thanks a lot, I will backtest them

I’ve posted it before (no sure if it was here), but DCA combined with leverage isolated may not go well. The backtest/paper environment does not take this into account, to my knowledge the DCA orders in terms of positions, seperate positions or your margin/liquidation does not go well.

But should you want to know for sure you would have to test it in real life.

Definitely Isolated margin with DCA is a an invitation to disaster, DCA can work with cross margin but it will take so long to close the position and you might miss an opportunity as well, rather let position close in profit and loss and wait for another opportunity.

In the past I have used cross in combination with DCA successfully, the downside is, DCA eats up your margin, so every DCA order causes your liquidation to get closer, so that is a risky one.

Yes we talked about it, I think that the best thing to do would be to not open the DCA settings. I will edit the inital posts by writting a warning about this and post these strats without DCA

yes I have seen a guy who made a DCA bot with CKBUSDT pair on with cross margin, he was very happy until CKB was up but suddenly it dropped 60% and ate all of his margin. he has to wait for eternity for CKB for go back up again.

Yes please post the bug report

this bot is making lot of profitable trades, but i turned it into paper bot to test it first, after two weeks , I will give it a try with small capital on real account.

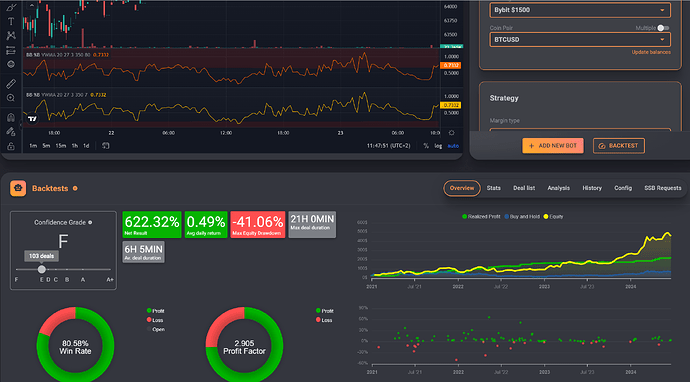

Hello again, so this time I tried to find the best possible settings for the BB%B strategy but using SPOT, so no leverage.

At first I was backtesting only BTC in a 6-months period ending 30-04-2024. The results where nice with 16% net result, -0,67% mas drawdown and 10,56 sortino ratio. I tried to not use DCA and the results were quite bad (-6,72% net result, -14,07% max drawdown).

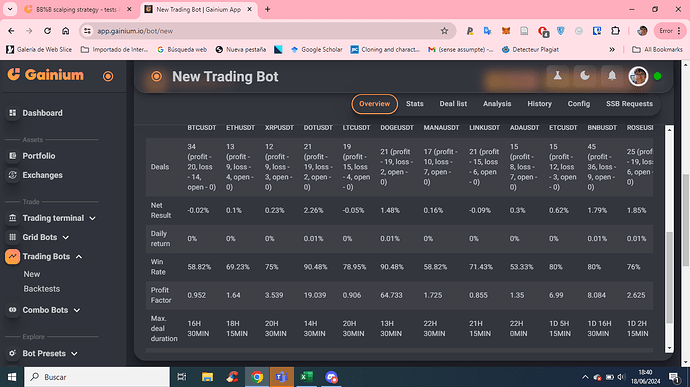

Then I tried to include more coins without really choosing them. The results improved to 29,94% net result, -3,1% max equity drawdown and 3,831 sortino ratio with no really bad results for any of the traded coins. I’m thinking that the more coins the better because the strat works quite well with all of them, but my laptop can’t handle backtests with more coins ![]()

