Hello everyone.

I have been thinking about SMC for some time and ways to implement it in bot trading, either as a full strategy or as a confluence/filter for other strategies. If you don’t know what I am talking about, here is some intro.

What is Smart Money?

Smart Money refers to capital invested by individuals or entities with a thorough understanding of the markets and access to comprehensive information. These include institutional investors, central banks, hedge funds, and market insiders. They often move in large volumes and can significantly influence market trends.

Why Understand Smart Money?

Recognizing Smart Money movements helps traders predict potential market movements. By aligning with Smart Money, you can potentially increase your chances of successful trades as you move in parallel with experienced market participants.

So the central concept here is that large players make money by moving the market against the retail trader’s expectations and sucking the liquidity where they expect retail traders to place their stop losses. Therefore, by anticipating their move and trading in alignment with them, you will be on the right side of that market movement.

This concept has been going around for a while, and now all retail traders talk about SMC. The issue then is that it becomes a cat-and-mouse chase, where one is trying to anticipate the move of the other.

Here is an example of someone already advising to trade against the traditional SMC concepts:

As soon as I have ported those concepts to Gainium, we will be able to test whether it is more profitable to trade against or in favor of traditional SMC. First, I am considering this indicator by Lux Algo. Here is a good video intro about this indicator:

Because the indicator is quite extensive, I am going to split it into different indicators:

SMC Indicators

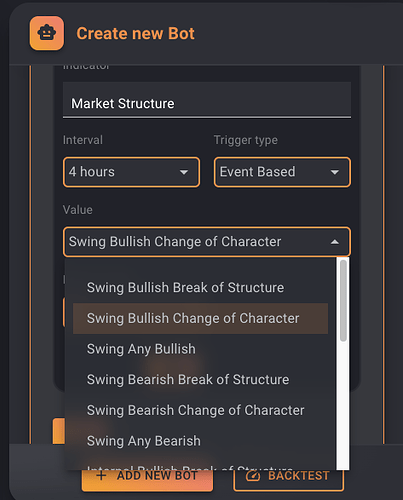

Market Structure Indicator

This will cover the fundamental market formations that SMC traders must identify: higher highs (HL), higher lows (HL), lower highs (LH), and lower lows (LL).

A bullish market structure occurs on HHs and HLs, and it will continue until there is a Change of Character (ChoCh), at which point it changes to a bearish market structure on LHs and LLs. When ChoCH occurs, the market breaks a significant swing point in the opposite direction of the current trend, which changes the market structure.

This will allow us to filter trades by market structure, independent of whether you want to use the rest of the SMC. At the moment, one of my favorite indicators for detecting trends is the SuperTrend indicator, so it would be good to see how filtering by market structure changes the profitability of strategies.

Order blocks and Fair-value gaps

In the context of Smart Money Concepts (SMC) trading, “order blocks” and “fair value gaps” are two key terms used to understand market dynamics and potential price movements. Here’s a breakdown of each:

Order Blocks

An order block is a price level or zone identified as having a significant trading activity, usually by large institutional players or “smart money.” These are typically seen as areas where:

- Bullish Order Block: A noticeable amount of buying occurred before the price increased significantly. This is often considered a demand zone or support area where traders might anticipate future price increases if the price returns to this level.

- Bearish Order Block: Significant selling took place before the price dropped noticeably. This is viewed as a supply zone or resistance area where prices could be pushed down again if revisited.

Order blocks are often identified using historical price charts where a swift move from a consolidation or accumulation zone occurred. Traders use these blocks to gauge potential entry or exit points, predicting that price reactions could occur when these levels are retested.

Fair Value Gaps

Fair value gaps (sometimes called “gaps”) are areas on a price chart where the price has moved sharply up or down, with little to no trading in between, essentially leaving a ‘gap’ in the normal price pattern. These gaps represent areas where the fair value hasn’t been established due to the rapid price changes.

In SMC trading, fair value gaps are essential for several reasons:

- They often act as targets for price to return to, as traders believe the market will move back to explore these price levels to establish fair value.

- Closing a gap can indicate that the market has stabilized or found equilibrium at that price range after the initial volatility that caused the gap.

Traders use both order blocks and fair value gaps to forecast potential market movements. By identifying these zones, traders aim to align their strategies with the probable actions of institutional or smart money, thus potentially increasing their chances of successful trades. These concepts are particularly useful in setting up automated trading strategies, where such technical cues can trigger entries and exits without manual intervention.

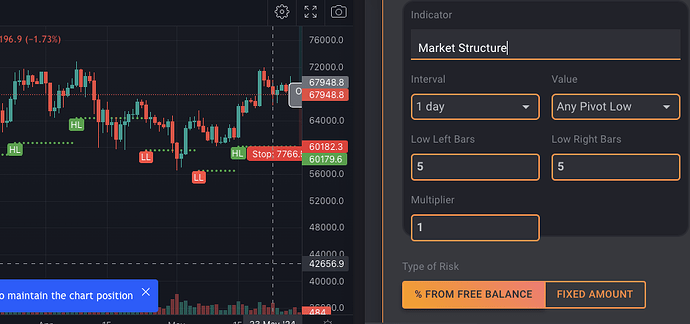

Here are examples of order blocks (blue) and fair value gaps (green) as shown by the Lux Algo indicator:

Questions for you

Have you used these concepts in your trading? What is your experience? What rules do you use to enter/exit trades? Have you automated them?