Great job @Perez - the all point for me to share my strategies is to help the community thinking out of the box and make your own strategies based on personal needs and goals

@Rossano I’m running your S10 Startegy now since 80 days and I’m very happy with the results so far (7% with some small interactions like merging some deals).

Now you mentioned the concept of two long and two short bots with profiting in base and quote. would you like to explain this concept a little bit in more details? I would also be interested in how you manage the alocation of funds, do you have several accounts for each bot?

By the way, I have created the S10 with DCA and got even better results but I give it some more time to check the performance before sharing.

Thanks

Yes sure - I’ll ask you 4 questions so you can better understand how it works

SHORT

How do we use our collected BASE to make more profit? using SHORT (SPOT)

1 - How do we accumulate cheaper BASE? profiting in BASE

2 - How do we reduce the risk when the price drops? profiting in QUOTE ($ value)

LONG

How do we reduce the risk of selling our collected base? using LONG (SPOT)

1 - How do we increase the the profit when the price raise? profiting in BASE

2 - How do we increase our $ portfolio size? profiting in QUOTE ($ value)

I have several subaccounts but I’m going to use only two - one for LONG and one for SHORT

Yep there are two versions of the S-10 and one uses dynamic DCA - dynamic DCAs allow you to use funds only when needed

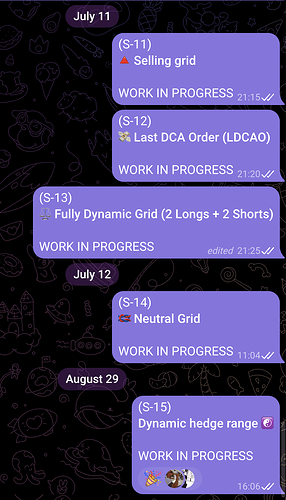

The strategy I’m referring to is the (S-13) ![]() Fully Dynamic Grid (2 Longs + 2 Shorts) I just need the time to explain them as I did with the rest of the strategies so it’s clear how it works

Fully Dynamic Grid (2 Longs + 2 Shorts) I just need the time to explain them as I did with the rest of the strategies so it’s clear how it works

Thank you for the feedback. It makes sense. What I have seen on backtests is that the short bot struggles a lot if there is a bull period, I guess you need to do more manual interactions (merging deals) with the short version? With a long bot I can set a “grid” to like -50% but with a Long bot you need to spread the deals furher I guess?

Great to see that you are working on more strategies, I’m looking forward and can’t wait to see it, Thank you very much for your content, it is always very inspiring!

we know the floor max distance but we can’t predict the ceiling max distance.

Most of the strategies I run are long because the market is always in a up trend (I’m not very popular with my quotes ![]() ) - it’s also true that the market is sideways 85% of the time - so we don’t have much info about SHORTS.

) - it’s also true that the market is sideways 85% of the time - so we don’t have much info about SHORTS.

LONGS won’t necessary need any manual or automated interaction while the SHORTS need monitoring.

We use SHORTS only for two reasons:

- Reduce our exposure - I will always use them as a backup

- Speed-up our profits - so while our longs are accumulating the shorts keep printing money

Thats true ![]() .

.

Do you already know when to share the bot details of the S12 Strat? I’m wondering how you do the dynamic price range with the short version.

I shared the logic of the S-12 a few times on telegram but there messages get diluted into the chat - the logic is quite simple you know exactly what’s the max floor distance so you can allocate a larger portion of your portfolio maximising the profit - the S-12 strategy uses in 80% of the case only one DCA to get out of the deal and only a few times 2 DCA

Good question via indicators is the best so you don’t waste asset

I shared the logic of the S-12 a few times on telegram but there messages get diluted into the chat - the logic is quite simple you know exactly what’s the max floor distance so you can allocate a larger portion of your portfolio maximising the profit - the S-12 strategy uses in 80% of the case only one DCA to get out of the deal and only a few times 2 DCA

I don’t get it, is the logic the same as the S-10 Strat were you start simultanos deals? if so, how much funds are “reserved” for DCA and how do you only get 1 DCA in most cases… in my opionion you also need to manualy merge the deals otherwise its not possible, but maybe I don’t understand it correctly ![]()

No the logic of the S-12 is different and it uses DCA.

It’s quite simple - instead of using a support to start your deal you use it to add DCA - how many supports can you beak before bouncing back? no more than 2. The stronger is the push down the greater is the push back - try it if you don’t trust it ![]()

You won’t need to merge any deal as deals are closed automatically without intervention

okay so you start Deals ASAP and use DCA instead of opening a new Deal? Or do you mean by “Support” DCA with the Indicator “Support & Resistance” sorry for asking all this questions but I don’t get it ![]()

Correct you can use ASAP or a condition and also has DCA

I use QFL but you can use any indicators which is able to calculate resistances or crack bases

Loving this thread and giving me some ideas. You mention Telegram, can you send me a link to the group?

S13 - has this setup been posted anywhere yet to copy and start forward testing on paper?

I will share the strategies here once explained in the Italian matrix group.

Nope I only have a similar version written by pig but I can’t share it

I will make new topics with new strategies as soon as I have a bit of time.

Currently working on the C-Strategies so the community can collaborate on some new strategies and on other projects so please be patient ![]()

Oh I thought @Brandon was referring to Matrix

Hello Perez,

Love your idea,

I was thinking should it be a good idea of running instead of 2 bots long / short with profit in BTC. Also running two bots but also take profit in USDT ?

I think it would work fine, you only need a bigger start account in my opinion ?

What do you think about that ?

Greeting Erwin

yes that’s the logic of the S-13

1 LONG profit in BASE

1 LONG profit in QUOTE

1 SHORT profit in BASE

1 SHORT profit in QUOTE

4 Bots in total so you are covered whatever it happens - explained HERE

Yes in fact I’m doing what @Rossano just write ![]() quite happy with this bot management of profits

quite happy with this bot management of profits

Is this similar to the setup you are using? Comparison BTC spot long/"short"