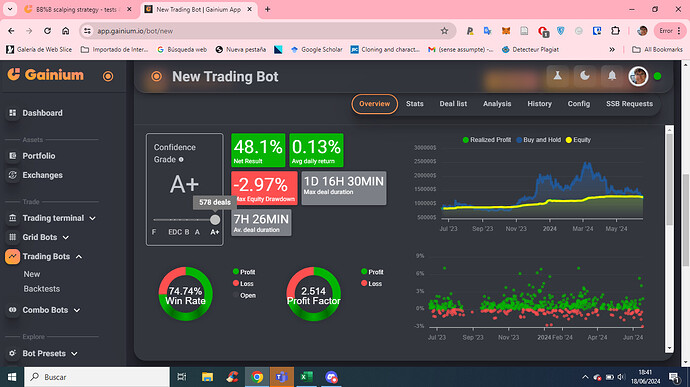

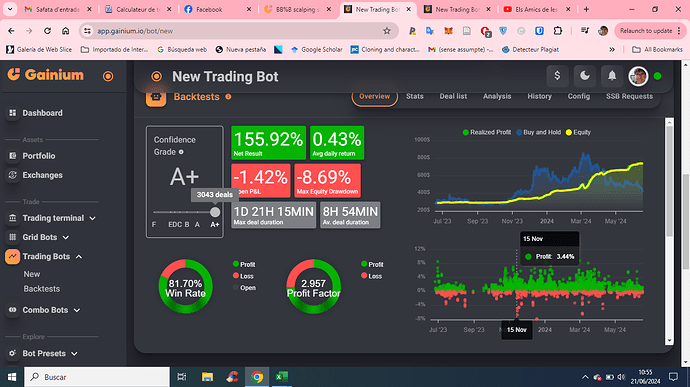

I then backtested this on a 1year basis ending today and these were the final results:

The strat seems quite resilient on the bear market also, so these are good news!

Here is the strategy: Market structure x BB%B (spot). As always, I will be glad to look at your improvements!

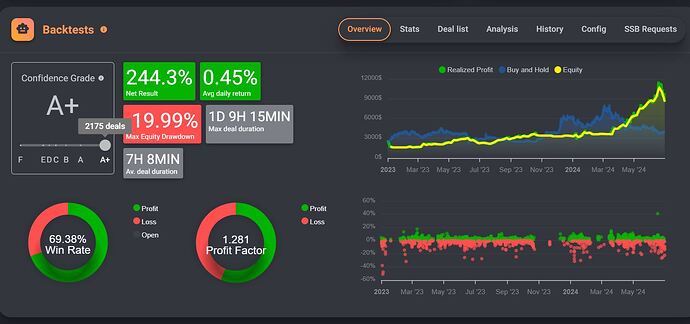

Since it looks like USDT will no longer be available in Europe (MICA) as of July. I started experimenting with EUR settings, I’m not really satisfied with it yet, but let’s see how it goes in the coming period.

Spot DCA option:

https://app.gainium.io/bot/backtests?a=140&aid=share-backtest&backtestShare=e3183077-143f-473c-b957-60eec8a35988

I think that the main limitation of this strategy is the speed, I was having the same issue with the strats that I shared just before you. Also because you are on SPOT you cannot use leverage to improve your results. Thus the only way to improve the speed/profit while being on SPOT if you have a good strat is to add more coins because the bot will open more deals.

Backtest spot DCA option BTCEUR (1 year ending 18-06-2024):

Backtest spot DCA option BTC-ETH-LINK-BNB-DOT-ADA-SOL-ICP against EUR (1 year ending 18-06-2024):

Backtest spot DCA option BTC-ETH-LINK-BNB-DOT-ADA-SOL-ICP against EUR but with 9 max open deals and 3 max open deals per coin (1 year ending 18-06-2024):

Here the bot settings : BB%B spot DCA multicoin multideal

Your strategy is very good I think as it is now ![]() It only needed more deals and speed. I haven’t fine-tuned the max open deals and max open deals per coin, also I just tested these 8 coins but could have tested more than that. I let you the pleausure to improve it

It only needed more deals and speed. I haven’t fine-tuned the max open deals and max open deals per coin, also I just tested these 8 coins but could have tested more than that. I let you the pleausure to improve it ![]()

That is true, speed is indeed the biggest problem of this bot.

And adding coins is indeed the solution to increase your profits, but my focus was mainly to see if this is a viable strategy for BTC/EUR. I haven’t actually concerned myself with other coins, nor do I know if I’m going to do that for this bot. I think other strategies are better at that.

That said, I hope to have time this weekend to convert the current strategy to a nice multi coin variant.

