tidak berhasil beli Kembali di harga yang lebih murah, tapi kalau logika pemikiran kita mau dapat profit secara Quote sebenarnya kita sudah untung sekitar $50 , tinggal stop bot saja kita sudah realized profit $50 secara quote, tetapi dengan catatan kita tidak pegang base sama sekali lagi, jadi sebenarnya logika berpikir kita Floating loss di short karena tujuan short itu untuk tetep bisa buy back basenya, tapi kalau di bikin simple maunya profit secara quote saja maka sebenarnya kita sudah profit

Namun hal ini tergantung settingan juga, kalau kasusnya DCA Short tanpa SO sudah pasti jual rugi kasusnya jika pakai scenario diatas, karena yang terjadi adalah beli base di harga $31,5 kemudian langsung dijual rugi di harag $31,17 tanpa mendapat kesempatan buy back lagi di harga yang lebih murah

Writer : t.me/Denvin1721

Partners to discuss during the experiment :

t.me/ES_forever

t.me/CHUPACHUPABC

Strategy Designer, Source of information & insight :