@Perez

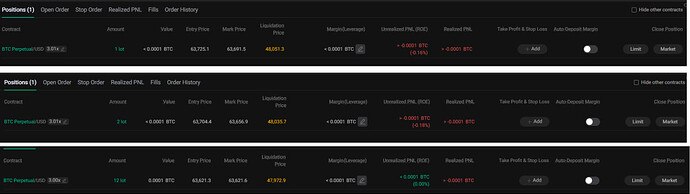

Hmm in another group we were just talking about Kucoin and leverage and DCA/Grid. And I thought, let me test anyway to see how Kucoin handles DCA in combination with leverage.

And it seems that their way of isolated is very much like a kind of hybrid of cross and isolated?

Because I first opened a x3 market order of $1 at 63725 and a few minutes later opened a x3 market order of $1 at 63704. LP dropped slightly. And lastly opened another x3 market order of $10, and LP dropped a little more now, but it all stayed 1 position.

Where with Bybit leverage isolated (which I am no longer allowed to use), per buy action a new position was opened.

How this is at other exchanges I do not know, but I am going to revisit my currently running strategies with some DCA options.

Will look more closely at it when I’m on my laptop but seems interesting! Thanks for the insights ![]()

Just started a leverage DCA bot on a real account with 0,001BTC to see if it works ![]()

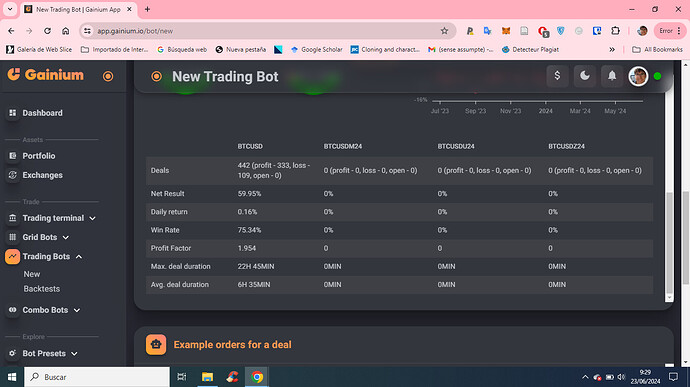

Hey @remy1111! Good luck with this one ![]() I was just wondering if there is a reason to add BTCUSDM24, BTCUSDU24 and BTCUSDZ24? Because when I do the backtest they are not used at all. And also why using inverse futures? Is the reason to profit in BTC?

I was just wondering if there is a reason to add BTCUSDM24, BTCUSDU24 and BTCUSDZ24? Because when I do the backtest they are not used at all. And also why using inverse futures? Is the reason to profit in BTC?

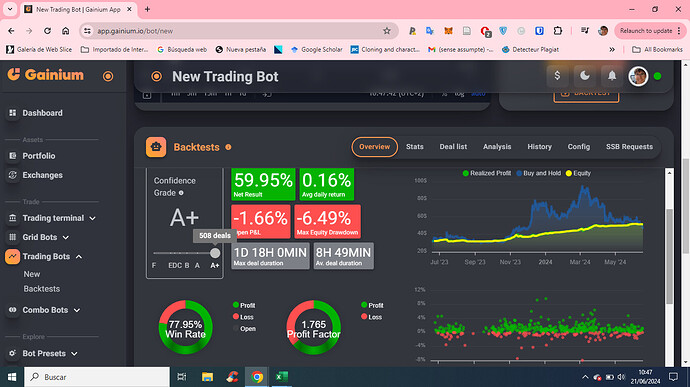

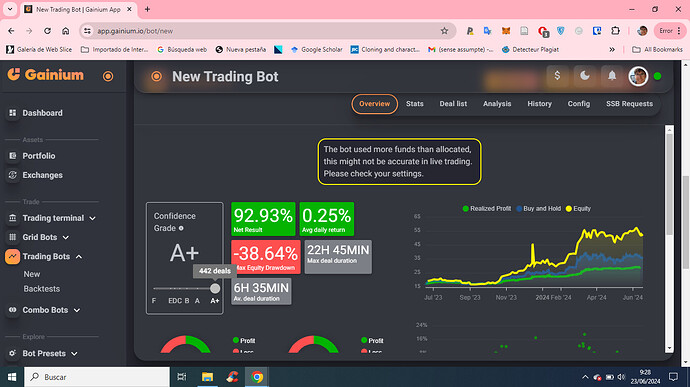

Also this may be a bug but I dont obtain the same results on the bot overview (92% net result) and the details of the bot overview (59% net result). Also the profit factor is not the same but this may be linked to the net result issue.

Thank you!

I didn’t add BTCUSDM24 and such, so maybe something goes wrong when copying the backtest settings?

Inverse I use quite a lot because I want to collect as many BTC as possible.

Hmm I don’t have that detail overview, but that’s because I only use 1 coin.

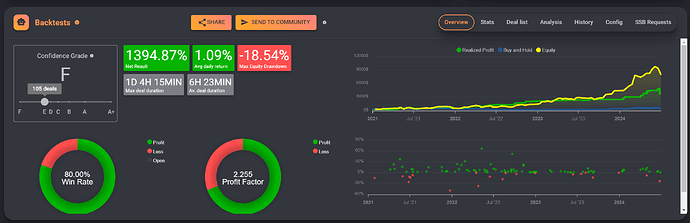

okay so I tried to develop a bb %b short strategy and this is what i found

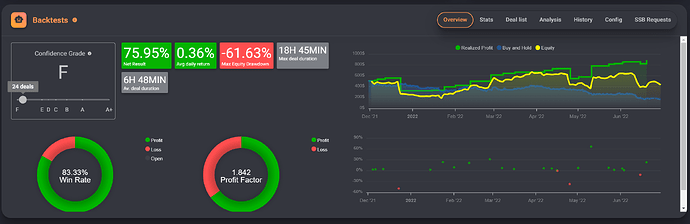

here are nice results from the period backtested 2023-2024

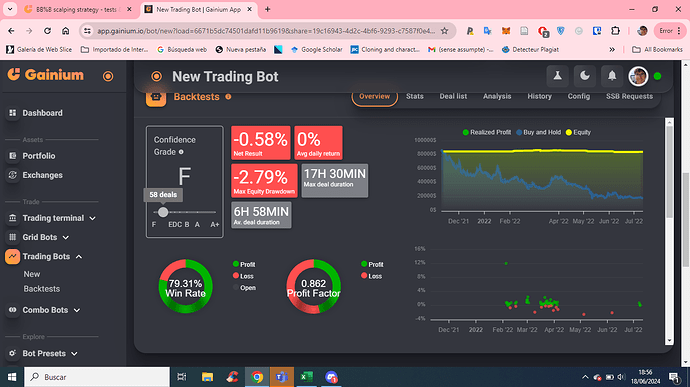

but drawdown is huge and produce no profit at all in bear market from December 2021 to June 2022

https://app.gainium.io/bot/backtests?a=2797&aid=share-backtest&backtestShare=456d1879-8ebc-49a1-b3a7-feebf32ef02f

I tried many other indicators like parabolic sar, ADX, Market Structure, some worked but it decreased overall profit so much, but i really wanted it to work in 2021-2022 bear market, if anybody can look into it and try optimize it then you are more than welcome

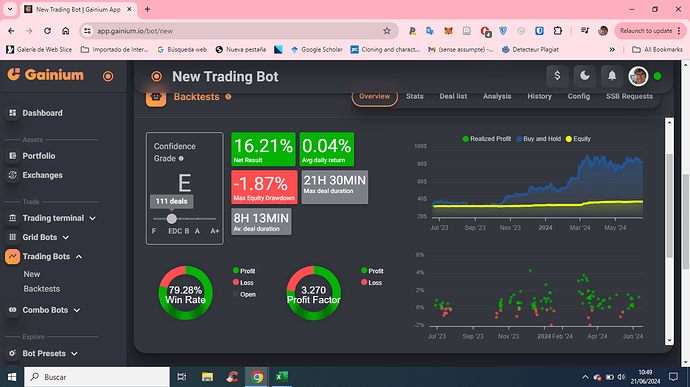

You can try to adjust this one:

https://app.gainium.io/bot/backtests?a=140&aid=share-backtest&backtestShare=1beabb06-5503-454c-9cb7-d236cf4eeccb

(4 year backtest)

(same as your 2021-2022 bear market test)